Notes to the financial statements

Contents

- Playing our part

- A year of achievement

- Stepping up to help other people

- Our purpose and method

- Our vision for the future

- Skills for Life: Our plan to prepare better futures 2018-2025

- Growth

- Inclusivity

- Youth Shaped

- Community Impact

- Three pillars of work

- Programme

- People

- Perception

- Theory of Change

- The impact of Scouts on young people

- Working Towards a Greener Future

- Our finances

- Trustees’ responsibilities

- Independent Auditor’s Report to the Trustees of The Scout Association

- Consolidated statement of financial activities

- Balance sheet

- Statements of cash flows

- Notes to the financial statements

- Our members

- How we operate

- Safety

- Safeguarding

- Governance structure and Board membership – 1 April 2022 to 31 March 2023

- Our advisers

- Our thanks

- Investors in People

Notes to the financial statements

1. Constitution

The Scout Association is incorporated by Royal Charter and is a registered charity whose purpose is to promote the development of young people in achieving their full physical, intellectual, social and spiritual potentials, as individuals, as responsible citizens and as members of their local, national and international communities.

2. Scope of the financial statements

These financial statements cover the activities directly controlled by The Scout Association. The activities of the Scout Councils of Northern Ireland, Scotland and Wales together with Scout Counties, Areas, Regions, Districts and Groups are not reflected in these financial statements. Those bodies are separate autonomous charities that are affiliated to The Scout Association.

3. Accounting policies

The principal accounting policies adopted, judgements and key sources of estimation uncertainty in the preparation of the financial statements are as follows:

a. Basis of preparation of consolidated financial statements

The financial statements have been prepared in accordance with the Financial Reporting Standard applicable in the UK and Republic of Ireland (FRS 102), and the Statement of Recommended Practice, Accounting and Reporting by Charities, applicable to charities preparing their accounts in accordance with FRS 102, known as the Charities SORP (FRS 102).

The Scout Association meets the definition of a public benefit entity under FRS 102. Assets and liabilities are initially recognised at historical cost or transaction value unless otherwise stated in the relevant accounting policy note.

The financial statements consolidate the financial statements of The Scout Association and its subsidiary companies. The financial year end of each of the subsidiary companies is 31 March.

The Balance Sheets and Profit and Loss accounts of the subsidiaries have been consolidated on a line by line basis as required by the Statement of Recommended Practice.

On acquisition of a business, all of the assets and liabilities that exist at the date of acquisition are recorded at their fair values reflecting their condition at that time. All changes to those assets and liabilities and the resulting surpluses that that arise after acquisition are charged to the post-acquisition Statement of Financial Activities.

The financial statements are prepared on the historical cost basis with the exception of investments, which are stated at fair value.

b. Going concern

Having reviewed financial plans and cash flow forecasts, the Trustees have a reasonable expectation that the charity has adequate resources to continue operating for the foreseeable future. Accordingly, they believe that the going concern basis remains the appropriate basis on which to prepare the financial statements.

c. Recognition of income

National membership subscriptions

Membership subscriptions are payable in advance for a year to 31 March and are recognised in the year of membership benefit.

Legacies

Legacies are accounted for when the Association becomes entitled to them, where receipt is probable and where their value can be established with reasonable certainty. Where legacies include non-cash items these are included in income at the lower of probate value and market value at the date of receipt.

Insurance Income

Insurance broking commission is recognised at the date of inception of the policy. The amount recognised is the total brokerage due to the company less an overall provision for unearned commission. Profit related commission is recognised when it can be reliably calculated and forecast to be received.

Commercial activities

Income from conference centres, sponsorship, National Scout Adventure Centres, and other income is accounted for when the Association is entitled to the income, the amount can be quantified with reasonable accuracy and the probability of receipt of the income is more likely than not.

Investment income

Dividends are accounted for on a receipts basis. Interest is accounted for on an accruals basis and includes all amounts earned up to the balance sheet date. Associated tax recoveries are included for all amounts shown as income.

Gifts in kind

Properties, investments, heritage assets, other fixed assets and any other assets or services donated to the charity are included as donated income at their estimated market value at the time of receipt.

Grant income

The fair value of grants receivable is accrued in accordance with the terms of the agreement with the funder.

d. Allocation of income and costs

All expenditure is accounted for on an accruals basis and is allocated as described below.

Activities for generating funds and fundraising trading: costs of goods sold and other costs.

Income and expenditure from Scout Store Limited, World Scout Shop Limited, Scout Services Limited and Scout Insurance Services Limited.

Charitable activities

This comprises income from the provision of services supporting the objects of the Association through operations including National Activity Centres, and the Information Centre.

Charitable activities have been analysed under the following headings:

- Youth programme

- Development of Scouting

- Adult support and training

- Support and services to members

The Association’s activities are largely financed by national membership subscriptions and by the surpluses generated by its trading subsidiaries rather than income from charitable activities. The activities have been classified as described in note 6.

In the current year, it has been determined that the insurance services provided by Unity are more appropriately regarded as a trading activity rather than as a charitable activity and the prior year comparatives have been restated accordingly.

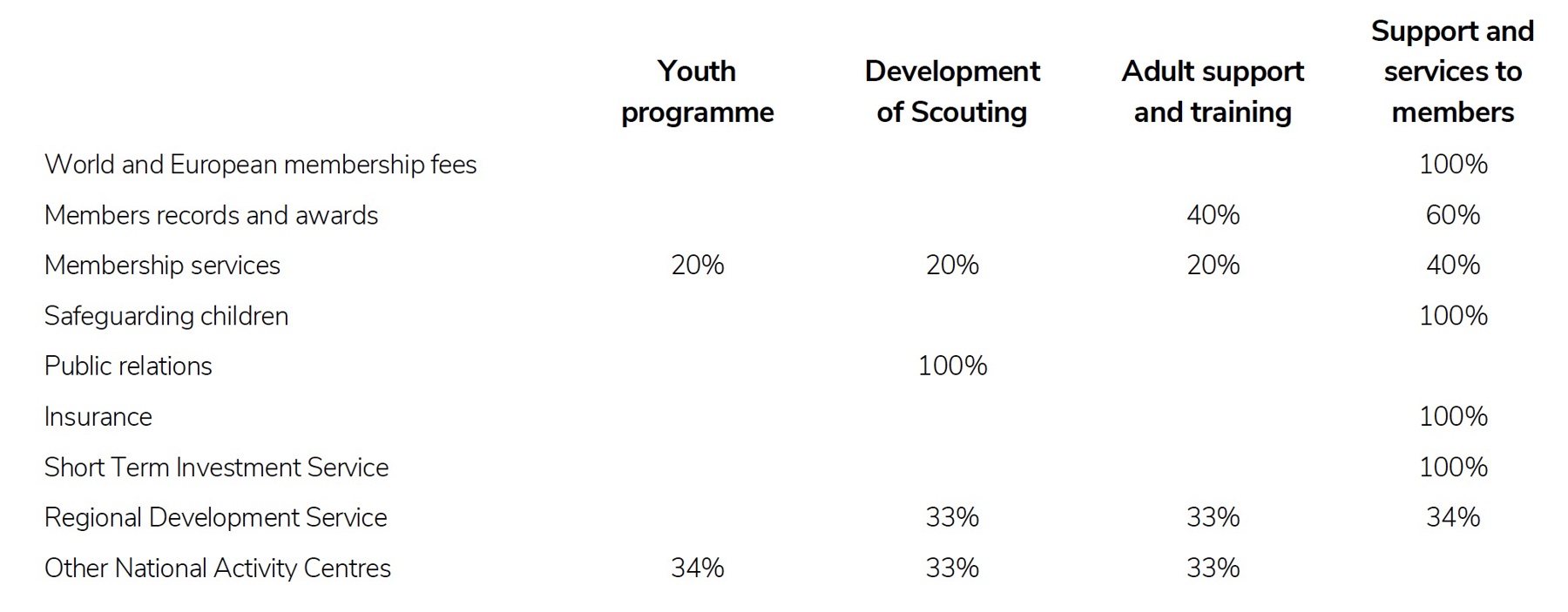

Where possible the income and costs relating to a department or cost centre are allocated in full to one of the above categories, but in practice many departments have an involvement in more than one activity. The other major allocations are set out in the table.

Support costs

These are costs incurred directly in support of the objects of the Charity. The costs are attributed to the activities that they support. Where a department supports all the Charity’s activities the costs have been apportioned pro-rata to the staff resources directly engaged in that activity. The percentages that apply are:

- Trading – 6%

- Youth programme – 20%

- Development of Scouting – 29%

- Adult support and training – 26%

- Support and services to members – 19%

Grants payable

Grants payable are included in the Statement of Financial Activities as expenditure in the period in which the award is made. Grants which have been approved by the Trustees and agreed with other organisations but which are unpaid at the year end are accrued. Grants where the beneficiary has not been informed or has to meet certain conditions before the grant is released are not accrued.

Governance costs

These are the costs associated with the governance arrangements of the Charity which relate to compliance with legal and statutory requirements of the Charity as opposed to those costs associated with fundraising. They include audit fees and the costs of Trustees’ meetings.

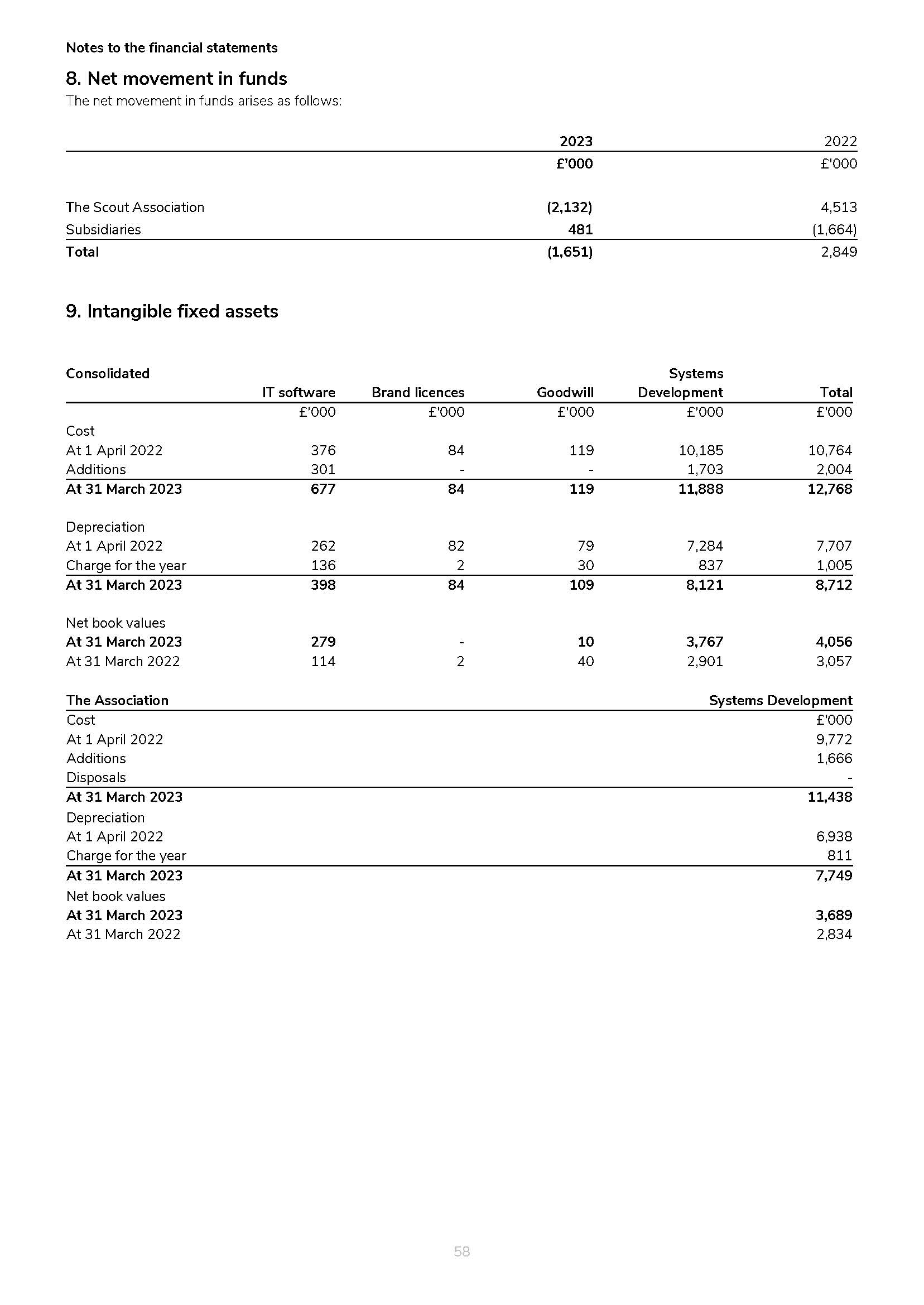

e. Intangible fixed assets

IT software is capitalised and written off over the term of the related contract, between 2 and 5 years.

Systems Development is capitalised and once the project have completed they are written off over 5 years. Goodwill arising on acquisition of an undertaking is the difference between the fair value of the consideration paid and the fair value of the assets and liabilities acquired. It is capitalised and amortised through the Statement of Financial Activities over the Trustees’ estimate of its useful economic life which can range from 5 to 10 years. Impairment tests on the carrying value are undertaken at the end of the first full year after acquisition and in any other subsequent period if events or changes in circumstances indicate that the carrying value may not be recoverable. The cost of acquiring a brand licence is written off over the term of the related contract.

f. Heritage fixed assets

The Association maintains a heritage collection of around 250,000 items. Through an active and innovative programme of collecting, interpreting and engagement, the Heritage Collection helps create connections between members of The Scout Association, both past and present, and the wider community. The Heritage Collection is managed by the Headquarters’ Heritage Service. To ensure its ongoing representation of Scouting’s story the Heritage Service continues to collect both historical and contemporary material. New acquisitions are normally made by donation with occasional low cost purchases.

New material is acquired in accordance with The Scout Association’s Collecting Policy.

Some 300 key items in the Association’s collection, particularly those relating to the Founder, are held at valuation since the nature of these items permits that to be sufficiently reliable. Gains and losses on revaluation are recognised through ‘Other recognised gains’ in the Statement of Financial Activities. It is the intention of The Scout Association to preserve these items indefinitely, therefore amortisation is not regarded as appropriate.

The Trustees consider that obtaining valuations for the remainder of the Collection would involve disproportionate cost due to the diverse nature of the material held and the lack of comparable market values. Such items are therefore not recognised on the Balance Sheet.

Expenditure that is in the Trustees’ view required to conserve or prevent further deterioration of individual items is recognised as expenditure when it is incurred.

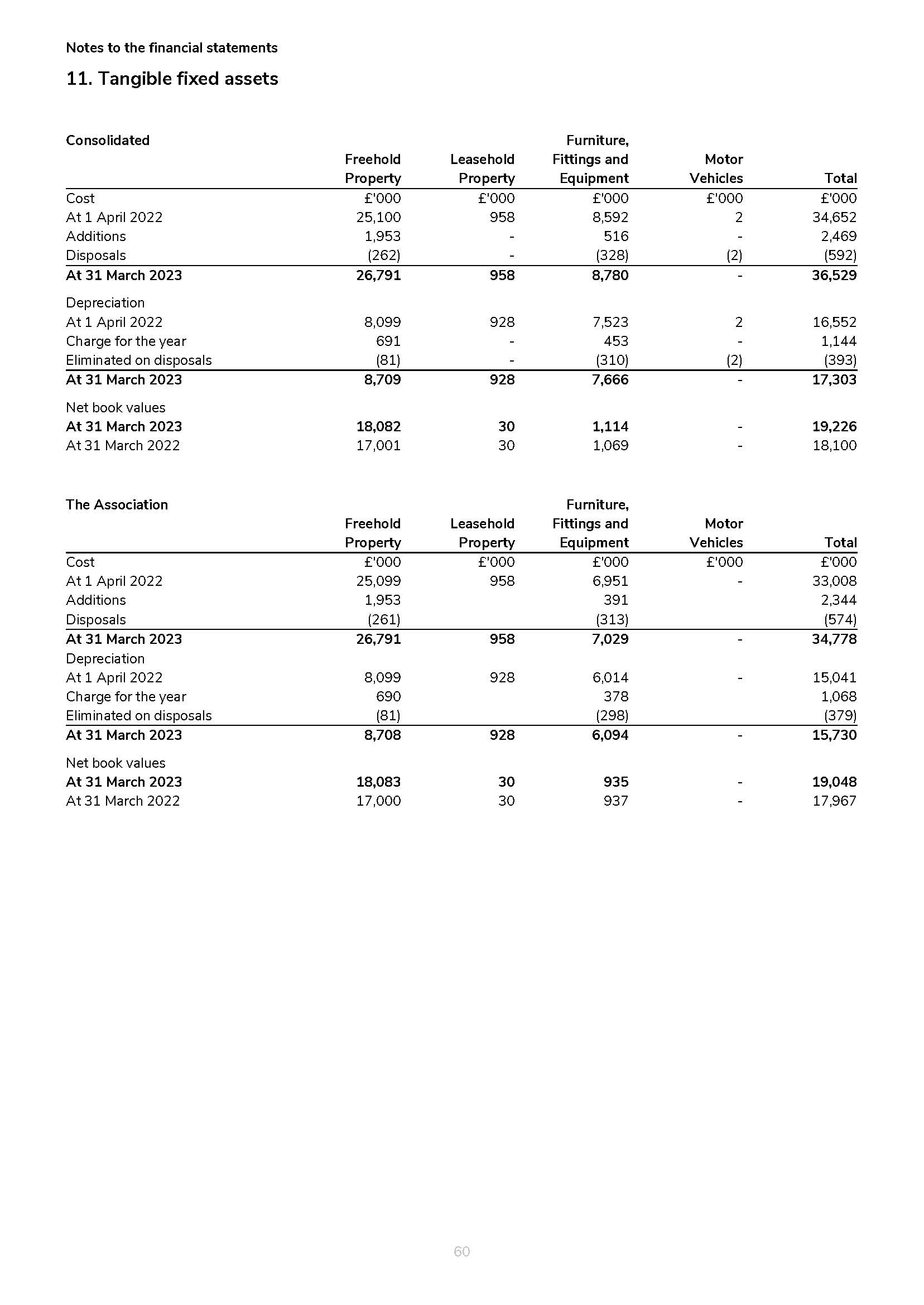

g. Other fixed assets

Other fixed assets are stated at cost. Where land and buildings are acquired together it is assumed that the buildings represent 50% of the initial cost. Investment in systems development in support of the charity's strategy is capitalised as a tangible fixed asset. Depreciation is calculated to write off the cost of assets by equal annual amounts over their expected useful lives. Assets costing less than £1,000 are not capitalised. No depreciation is provided on freehold land.

Depreciation rates used are:

- Freehold property – 50 years, with 10 years for replacement elements

- Leasehold property – the shorter of the lease period or 50 years

- Furniture fittings and equipment – 4 to 5 years

- Motor vehicles – 5 to 10 years

Gains or losses on the disposal of fixed assets are reflected in net income/expenditure for the year shown in the Statement of Financial Activities.

Impairment reviews on fixed assets are carried out each year and any asset with a carrying value materially higher than its recoverable or useful value is written down accordingly.

h. Fixed asset Investments

The Scout Association holds investments both in order to generate income for the support of charitable objectives and to provide assets to meet the need of reserves, identified in the reserves policy. Investments are stated at current market value on the balance sheet date unless there’s evidence of a different fair value.

Gains or losses arising during the year are disclosed in the statement of financial activities and in the notes to the financial statements.

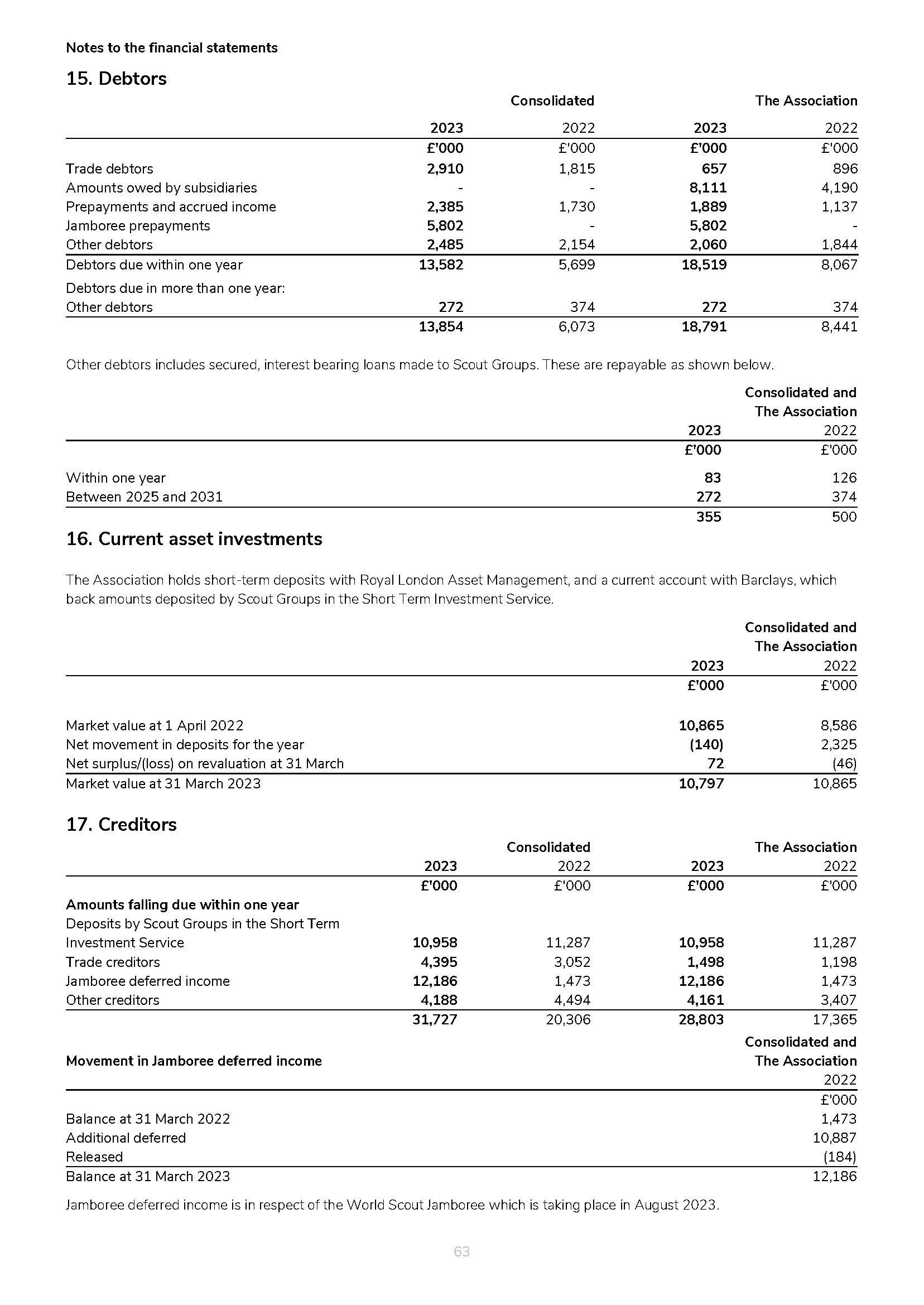

i. Current asset investments

The funds deposited by Scout Groups in the Short Term Investment Service are held on short-term deposit with an external investment manager. These short-term deposits are not held by the Scout Association for investments purposes and are included in the balance sheet at fair value as current asset investments. Movements in these funds are shown in the notes to the financial statements.

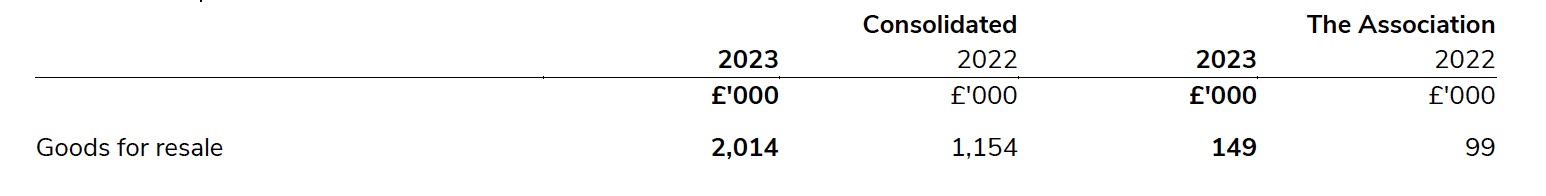

j. Stocks

Stocks are valued at the lower of cost and estimated net realisable value. Cost is calculated using the current purchase price method and consists of the original cost of goods without any addition for overheads.

k. Provisions

A provision is recognised in the balance sheet when the Association has an obligation as a result of a past event and it is probable that an outflow of economic benefits that can be reliably measured will be required to settle that obligation.

l. VAT

The Association is partially exempt for VAT purposes and is not able to reclaim all the VAT it pays. It is not practicable to allocate irrecoverable VAT to the expenses and assets concerned, and irrecoverable VAT is written off.

m. Leases

Significant assets held under finance leases and the related lease obligations are included at the fair value of the leased assets at the inception of the lease. Depreciation on leased assets is calculated to write off this amount on a straight-line basis over the shorter of the lease term and the useful life of the asset.

Rentals payable are apportioned between the finance charge and a reduction of the outstanding obligations.

All other leases have been treated as operating leases and the rentals written off as they are paid because of the insignificant amounts involved.

n. Pension costs

Contributions payable to The Scout Association Pension Scheme are charged to the Statement of Financial Activities so as to spread the cost of pensions over the working lives of employees in the scheme. The pension charge is calculated on the basis of actuarial advice.

The pension scheme liabilities are measured using a projected unit method and discounted at an AA sterling corporate bond rate. Any excess of liabilities over the value of the pension scheme assets which are measured at fair value is recognised in full. Any surplus of pension scheme assets over liabilities is recognised as an asset to the extent that the Association is able to recover the surplus either through reduced contributions in the future or refunds from the plan.

Administration costs, the current service cost and net return on the scheme’s assets and liabilities for the year is allocated across the resources expended categories in the Statement of Financial Activities. The actuarial gain on the scheme for the year is included in the gains/(losses) section of the Statement of Financial Activities.

Contributions towards personal pension policies, which are defined contribution schemes, are charged to the Statement of Financial Activities as they are incurred.

o. Financial assets

Financial assets, other than investments and derivatives, are initially measured at transaction price (including transaction costs) and subsequently held at cost, less any impairment.

p. Financial liabilities

Financial liabilities are classified according to the substance of the financial instrument’s contractual obligations, rather than the financial instrument’s legal form. Financial liabilities, excluding derivatives, are initially measured at transaction price (including transaction costs) and subsequently held at amortised cost.

q. Judgements in applying accounting policies and key sources of estimation uncertainty

In preparing these financial statements, the Trustees have made the following judgements:

- The determination of whether or not there are indications of impairment of the Scout Association’s tangible and intangible assets, including goodwill, taking into consideration the economic viability and expected future financial performance of the asset.

- The determination of appropriate provision for claims, supported by legal advice.

- The determination of appropriate financial and demographic assumptions in valuing the defined benefit pension obligations in line with FRS 102 requirements, supported by actuarial advice.

- The determination of whether the organisation can recover any pension scheme asset in line with FRS102 requirements.

4. Nature of funds

All funds are identified as identified as falling into one of three categories.

Endowment funds

Endowment funds are those received to be held as capital on a total returns basis with only the income available to be spent. Subsequent gains or losses on the disposal of the underlying assets of the fund become part of the capital.

Restricted funds

Restricted funds are those received which have been earmarked for a special purpose by the donor or the terms of an appeal.

Unrestricted funds

Unrestricted funds are those received, which are not subject to any special restriction. They are divided between general funds and designated funds. Designated funds comprise amounts set aside by the Trustees to be used for particular purposes.

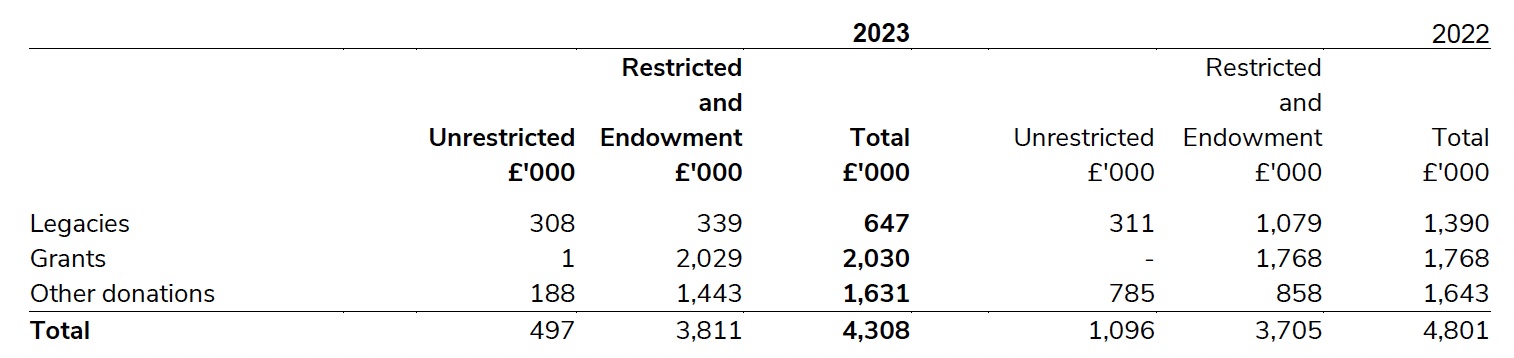

5. Income and endowments

a. Other voluntary income

Included in grants above are Furlough grants of £nil (2022: £6,514) which were received under the Covid-19 job retention scheme, grants of £118,371 (2022: £66,971) which were received under the Kickstarter scheme and DCMS grants of £724,569 (2022: £nil).

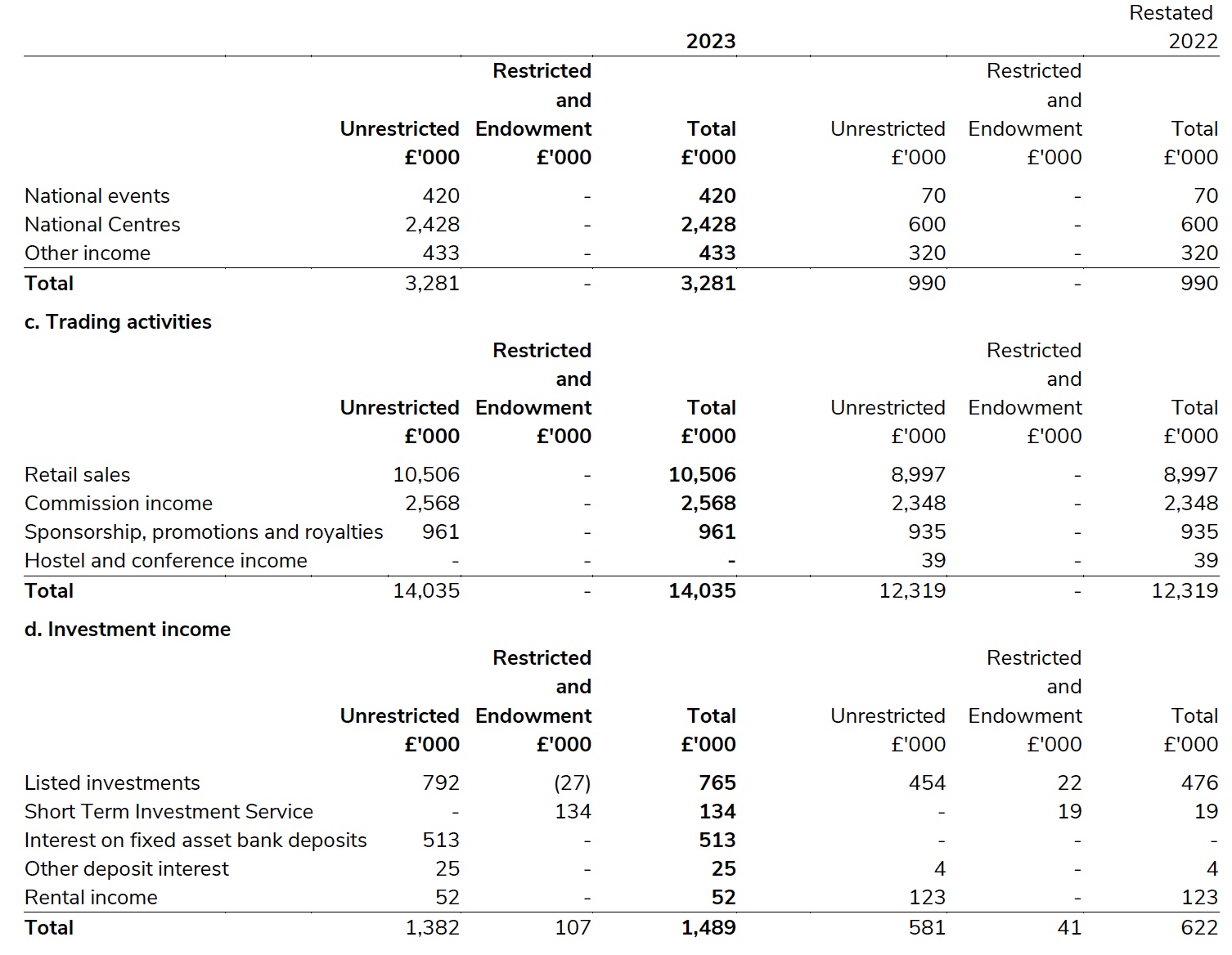

b. Charitable activities

The income in this category is derived primarily from the National Activity Centres. Many of the activities are not conducted with the principal intention of generating net income. Instead the Association's charitable activities are financed largely by fundraising activities and by membership subscriptions.

6. Expenditure

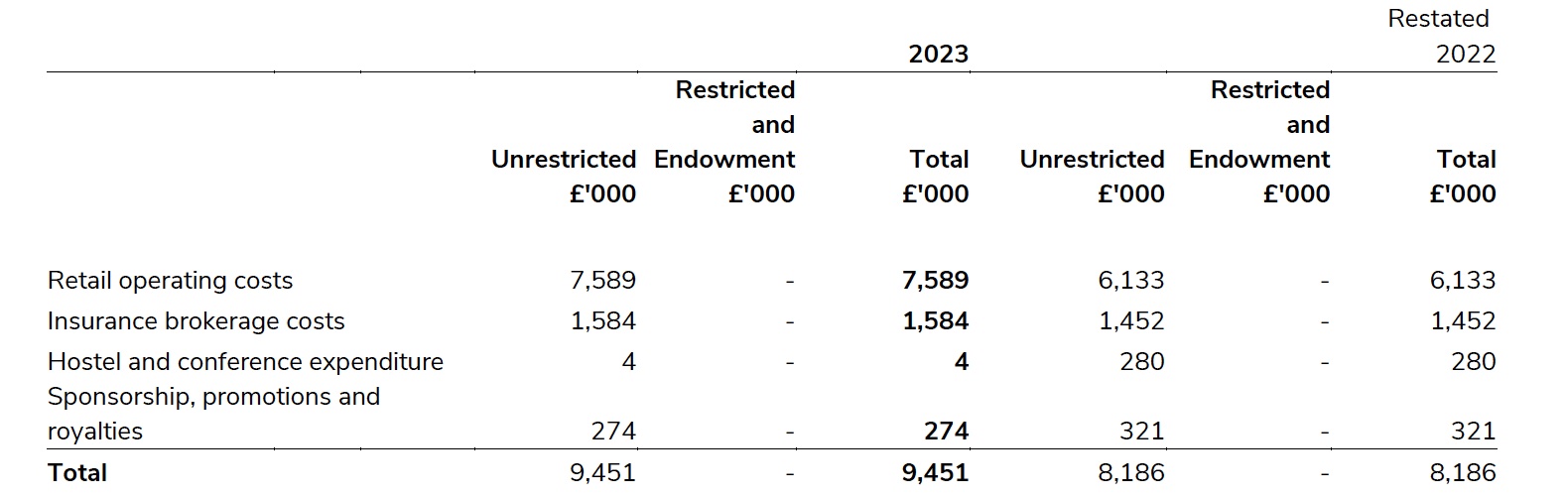

a. Trading activities

Expenditure on trading activities includes support costs of £540,000 (2022: £551,000). The basis for the allocation of support costs is explained in note 6.b.

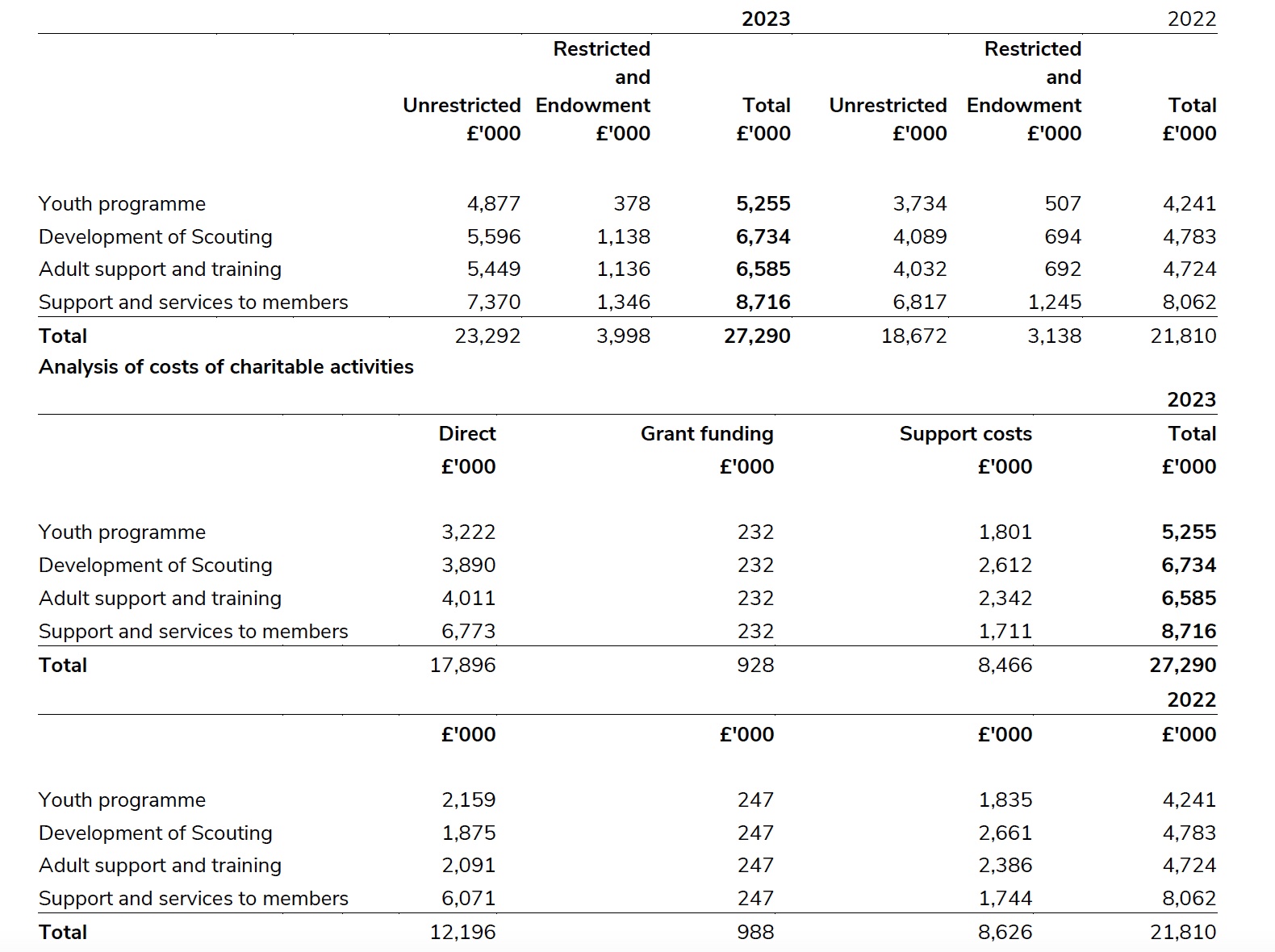

b. Costs of charitable activities

Charitable activities have been analysed into four categories as explained in note 3.d. Costs are allocated using the principles

explained in that note.

Youth programme includes the various educational activities in which members participate. Development activities are those which are focused on growing our movement. Adult support and training includes those activities which assist leaders and other adults involved in Scouts. Support and services to the movement includes those activities that help ensure the safety and safeguarding of members, which underpin the activities of Scout Groups.

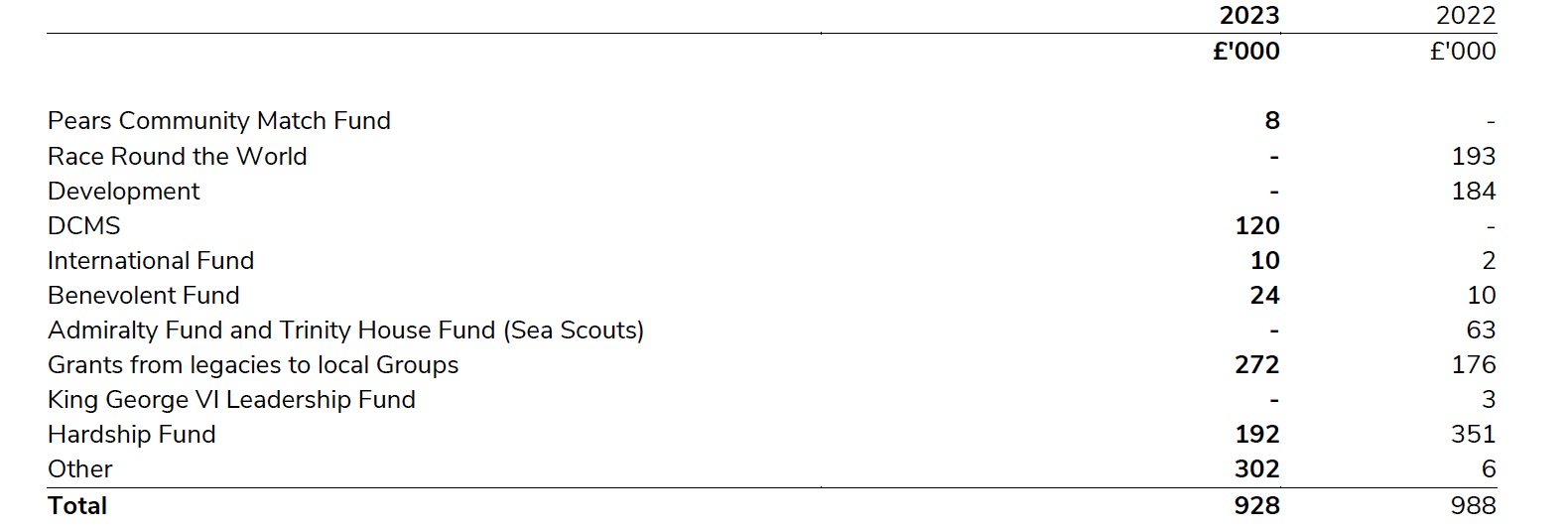

Analysis of grants to local Scouting

Grants from restricted and designated funds administered by the Association are paid, in accordance with the terms governing those funds, to a large number of Scout Groups, Districts, Areas and Counties.

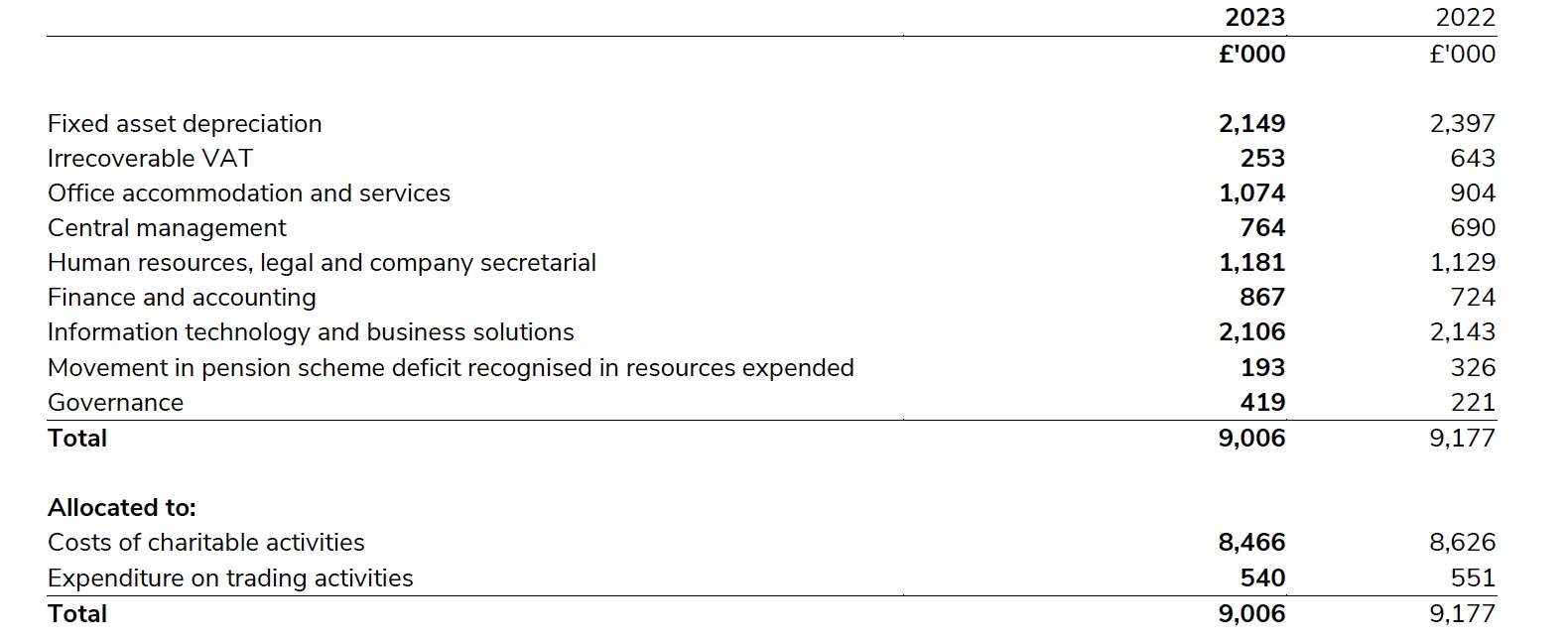

Support costs allocation

Support costs comprise that expenditure which facilitates fundraising and charitable activity but which is not directly incurred in the conduct of those activities. The support costs itemised above have been apportioned to fundraising and charitable activities pro rata to the employment costs of staff directly engaged on the relevant activities. The percentage allocations are disclosed in note 3.d.

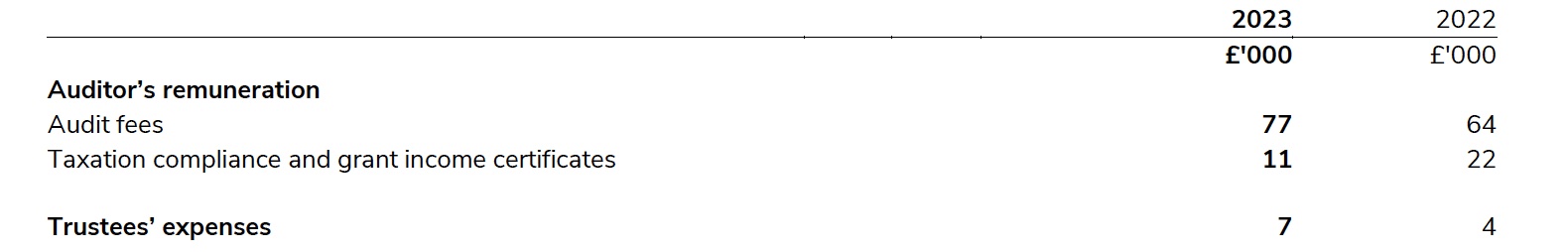

c. Expenditure includes:

During the year 15 Trustees (2022: 15 Trustees) were reimbursed £6,968 (2022: £4,281) for expenses, such as travel and subsistence, incurred in their attending meetings and in the carrying out of their duties. The Association provided accommodation for the Chief Scout and for others while they were on Scout business.

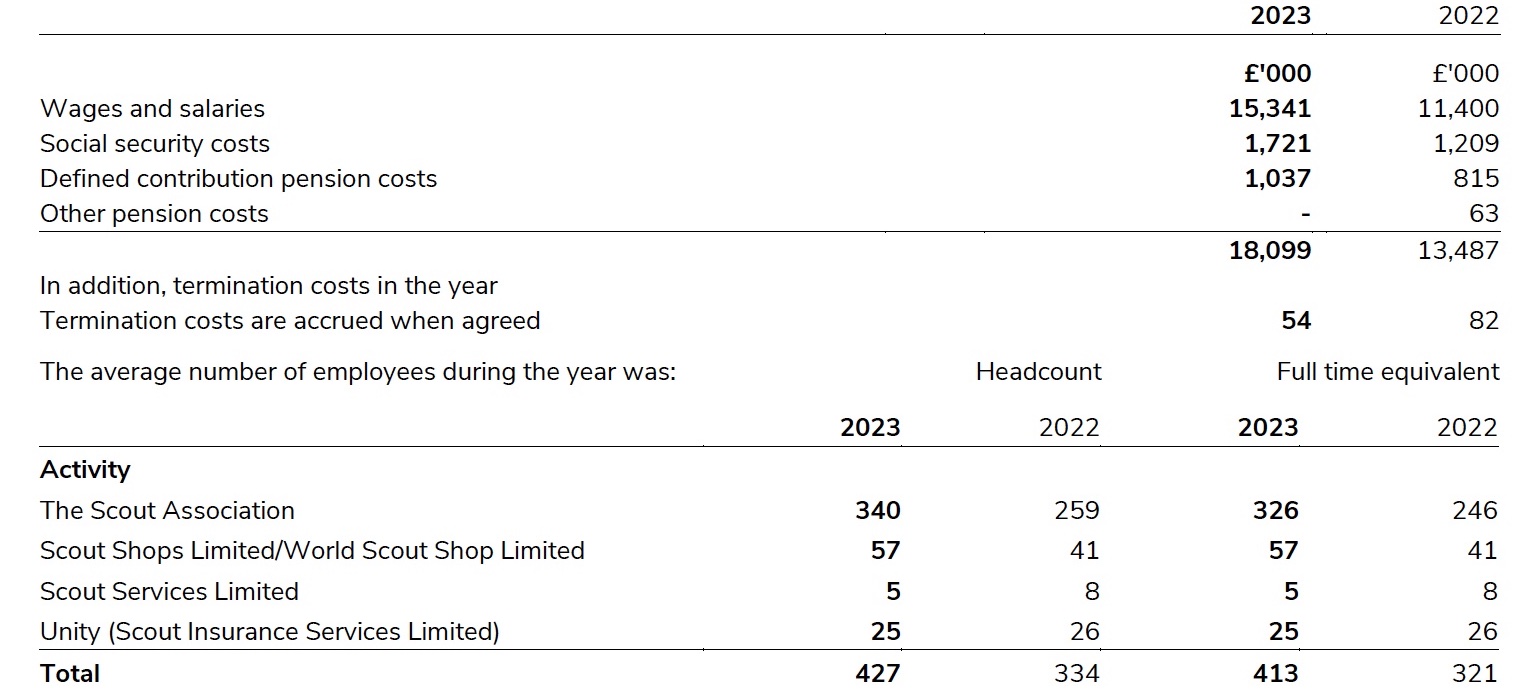

7. Staff costs

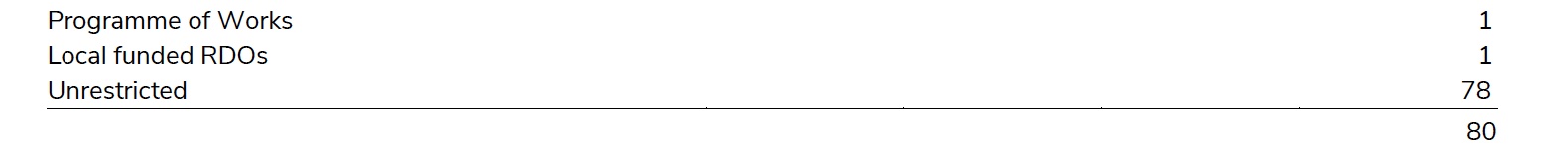

Movement in The Scout Association full time equivalent for 2022/2023:

Staff numbers for our general funds are up by 78 reflecting the recovery from the pandemic, and the increase as activities across the movement recover. Activity Centres have had the largest increase of staff with an increase of 20.

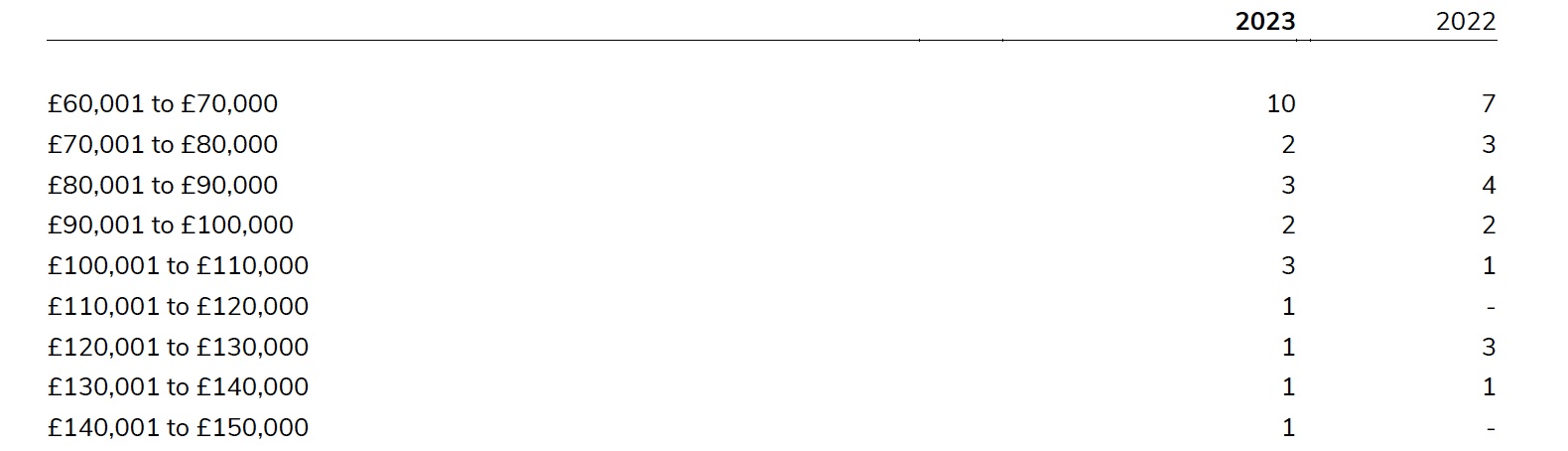

The number of employees whose total emoluments for the year exceeded £60,000 were as follows:

The Chief Executive Officer, Matt Hyde, is also a Trustee, for which he is not paid. He received salary and benefits for his service as Chief Executive Officer of £141,737 (2022: £131,011). No other Trustee received remuneration for services to the Association.

The key management personnel of the parent charity and its subsidiaries currently comprise the Trustees, the Chief Executive Officer, Director of Commercial Services, Director of Communications and Marketing, Director of Operations, Director of Finance & Resources, Director of Strategy and Transformation and General Manager of Scout Shops and World Scout Shop. The total employer cost of the key management personnel of the Scout Association and its subsidiaries was £946,310 (2022: £937,796).

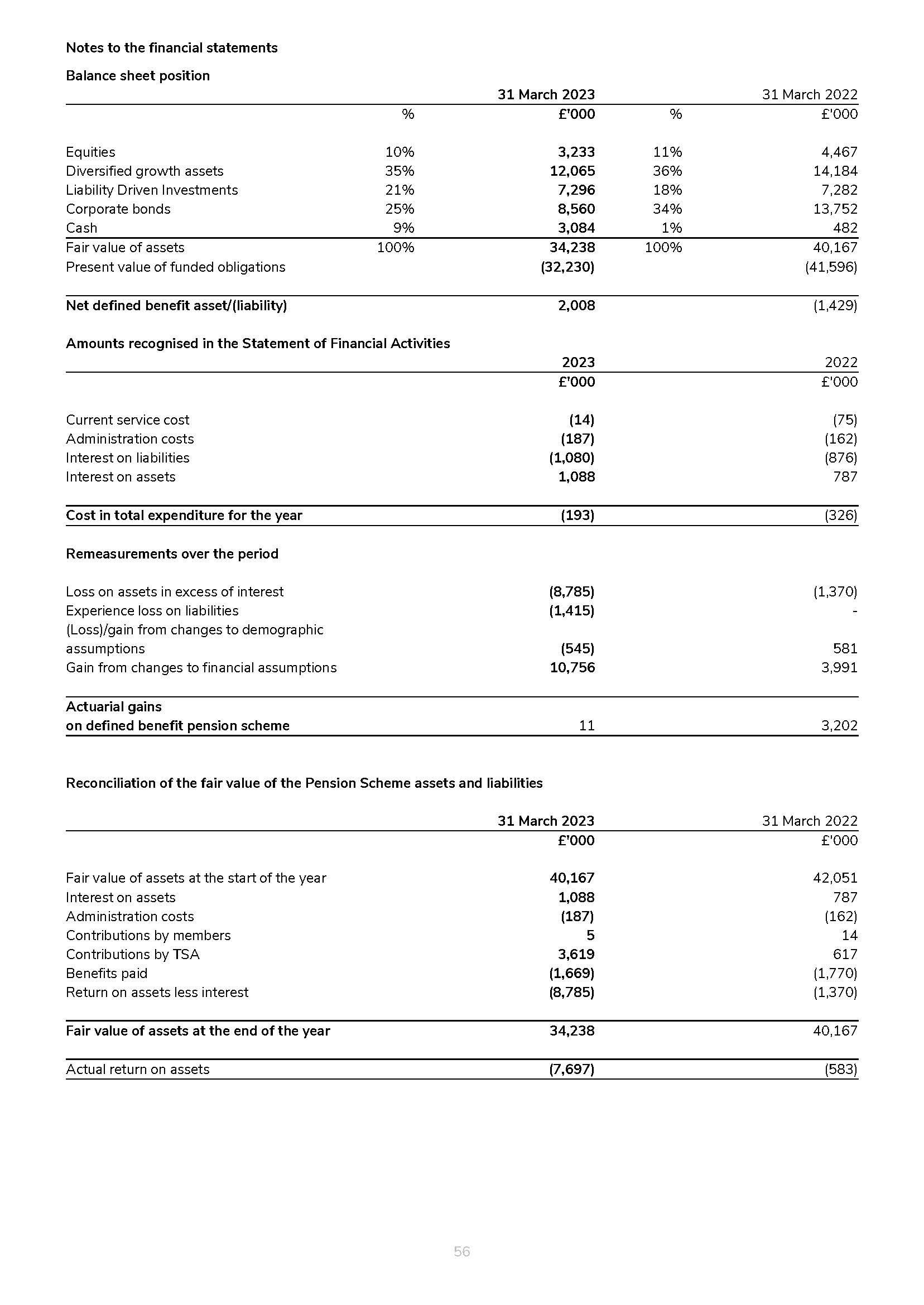

Pension schemes

Pension provision for current staff is mainly provided through a defined contribution arrangement.

Additionally the Association previously provided defined benefit pensions through the Scout Association Defined Benefit Pension Scheme ("the Scheme"). The Scheme was closed to future accrual with effect from 1 July 2022. It has 87 deferred members and 156 members in receipt of a current pension. The Scheme provides benefits, on retirement, on leaving service or on death, based on final salary and length of service.

The Scheme is subject to the Statutory Funding Objective under the Pensions Act 2004 and a valuation of the Scheme is carried out at least once every three years. As part of the process, the Association must agree with the trustees of the Scheme the contributions to be paid in order to address any shortfall against the Statutory Funding Objective and the contributions to be paid in respect of the accrual of the future benefits.

The most recent comprehensive actuarial valuation of the scheme was carried out as at 31st March 2022 and showed a deficit of £2.5 million. During the course of the financial year 2022-23, The Scout Association paid £1,119,000 in respect of the previous deficit reduction plan and for administration expenses and also agreed with the Trustees to make a further payment of £2.5 million in March 2023 to eliminate the deficit shown by the most recent triennial valuation.

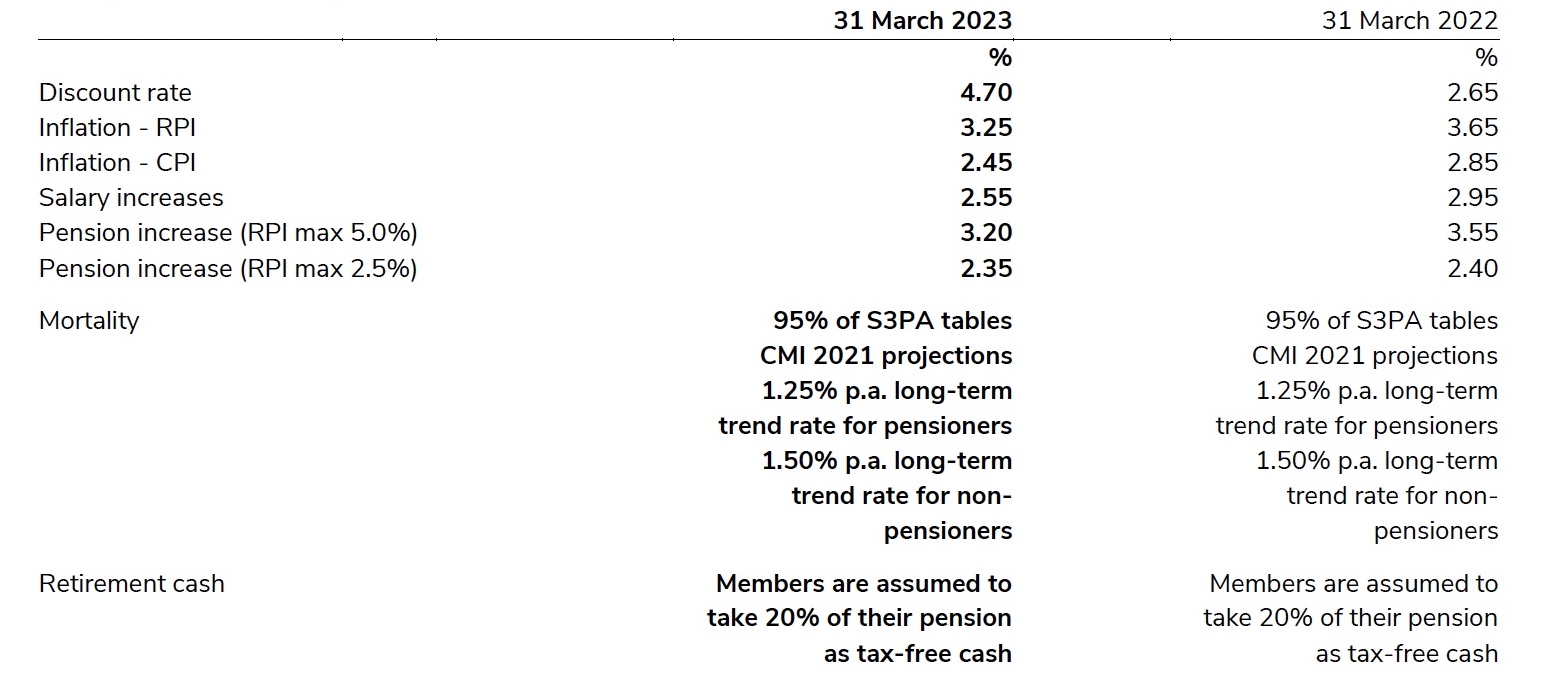

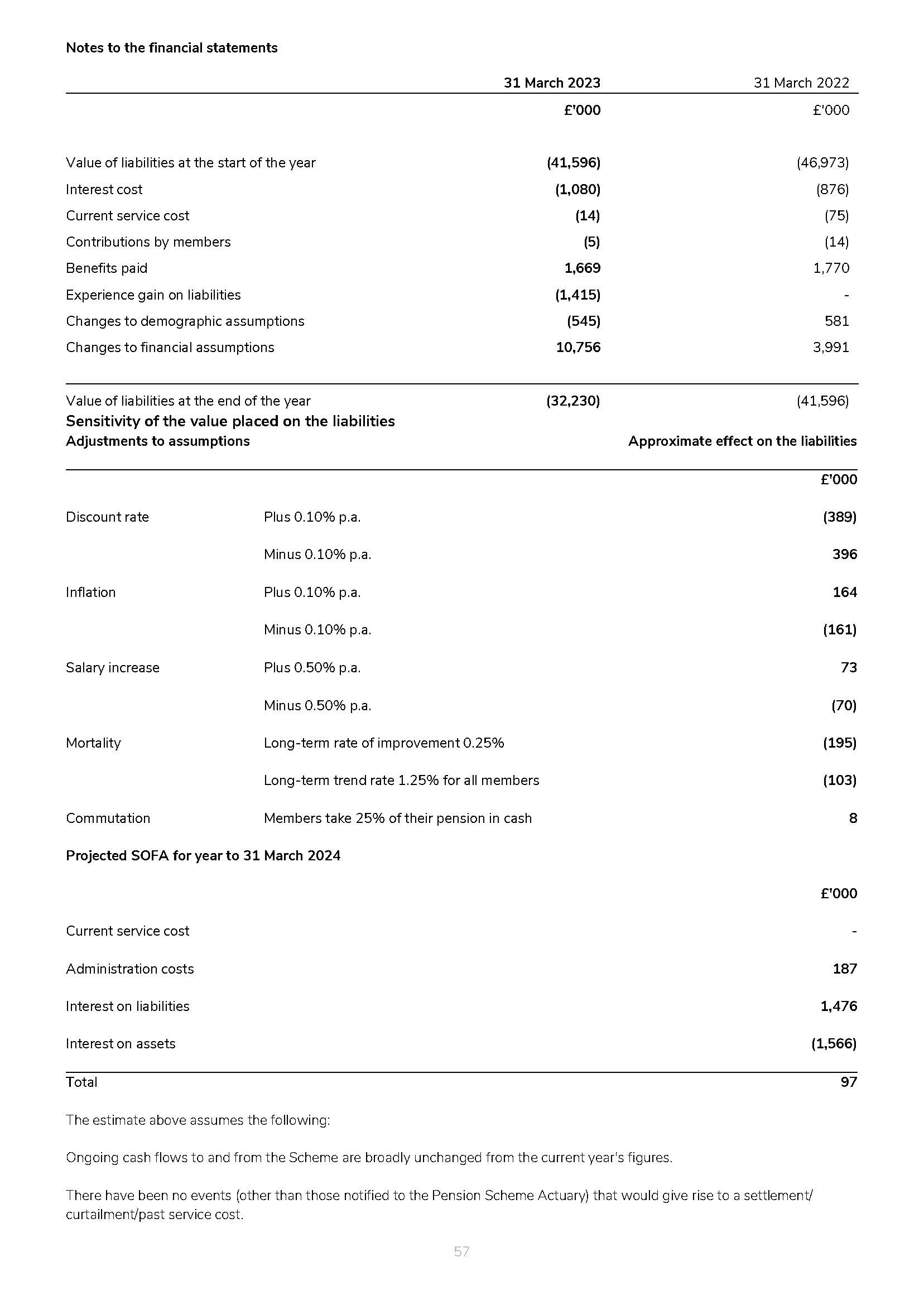

FRS102 valuation

These financial statements have been prepared in line with the requirements of FRS 102. The FRS 102 valuation is only in respect of the defined benefit Scheme. The principal FRS 102 actuarial assumptions, determined by financial markets and demographic conditions, are shown below. Pension payments increase at different rates for different accrual periods. A later table shows the sensitivity of the liability to these assumptions.

The fair value of the scheme assets exceeded the present value of future obligations at 31 March 2023 by £2,008,000.

Principal actuarial assumptions

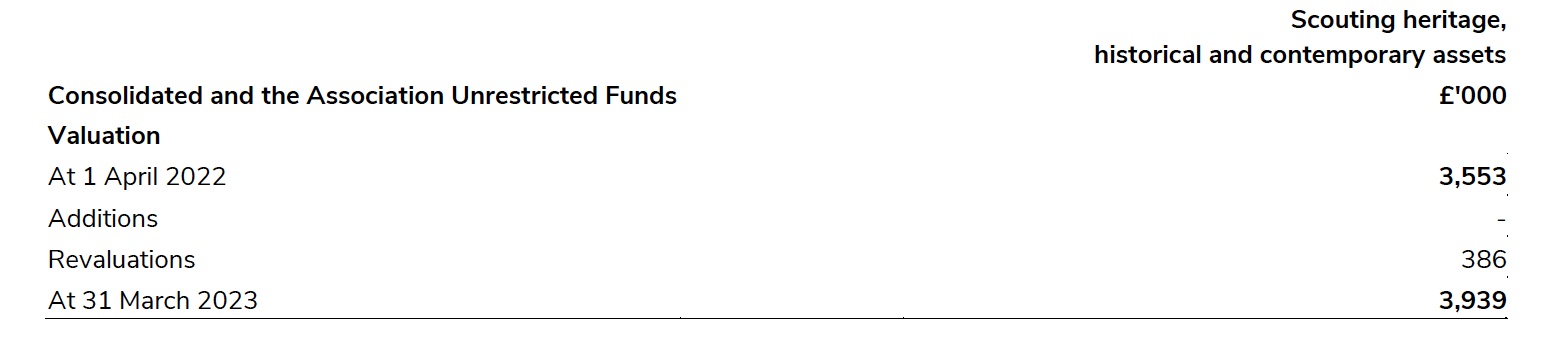

10. Heritage assets

a. Value

An updated valuation of certain key items as noted in 3.f was prepared as at 31st March 2023 by Patrick Bowen BA (Hons) Lond., MRICS giving rise to a revaluation surplus since the previous valuation in 2011.

(b) Five year financial summary of heritage asset transactions

There have been no purchases, donations, disposals or valuations in the last five years.

(c) Further information on heritage assets

The Heritage Service, supported by a small team of volunteers, is working to catalogue the Collection in line with The Heritage Collections Trust SPECTRUM standard and the national standard for archive cataloguing, this activity is an ongoing priority. Currently 10% of the Collection by number, including all those items held at valuation, is catalogued to these standards A small number of Collection items is displayed within the buildings and grounds of Gilwell Park but most of the Collection is held in storage. Included in the development plans for Gilwell Park is a new facility which would increase public access to the Collection, through a permanent display and a series of temporary exhibitions, as well as providing more appropriate storage for the Collection, ensuring its long term preservation. Currently access to the Collection is provided through the enquiries service, research appointments, the Gilwell Park Heritage Trail, the Scout Heritage website and exhibitions and activities organised with partner organisations. The Heritage Service continues to reach out to new audiences through activities including participation in the national Heritage Open Days scheme and programmes, including the UK Dementia Friendly Heritage Network.

The Association maintains the heritage collection in a good condition, and no items currently require substantial conservation expenditure. The nature of some of the assets, such as early cine- film, means they will deteriorate over time and should be considered a priority for preservation by digitisation and specialist storage. The Heritage Service actively seeks external funding to support the delivery of its conservation work.

The Association will occasionally approve the disposal of elements of the Collection, this process is carried out in accordance with the Code of Ethics and industry best practice as dictated by the Arts Council England Accreditation Standard. Disposal will be judged against the Association’s Collecting Policy. Disposal will be carried out in line with the Disposal Policy and follow the Disposal Procedure. Disposal of accessioned material only takes place with the approval of the Trustees or their designated representative. Disposal of non-accessioned items takes place with the approval of the Director of Commercial Services. In accordance with best practice the Heritage Service will always try to keep the item in the public domain by gifting it free of charge to other relevant museum collections or archives. If an appropriate museum or archive cannot be found the item may be considered for sale, any proceeds from such a sale would be restricted to the care and preservation of the Collection.

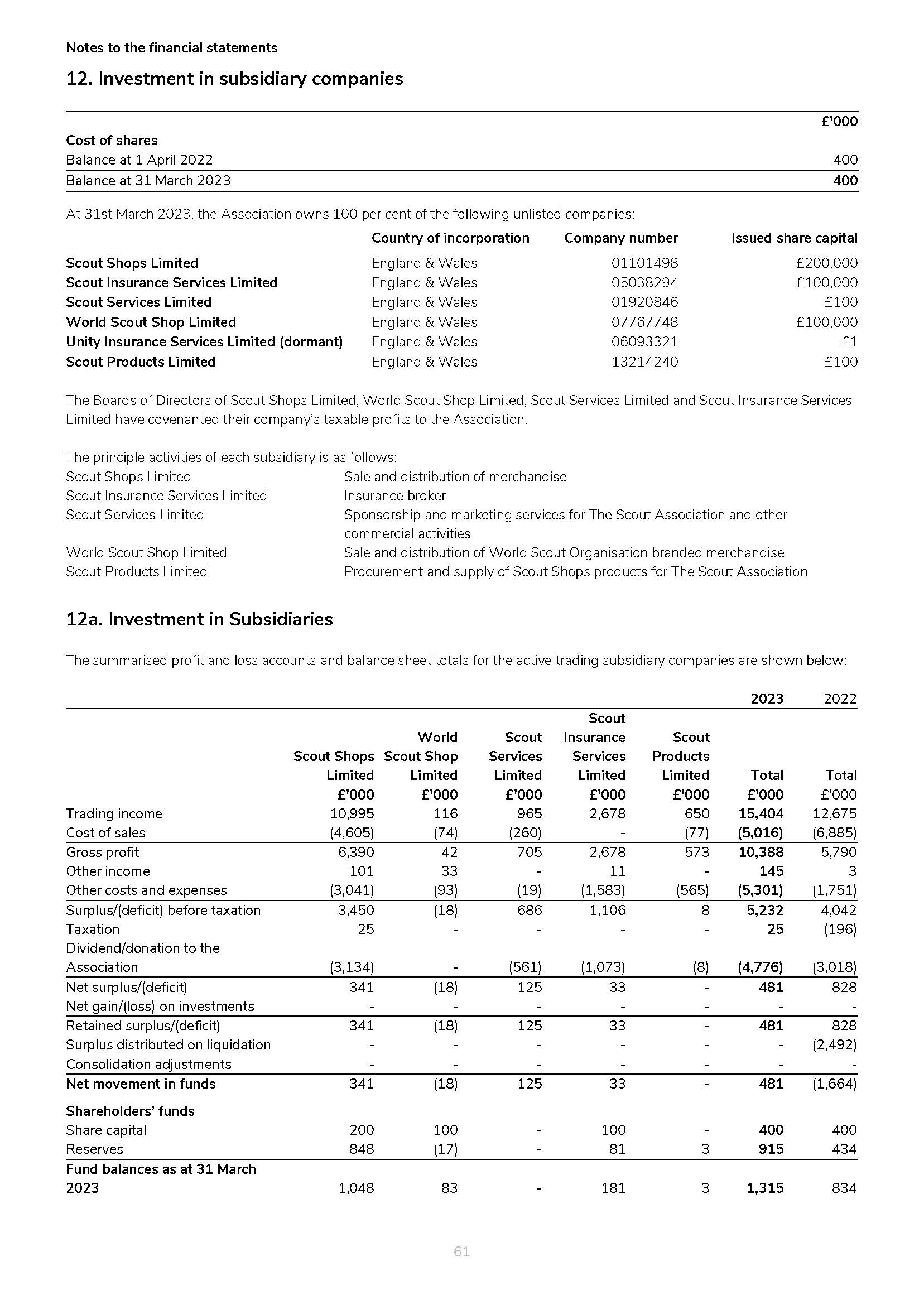

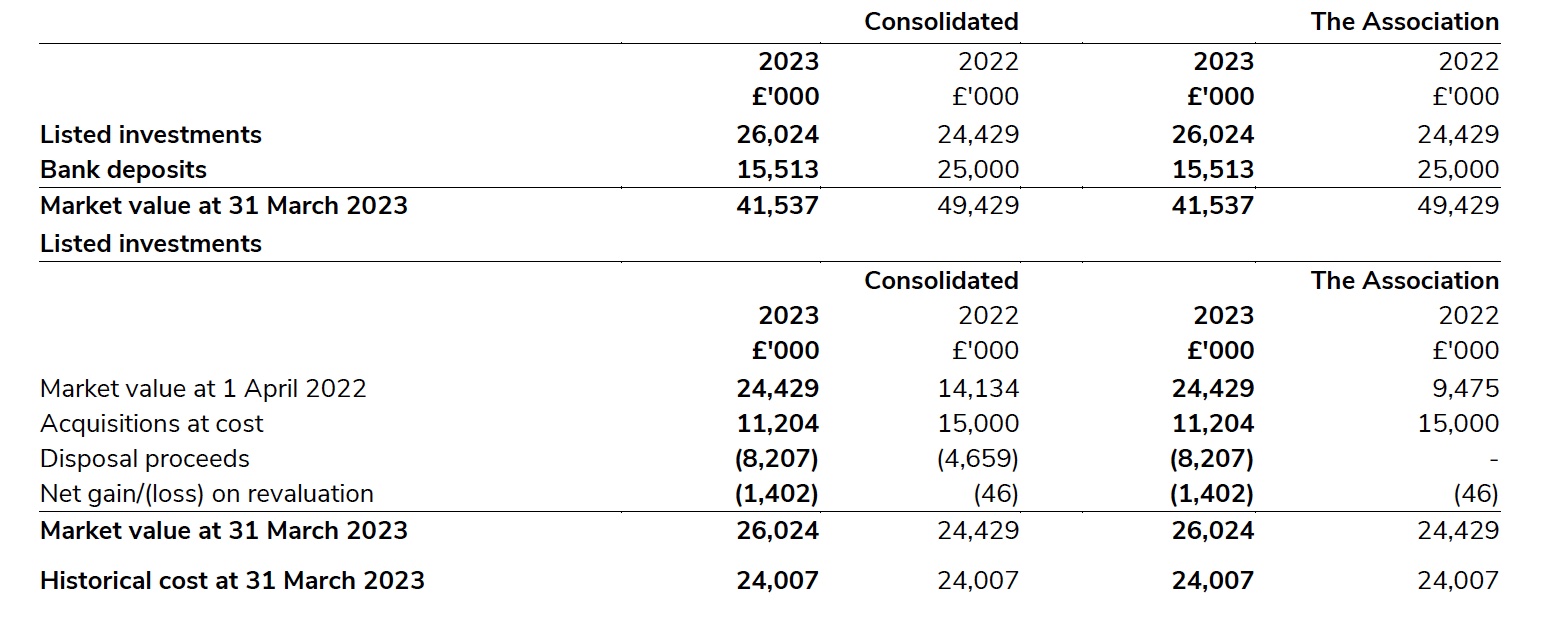

13. Fixed asset investments

All the listed investments are classified as tier 1 in the fair value hierarchy, being quoted prices in an active market. The listed investments have a credit rating of at least A. The listed investments are subject to market risk, with their value changing as market prices change. The Scout Association holds investments in support of the reserves policy.

The bank deposits declined from £25 million to £15,513 thousand during the year as a result of reinvesting interest received of £513,000 and transferring £10m to cash and cash equivalents being the anticipated extent to which amounts may be spent during the course of the year.

The Association paid £63,942 investment management fees and commission charges during the year (2022: £25,015).

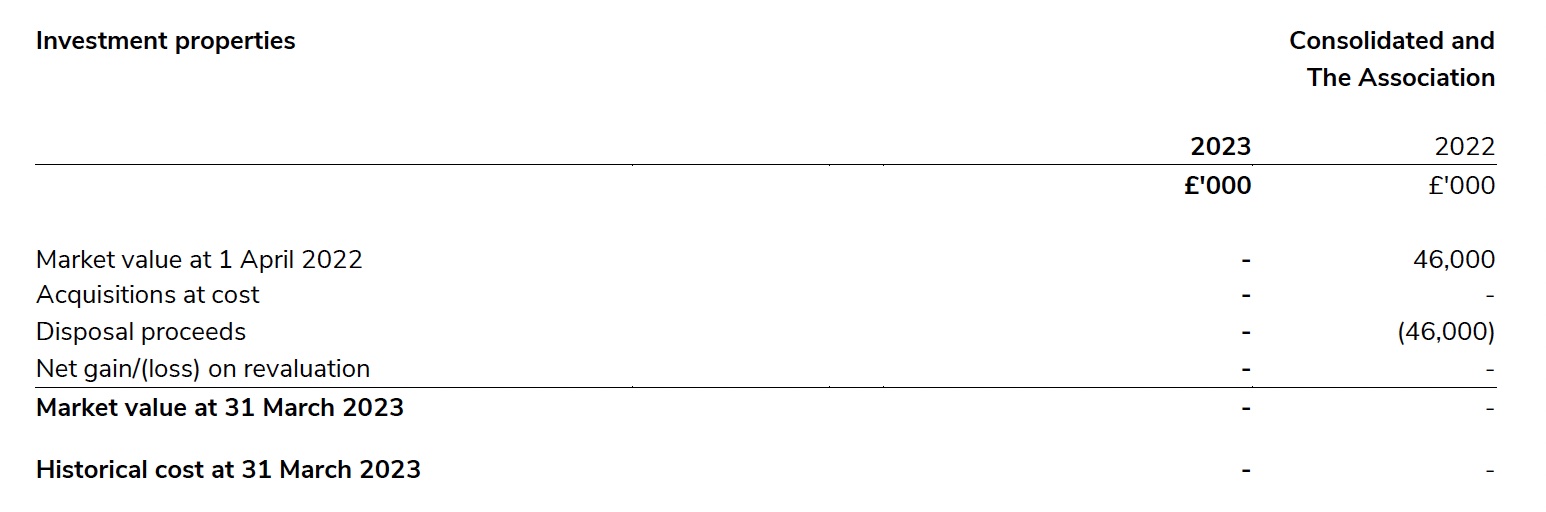

The investment property at 65 Queens Gate, Baden-Powell House was sold in August 2021 for £46 million.

14. Stocks

18. Provisions for liabilities and contingent liabilities

The Association puts young people first and their safeguarding and safety is paramount, but with the nature of our work there are claims made against the Scout Association. Taking account of legal advice, provision is made on a best estimates basis for those claims of which the Association is aware and for which it is assessed it is probable that the Association will be liable. Such claims are covered in part by commercial insurance policies. The amount receivable from insurers to the extent that provision has been made is included in debtors.

In addition it is the Association’s experience that incidents and/or claims may still be notified to the Association for events which occurred prior to 31 March 2023. In some cases, particularly regarding safeguarding or abuse claims, these may be made many years after the original event. Since the nature of any such incident or claim is not yet known, it is not possible for the Association to determine whether it is probable that the Association will be held liable or to estimate the amount of any consequential outflow of economic benefits. Therefore there exists an unquantifiable contingent liability in respect of such incidents and/or claims. Taking into account such insurance cover as is available, the Association is satisfied that any such claims that might arise would not present a significant financial risk to the Association.

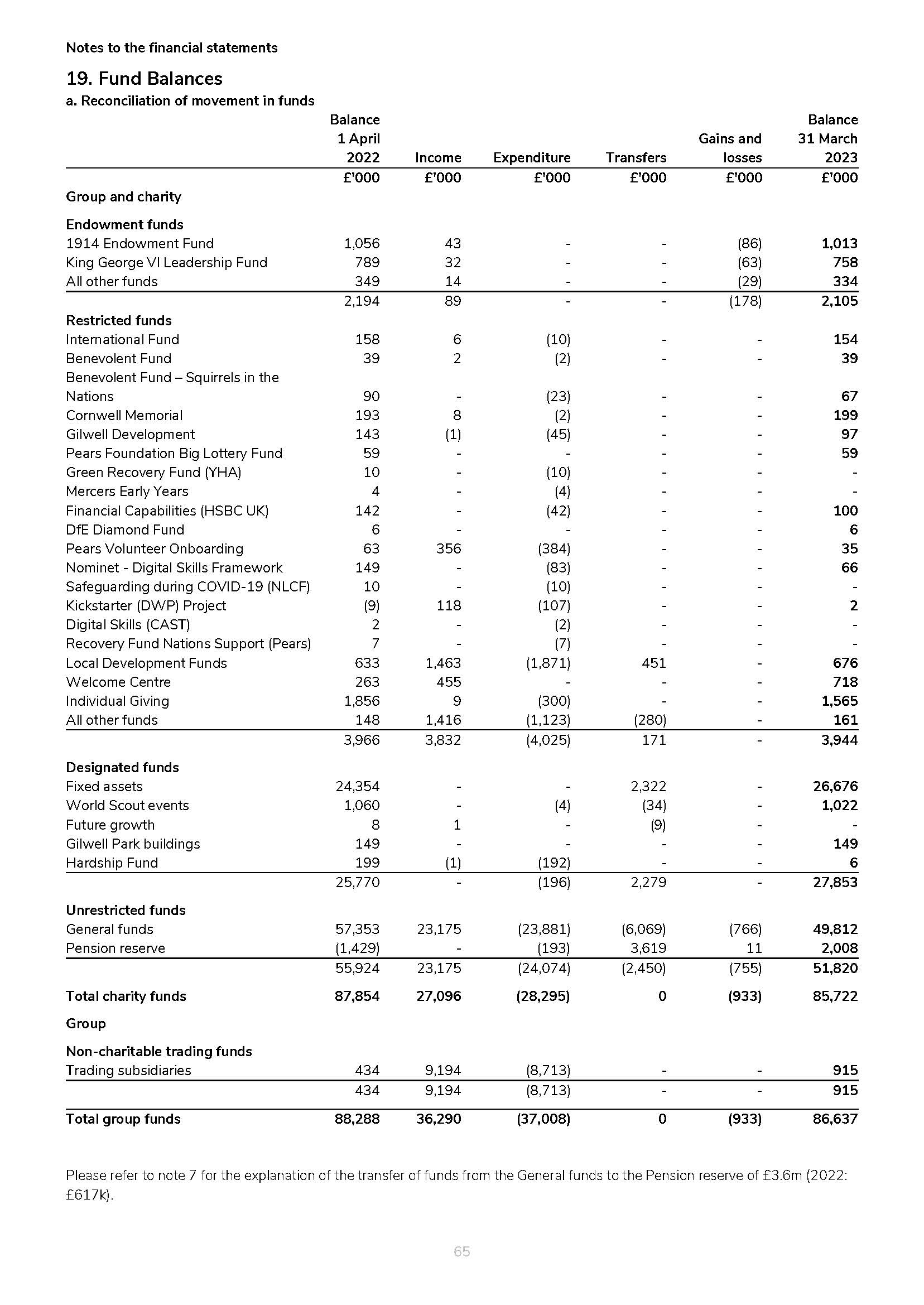

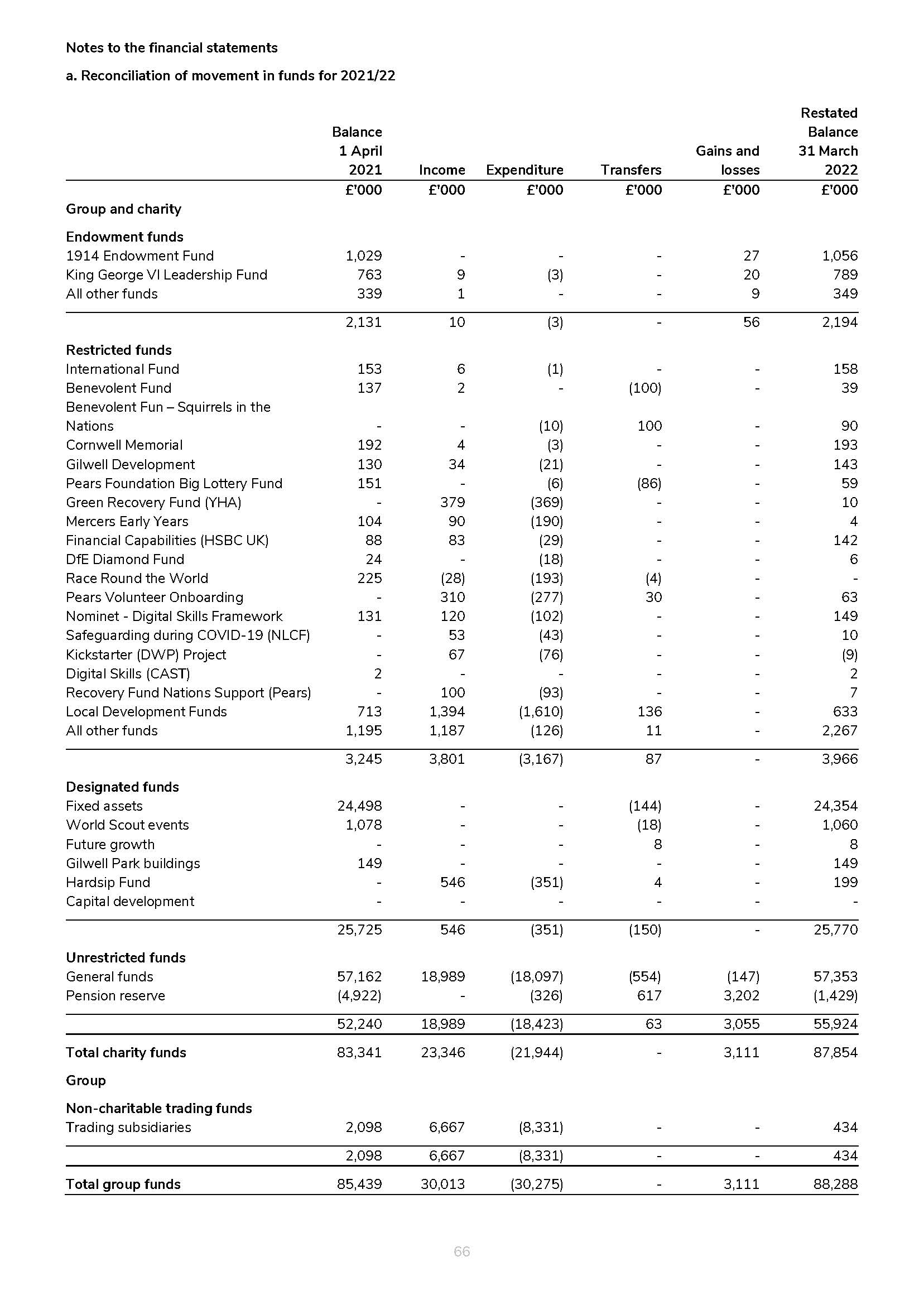

b. Endowment funds - Consolidated and the Association

Endowment funds include the 1914 Endowment Fund, the King George VI Leadership Fund and 6 (2022: 6) other funds administered by the Association.

Income from the 1914 Endowment Fund and two others is unrestricted and credited to the General Fund. Income from the King George VI Leadership Fund and three others is restricted and income from the remaining fund is paid to an external Scouting beneficiary.

c. Restricted funds - Consolidated and the Association

The main restricted funds are shown in note 19(a), comprising national and local development funds.

The Welcome Centre Fund is the largest individual restricted fund with a balance of £718,002 (2022: £262,746). This is funding to be used to build a Welcome Centre at Gilwell Park.

Further details of the funds available, and the process of applying to them for grants, are to be found at www.scouts.org.uk/grants.

d. Designated funds - Consolidated and the Association

The fixed asset fund represents the value of the Association's tangible fixed assets, goodwill & licences, and heritage assets. The transfer to Designated funds from General funds of £2.3m (2022: £144,000 transfer from) relates to the movement in the fixed assets during the year.

The World Scout Events Fund provides support to members attending World Scouting events, such as World Jamborees, the World Moot and the World Scout Conference.

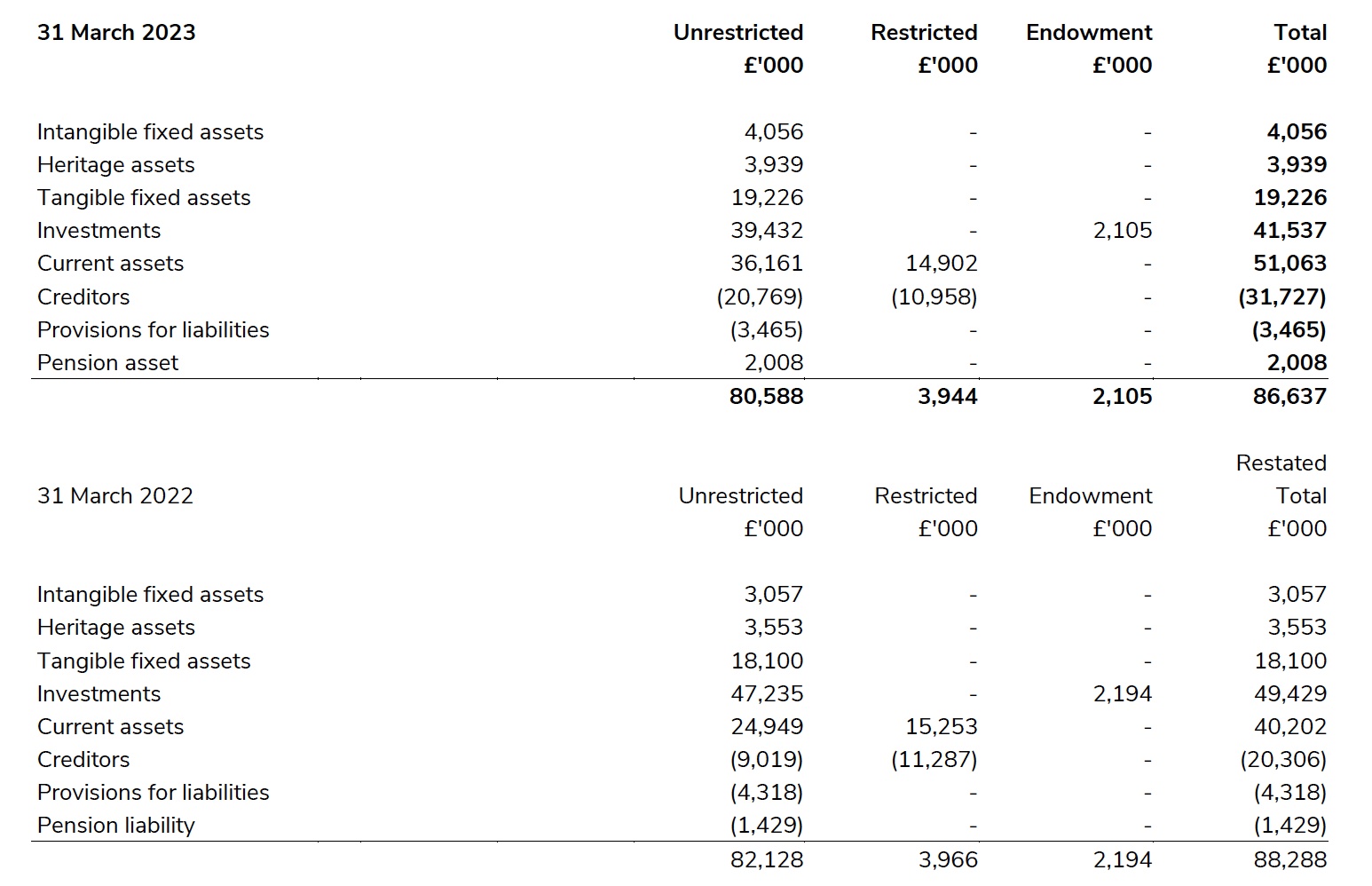

e. Analysis of net assets between funds

20. Other financial commitments and authorised expenditure

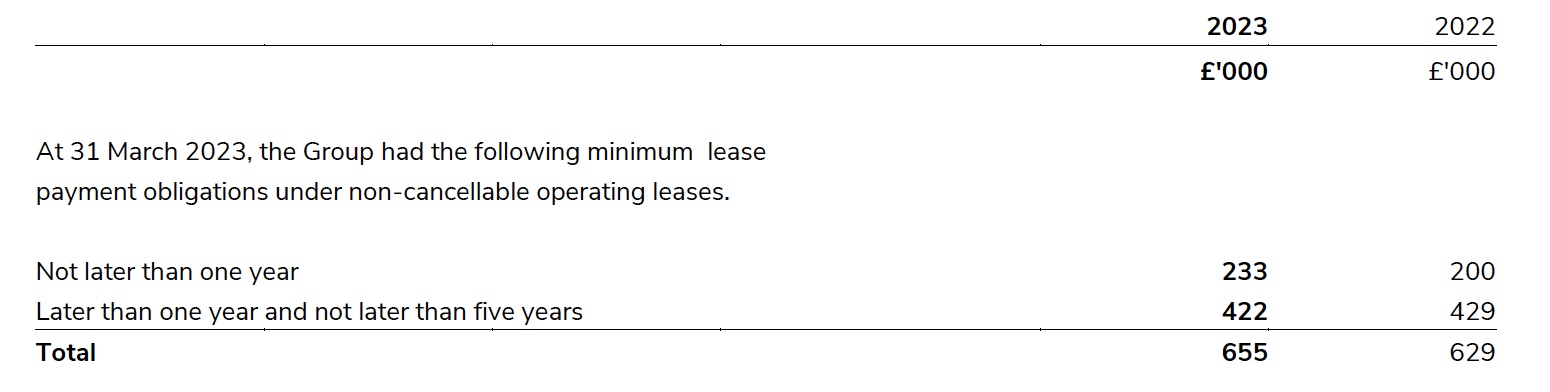

The total lease payments, included within the financial statements for the year were £134,956 (2022: £143,547).

At 31 March 2023 there was capital expenditure authorised but not committed of £1,343,689 (2022: £nil).

21. Events occurring after the reporting period

There have been no material events occurring after the reporting period.

22. Related party transactions

Expenses and remuneration paid to the Trustees are disclosed in notes 6 and 7 respectively.

Transactions with the defined benefit pension scheme are disclosed in note 7.

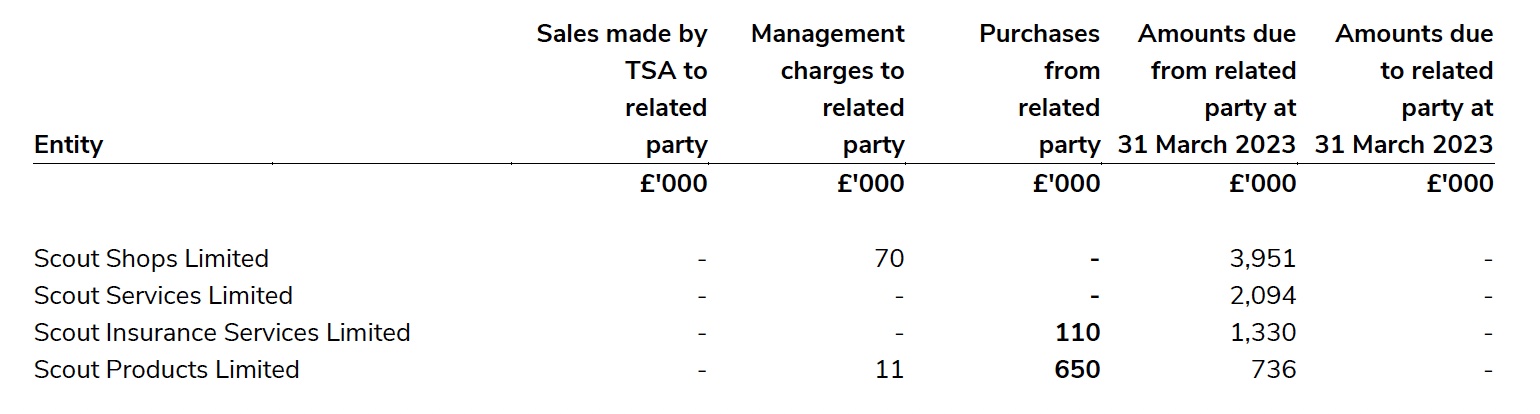

Transactions with subsidiaries: