Our finances

Contents

- Creating brighter futures

- A year of challenge, learning and change

- As Scouts, we believe in creating brighter futures

- Skills for Life: Our plan to prepare better futures 2018-2025

- Growth

- Inclusivity

- Youth shaped

- Community impact

- Keeping young people safe

- Three pillars of work

- Programme

- People

- Perception

- Theory of change

- The impact of Scouts on young people

- Working towards a regenerative change

- Our finances

- Trustees' responsibilities

- Independent Auditor’s Report to the Trustees of The Scout Association

- Consolidated statement of financial activities

- Balance sheet

- Statement of cash flows

- Notes to the financial statements

- Our members

- How we operate

- Fundraising: our approach

- Governance structure and Board membership – 1 April 2023 to 31 March 2024

- Our thanks

- Investors in People

Our finances

Overview

Our balance sheet remains strong, despite a reduction in total funds from £86.6 million to £82.5 million. Our liquid assets (fixed asset investments, and cash and cash equivalents) are £50.4 million a reduction of £9 million, excluding Jamboree funds held on 31 March 2023. This reduction reflects the higher-than-expected operating deficit of £6.5 million (2022-23: £0.6 million) incurred for the year.

The main contributors to the higher operational deficit were:

- A higher level of claims resulting in a £1.5 million increase in our claims provision net of related insurance recoveries.

- £4.3 million increase in staff costs is mainly due to the impact of the annual pay award of 5% (lower pay bands received 7%), full year impact of various roles recruited in 2023, and additional staff in digital transformation (£0.9 million), Volunteer Experience (£0.5 million), Skills for Life (£1.0 million), and new Safety roles (£0.7 million). A number of roles, particularly across Skills for Life and Volunteer Experience are fixed term and come to an end in stages up to March 2025 as the programmes of work complete.

- The additional costs incurred relating to the 25th World Scout Jamboree (see note 23 to the accounts) which took place in South Korea in August 2023 and resulted in an overall loss of £2.4 million of which £1.8 million occurred during the year.

The value of our listed investments increased by £1.5 million (2022-23: Loss of £1.4 million) and the surplus on the defined benefit scheme increased by £0.8 million (2023: £11k) resulting in the overall reduction of funds (restricted and unrestricted) of £4.4 million (2022-23: £1.7 million).

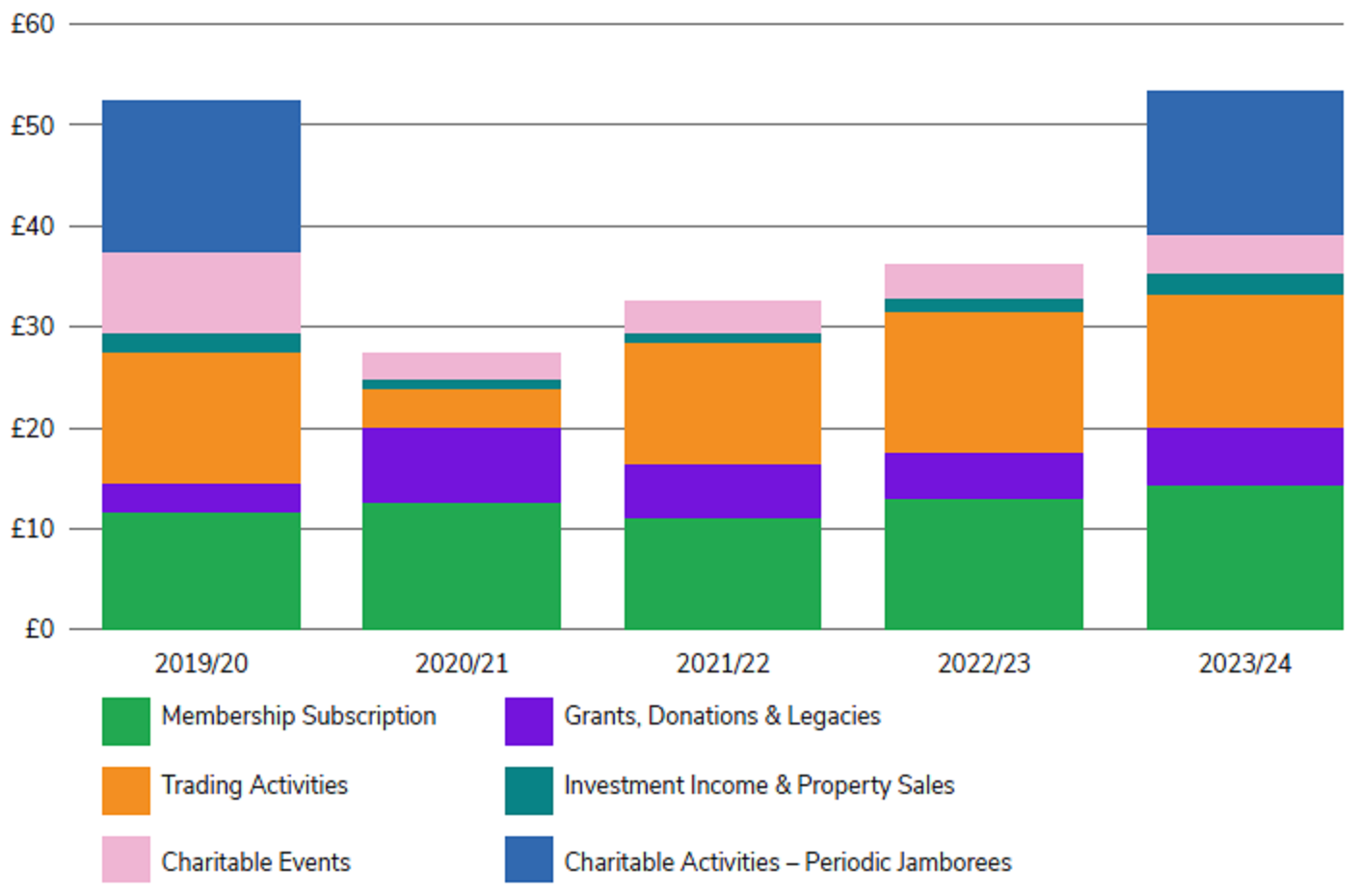

Income

Total income for the year was £53.7 million, compared with £36.3 million in 2023. £48.9 million of total income was unrestricted (2023: £32.4 million) and £4.8 million was restricted (2023: £3.9 million).

Membership subscriptions increased to £14.3 million (2022-23: £13.2 million) reflecting a 5.6% increase in youth membership (in 2022) and an increase in the core membership fee of £1.

The continued and generous support of our donors is important and greatly appreciated by Scouts. In difficult and uncertain economic times, legacies and donations were £0.7 million higher than the previous year at £2.2 million (2023: £1.5 million). Grant funding increased by £0.6 million to £3.6 million (2023: £2.8 million), mainly due to the DCMS Uniformed Youth Fund grant funding which is being used to fund Local Growth Officers in England, specifically in government levelling up areas to open new Scout and Explorer sections (see note 5a).

Our trading income includes the retail sales from Scout Shops and World Scout Shop Limited, insurance commission income generated by Unity and sponsorship and promotional income. Scout Shop income decreased by £1.0 million to £9.5 million, due to a decline in uniform and badge sales following a post-COVID-19 surge the previous year and then lower than expected membership growth during 2023. Unity Commission income was broadly the same as the prior year at £2.6 million. We’ve continued our strong links with corporate sponsors and generated £1.1 million from these beneficial connections, which is £0.1 million higher than last year.

Income from charitable activities is derived from our activity centres and other sales linked to our charitable purposes. These include camping, training, activities and accommodation charges at Gilwell Park and the other National Scout Adventure Centres. This year it also included income from the Jamboree of £14.1 million. Excluding the Jamboree, income was £0.9 million higher at £4.0 million (2023: £3.1 million) mainly due to an increase in revenue from the activity centres.

Investment income (including interest) increased by £0.6 million to £2.0 million. This reflects the higher interest rates for the full year.

Expenditure

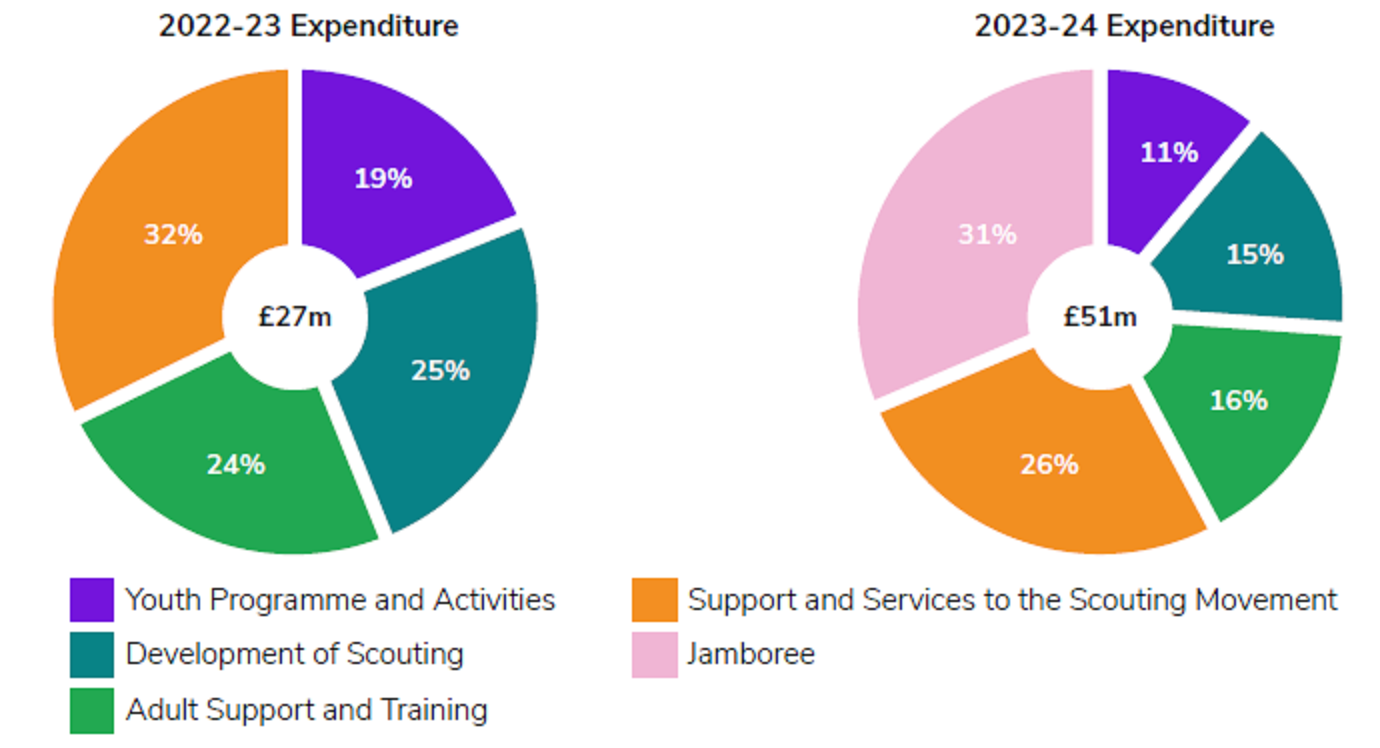

Total expenditure was £60.2 million, however this included £16.0 million of expenditure related to the Jamboree. Excluding the Jamboree operating (unrestricted) expenditure was £40.0 million (2022-23: £32.4 million) an increase of £7.6 million and £4.3 million of expenditure was related to restricted funds (2022-23: £4.0 million).

Unrestricted charitable activity expenditure was higher due to a higher level of claims (which has resulted in either net new or additional provisions), increased staff costs (see above), Skills for Life non-staff costs of £0.3 million, increase in Volunteer Experience Programme non-staff revenue costs of £0.8 million higher software costs, and irrecoverable VAT.

Our expenditure (and income) on charitable activities is allocated to four activities, which help fulfil our four strategic objectives (Growth, Inclusivity, Youth Shaped and Community Impact) as shown in the pie chart below. The activities undertaken during the year are detailed in the annual report on pages 10 to 31).

Charity funds

The Scout Association’s consolidated funds were £82.5 million (2022-23: £86.6 million) with the aggregate value of endowment funds (£2.3 million) and restricted funds (£4.3 million) remaining broadly in line with the previous year. Within unrestricted funds the General Fund declined by £7.7 million, partially offset by increases in the designated funds of £2.2 million and pension reserve of £0.7 million.

The increase in the designated fund for fixed assets of £2.2 million reflects the net increase in intangible and tangible fixed assets of The Scout Association of £1.4 million and £1.9 million respectively offset by the transfer of the surpluses from prior Jamborees accumulated in the Inclusion and Solidarity Fund to partially cover the Jamboree losses incurred this year. The Group’s total investment in intangible assets of £5.4 million represents the development of digital tools particularly work on the volunteer experience programme as well as some software to support the commercial operations.

All funds are described in more detail in note 19 in the financial statements with analysis of movements in the year.

Reserve policy

The Trustees annually review the reserves policy and continue to plan to hold reserves to protect The Scout Association and delivery of its charitable programmes by providing time to adjust to the changing financial environment.

The reserves policy establishes an appropriate target for the level of general ‘free’ reserves as represented by the balance of the General Fund. The target is based on a risk assessment of the probability and likely financial impact on The Scout Association’s activities, which might be caused by a decline in income, an inability to meet its financial obligations, or an inability to reduce expenditure in the short term.

We also hold reserves to support the development of Scouts. The policy seeks to make sure there’s an equitable balance between spending the maximum amount of income raised as soon as reasonably possible after receipt, while maintaining an appropriate level of reserves to make sure the charity can operate uninterrupted. It also provides parameters for future budgeting and strategic plans and contributes towards decision making.

The COVID-19 pandemic highlighted the risks of short-term reductions in membership and losing commercial income due to curtailment of face-to-face Scouts, while needing to maintain member services. As a consequence, the Trustees deemed that the appropriate target for free reserves for The Scout Association itself should be based on one year’s expenditure with an additional element for possible future claims costs reflecting their longer-term nature. At present, this indicates a level of reserves of the order of £31 million.

The general free reserves for The Scout Association on 31 March are £41.9 million, which is still well in excess of this target following the sale of Baden Powell House in August 2021. However, it’s been reduced significantly from last year, when the free reserves were £49.8 million. This has been caused by a number of items in addition to the operating deficit, specifically systems development (Volunteer Experience Programme), development of our Scout Adventure Centres, and the Jamboree emergency action taken.

In addition, the Trustees recognise there are a number of factors which’ll further reduce the free reserves over the next two years, in particular:

- Investment in Safe Scouting assurance work and commitments made in response to the outcome of the Great Orme inquest.

- Further budgeted losses while membership numbers recover to previous levels.

- Capital investments required particularly in digital capabilities.

- The need for funds to deliver our Skills for Life strategy and inclusive membership growth.

At the same time, it’s envisaged that the target level may increase due to inflation and other cost pressures. Therefore, over the next two years we may drop slightly below our target reserves. If that happens, the intention thereafter would be to build back the free reserves primarily through earnings with depreciation exceeding capital expenditure.

Investment policy and performance

£24.4 million of targeted reserves are invested in a longer-term investment portfolio initially equally allocated between two fund managers, Cazenove and Sarasin & Partners. The balance of £8.4 million is effectively held in short-term money market funds. The performance targets given to the fund managers since 2022 for the longer-term portfolios over the medium to long term are:

- to maintain an optimum level of income tempered by the need for capital growth in order to safeguard future grant-making capacity; and

- on a total return basis to outperform CPI + 4% per annum on a rolling three-year basis.

The target hasn’t been met over the past two years. On the total return basis (combining investment income and valuation changes,) the funds provided an overall gain of £2.0 million for 2022/23 and 2023/24 representing about 8.4% of the opening market value. This compares to CPI increases over the same period of 13.6% which once adding in the 8% required makes the target 21.6%.

Current asset investments in 2023 represented holdings in the Royal London Asset Management Funds, on behalf of the Short Term Investment Service. This service was wound up during the year, and all monies returned to the Groups (see note 16).

Going concern

The Trustees have considered the financial plans for the budget year of 2024/25 and projections for the following two years, looking at the cash and reserve projections.

Current actions and clear plans for the continuing growth of membership provide a solid foundation for the finances of The Scout Association. The sale of Baden Powell House has also provided resources to maintain a sustainable operating model while that growth occurs, and to invest in growing our services. Our current level of reserves provides a significant level of resilience to possible financial risks that may materialise in the short term.

Taking all of the above into account, the Trustees have a reasonable expectation that the charity has adequate resources to continue operating for the foreseeable future. Accordingly, they believe the going concern basis remains the appropriate approach for preparing the financial statements.

The Scout Association Defined Benefit Pension Scheme

The most recent full triennial actuarial valuation of the Scout Associated Defined Benefit Scheme was carried out as of 31 March 2022. The valuation resulted in a deficit of £2.5 million and a funding level of 94% which was an improvement from the 86% funding level at the previous March 2019 valuation. £2.5 million was paid in March 2023 to eliminate this deficit as agreed by the Board. Following this injection and as agreed with the Pension Fund Trustees the Scheme has further reduced its exposure to changes in future interest rates. As such the probability of liabilities arising in the future has also reduced although the Board continue to monitor the Scheme’s funding to make sure general reserves provide adequate cover against any future liability and also keep the potential for effecting an insurance buy-out of the Scheme under review.

The accounting FRS102 valuation as at 31 March shows the fair value of the scheme assets exceeded the present value of future obligations by £2.7 million (2022-23: £2.0 million) primarily due to changes in both financial and demographic assumptions slightly reducing the fund’s liabilities and a higher than expected return on assets in the period.

Remuneration policy

The Trustees consider that the Board of Trustees and the Executive Leadership Team (the Chief Executive and the Directors) comprise the key management personnel of the Charity.

All Trustees give their time freely, and no Trustee received remuneration in the year. The Chief Executive (who is also a Trustee and a full member of the Board) is paid for his executive duties only.

Details of Trustees’ expenses and related party transactions are disclosed in note 6c to the financial statements.

The remuneration of the senior staff is reviewed annually by the People and Culture Committee (a subcommittee of the Board), considering market conditions, cost of living increases and the financial position of the organisation. The salaries of the Executive Leadership Team are benchmarked to make sure they’re commensurate with the size of the roles.

The Executive Leadership Team members are entitled to employer pension contributions, and other benefits that are available to employees generally. In addition, enhanced medical insurance provision is provided.

The Executive Leadership Team sets the salaries for all other employees.

The remuneration benchmark is the mid-point of the range paid for similar roles, although a market rate supplement may also be paid where appropriate.