Our new digital system and ways of volunteering are live

Our new digital system and ways of volunteering are live

Our new digital system is now live. Read more

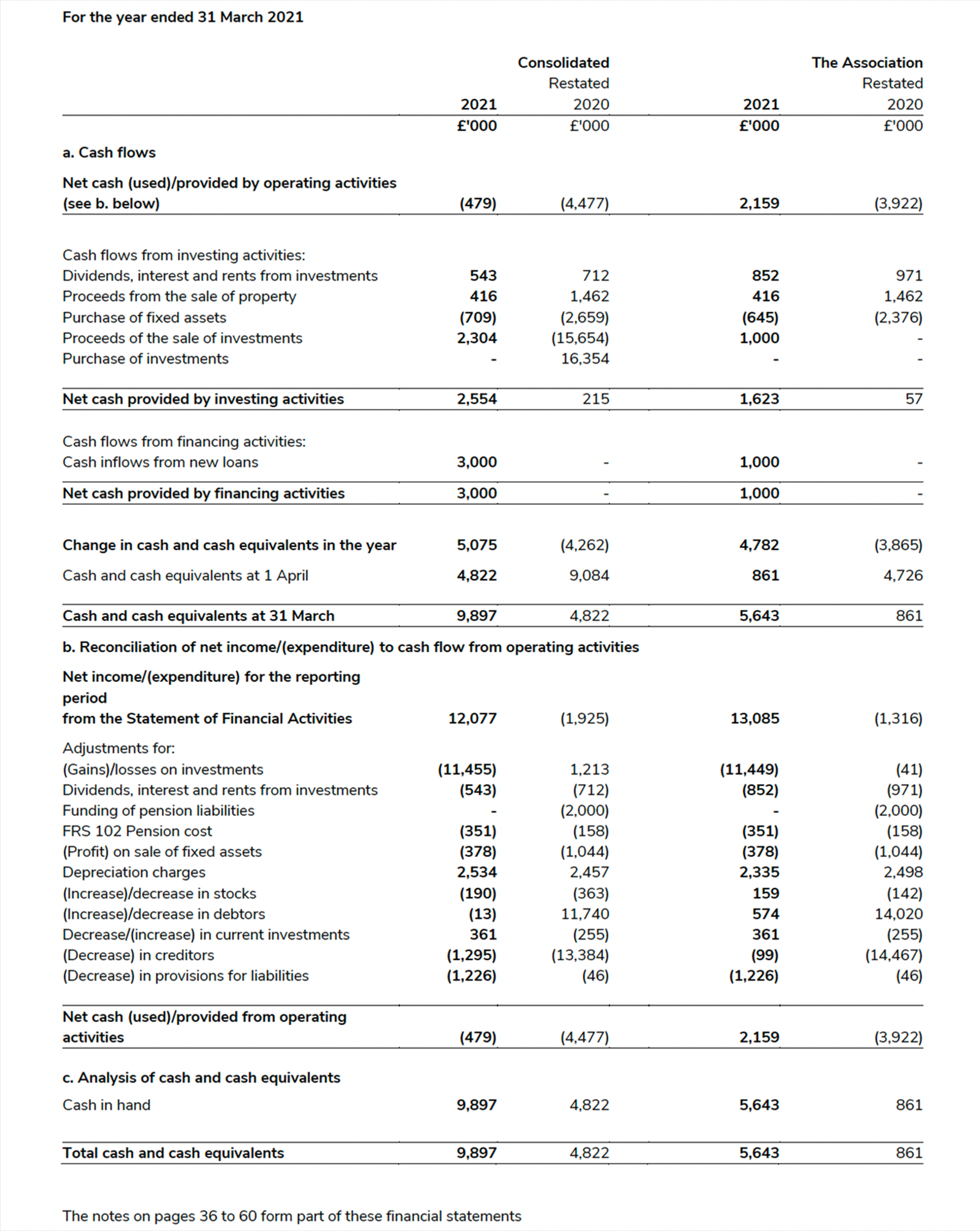

Statements of cash flows

Contents

- Welcome from the Chair

- Different thinking for a different world

- Safety first

- Our purpose and method

- Vision and strategic objectives

- Skills for Life: Our plan to prepare better futures 2018–2025

- Growth

- Inclusivity

- Youth Shaped

- Community Impact

- Three pillars of work

- Programme

- People

- Perception

- Theory of Change

- Theory of Change (diagram)

- The impact of Scouts on young people

- Our finances

- Trustees’ responsibilities

- Independent Auditor’s Report to the Trustees of The Scout Association

- Consolidated statement of financial activities

- Balance sheet

- Statements of cash flows

- Our members

- How we operate

- Governance structure and Board membership – 1 April 2020 to 31 March 2021

- Our advisers

- Our thanks

- Investors in People

Statements of cash flows

The notes on pages 36 to 60 form part of these financial statements

Notes to the financial statements

1. Constitution

The Scout Association is incorporated by Royal Charter and is a registered charity whose purpose is to promote the development of young people in achieving their full physical, intellectual, social and spiritual potentials, as individuals, as responsible citizens and as members of their local, national and international communities.

2. Scope of the financial statements

These financial statements cover the activities directly controlled by The Scout Association. The activities of the Scout Councils of Northern Ireland, Scotland and Wales together with Scout Counties, Areas, Regions, Districts and Groups are not reflected in these financial statements. Those bodies are separate autonomous charities that are affiliated to The Scout Association.

3. Accounting policies

The principal accounting policies adopted, judgements and key sources of estimation uncertainty in the preparation of the financial statements are as follows:

a. Basis of preparation of consolidated financial statements

The financial statements have been prepared in accordance with the Financial Reporting Standard applicable in the UK and Republic of Ireland (FRS 102), and the Statement of Recommended Practice, Accounting and Reporting by Charities, applicable to charities preparing their accounts in accordance with FRS 102, known as the Charities SORP (FRS 102).

The Scout Association meets the definition of a public benefit entity under FRS 102. Assets and liabilities are initially recognised at historical cost or transaction value unless otherwise stated in the relevant accounting policy note.

The financial statements consolidate the financial statements of The Scout Association and its subsidiary companies. The financial year end of each of the subsidiary companies is 31 March with the exception of Scout Shops Limited and World Scout Shop Limited, which each have a December year end, and whose management accounts prepared to 31 March are used for consolidation purposes.

The Balance Sheets and Profit and Loss accounts of the subsidiaries have been consolidated on a line by line basis as required by the Statement of Recommended Practice.

On acquisition of a business, all of the assets and liabilities that exist at the date of acquisition are recorded at their fair values reflecting their condition at that time. All changes to those assets and liabilities and the resulting surpluses that that arise after acquisition are charged to the post-acquisition Statement of Financial Activities.

The financial statements are prepared on the historical cost basis with the exception of investments, which are stated at fair value.

b. Going concern

Having reviewed financial plans and cash flow forecasts, the Trustees have a reasonable expectation that the charity has adequate resources to continue operating for the foreseeable future. Accordingly, they believe that the going concern basis remains the appropriate basis on which to prepare the financial statements.

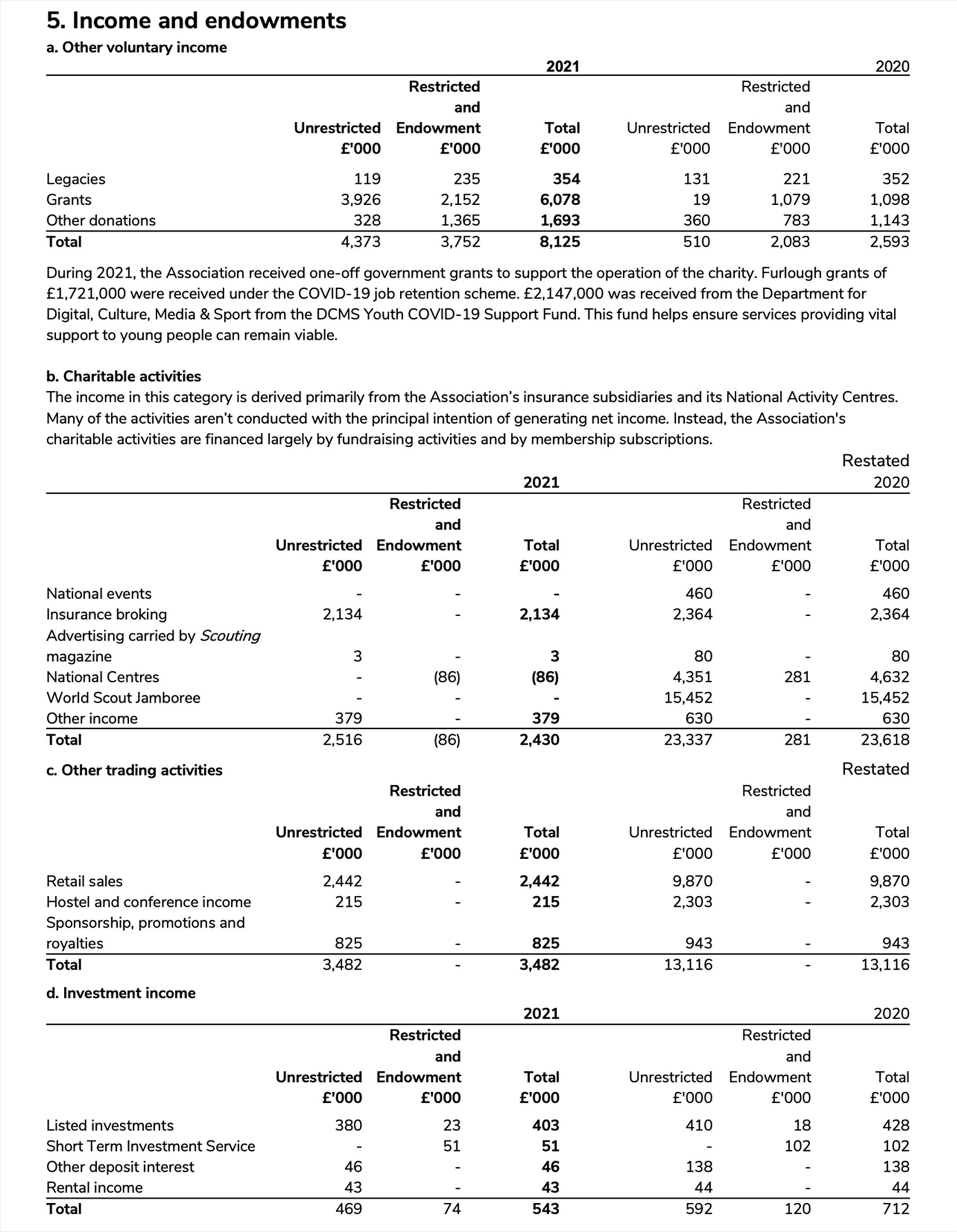

c. Recognition of income

National membership subscriptions

Membership subscriptions are payable in advance for a year to 31 March and are recognised when receivable.

Legacies

Legacies are accounted for when the Association becomes entitled to them, where receipt is probable and where their value can be established with reasonable certainty. Where legacies include non-cash items these are included in income at the lower of probate value and market value at the date of receipt.

Insurance Income

Insurance commission is recognised at the date of inception of the policy. The amount recognised is the total brokerage due to the company less an overall provision for unearned commission. Historic profit commission is recognised when it can be reliably calculated and forecast to be received.

Commercial activities

Income from conference centres, sponsorship, National Scout Adventure Centres, and other income is accounted for when the Association is entitled to the income, the amount can be quantified with reasonable accuracy and the probability of receipt of the income is more likely than not.

Investment income

Dividends are accounted for on a receipts basis. Interest is accounted for on an accruals basis and includes all amounts earned up to the balance sheet date. Associated tax recoveries are included for all amounts shown as income.

Gifts in kind

Properties, investments, heritage assets, other fixed assets and any other assets or services donated to the charity are included as donated income at their estimated market value at the time of receipt.

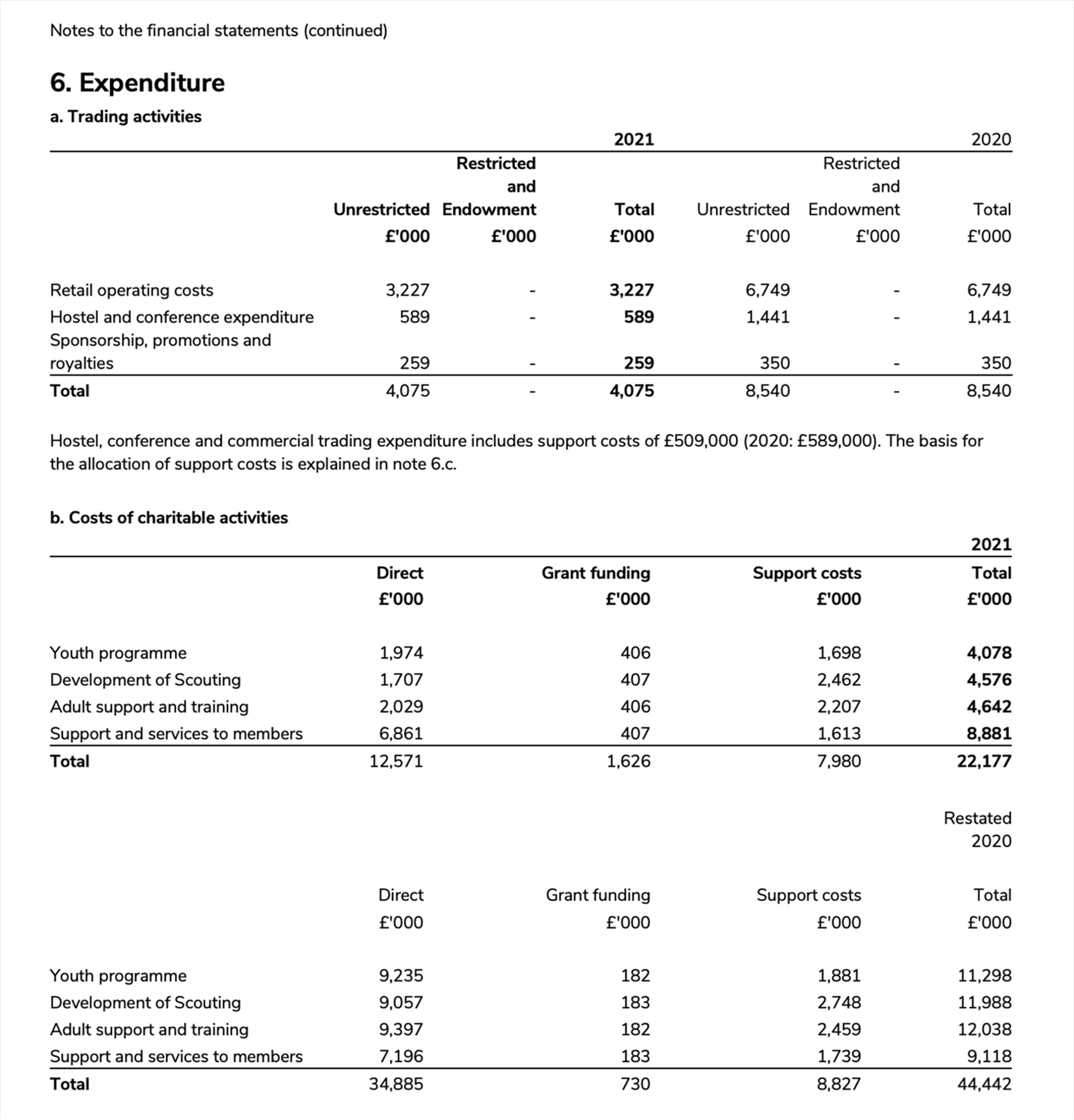

d. Allocation of income and costs

All expenditure is accounted for on an accruals basis and is allocated as described below.

Notes to the financial statements (continued)

Activities for generating funds and fundraising trading: costs of goods sold and other costs.

Income and expenditure from Scout Store Limited, World Scout Shop Limited, Scout Services Limited

and from commercial activities carried out at 65 Queen’s Gate and the Gilwell Conference Centre are

classified under these headings.

Charitable activities

This comprises income from the provision of services supporting the objects of the Association through operations including the Information Centre, insurance services, and Scouting magazine as well as the National Activity Centres. 20% of accommodation and training fees receivable at the Gilwell Conference Centre are also included under this heading, with the remaining income included in activities for generating funds.

Charitable activities have been analysed under the following headings:

– Youth programme

– Development of Scouting

– Adult support and training

– Support and services to members

The Association’s activities are largely financed by national membership subscriptions and by the surpluses generated by its trading subsidiaries rather than income from charitable activities. The activities have been classified as described in note 6.

Where possible the income and costs relating to a department or cost centre are allocated in full to one of the above categories, but in practice many departments have an involvement in more than one activity. The other major allocations, which are reviewed annually by the Trustees, are set out below.

Support costs

These are costs incurred directly in support of the objects of the charity. The costs are attributed to the activities that they support. Where a department supports all the charity’s activities, the costs have been apportioned pro-rata to the staff resources directly engaged in that activity. The percentages that apply are:

Trading – 6%

Youth programme – 20%

Development of Scouting – 29%

Adult support and training – 26%

Support and services to members – 19%

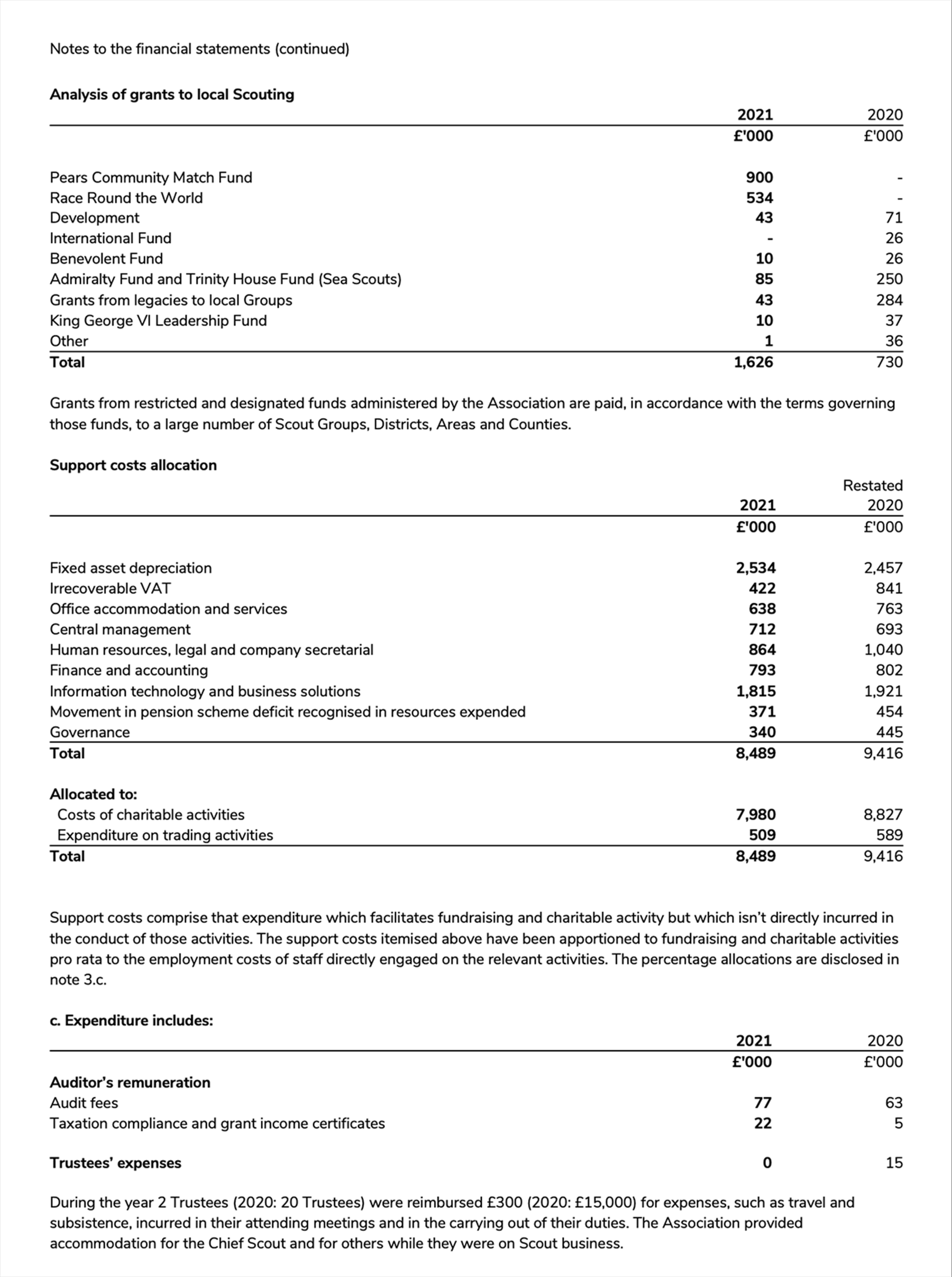

Grants payable

Grants payable are included in the Statement of Financial Activities as expenditure in the period in which the award is made. Grants which have been approved by the Trustees and agreed with other organisations but which are unpaid at the year end are accrued. Grants where the beneficiary has not been informed or has to meet certain conditions before the grant is released are not accrued.

Governance costs

These are the costs associated with the governance arrangements of the charity which relate to compliance with legal and statutory requirements of the charity as opposed to those costs associated with fundraising. They include audit fees and the costs of Trustees’ meetings.

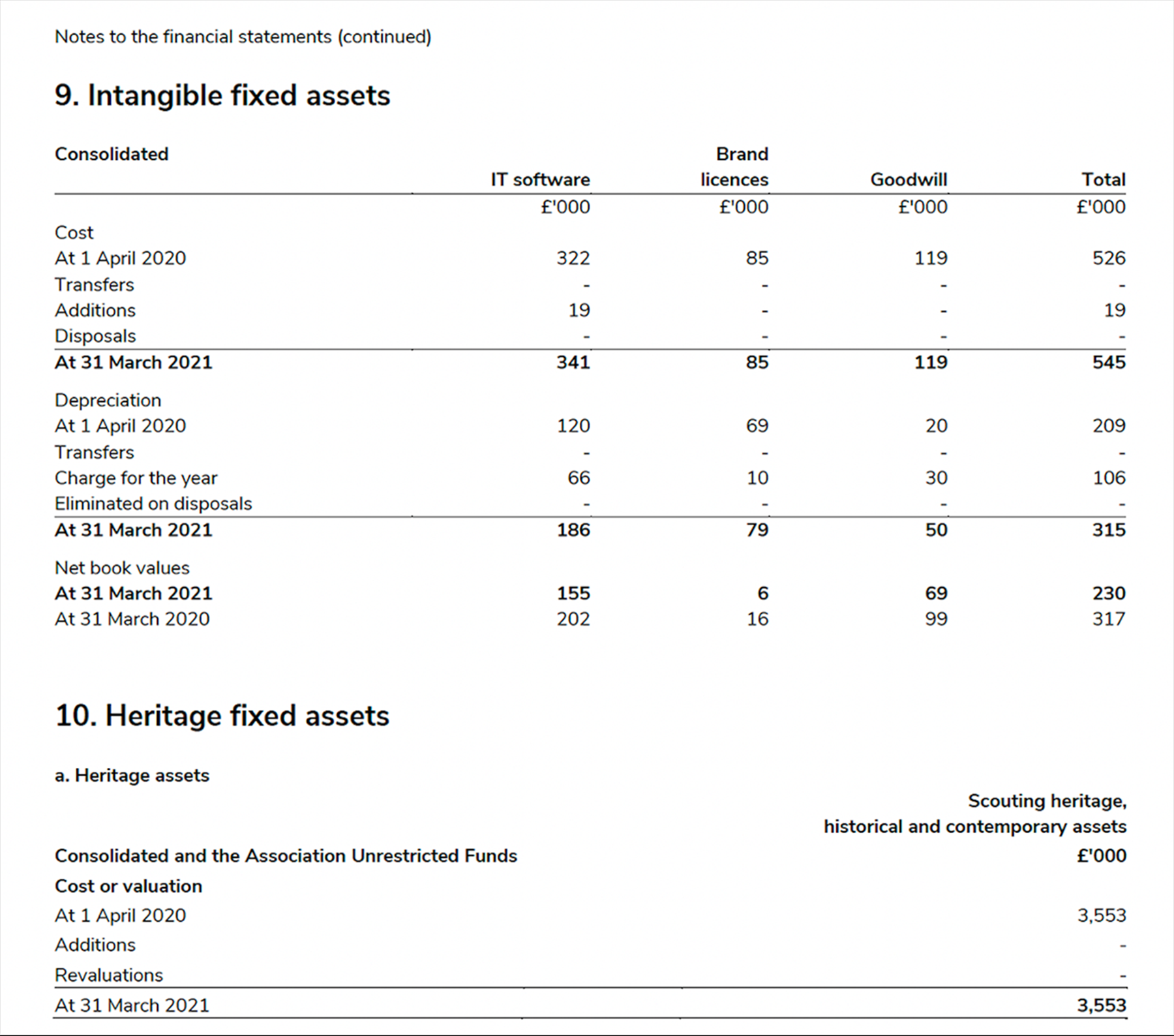

e. Intangible fixed assets

IT software is capitalised and written off over the term of the related contract, between two and five years. Goodwill arising on acquisition of an undertaking is the difference between the fair value of the consideration paid and the fair value of the assets and liabilities acquired. It is capitalised and amortised through the Statement of Financial Activities over the Trustees’ estimate of its useful economic life which can range from 5 to 10 years. Impairment tests on the carrying value are undertaken at the end of the first full year after acquisition and in any other subsequent period if events or changes in circumstances indicate that the carrying value may not be recoverable. The cost of acquiring a brand licence is written off over the term of the related contract.

f. Heritage fixed assets

The Association maintains a heritage collection of around 250,000 items. Through an active and innovative programme of collecting, interpreting and engagement, the Heritage Collection helps create connections between members of The Scout Association, both past and present, and the wider community. The Heritage Collection is managed by the Headquarters’ Heritage Service. To ensure its ongoing representation of Scouting’s story the Heritage Service continues to collect both historical and contemporary material. New acquisitions are normally made by donation with occasional low cost purchases. New material is acquired in accordance with The Scout Association’s Collecting Policy.

Heritage assets are carried at fair value. The Association has made reference to the latest available external valuations in forming their assessment of period end fair value. Gains and losses on revaluation are recognised through ‘Other recognised gains’ in the Statement of Financial Activities.

The Association will occasionally approve the disposal of elements of the Collection, this process is carried out in accordance with the Code of Ethics and industry best practice as dictated by the Arts Council England Accreditation Standard. Disposal will be judged against the Association’s Collecting Policy. Disposal will be carried out in line with the Disposal Policy and follow the Disposal Procedure. Disposal of accessioned material only takes place with the approval of the Trustees or

their designated representative. Disposal of non-accessioned items takes place with the approval of the Director of Commercial Services.

Expenditure that is in the Trustees’ view required to conserve or prevent further deterioration of individual items is recognised as expenditure when it is incurred. The Heritage Service actively seeks external funding to support the delivery of this work.

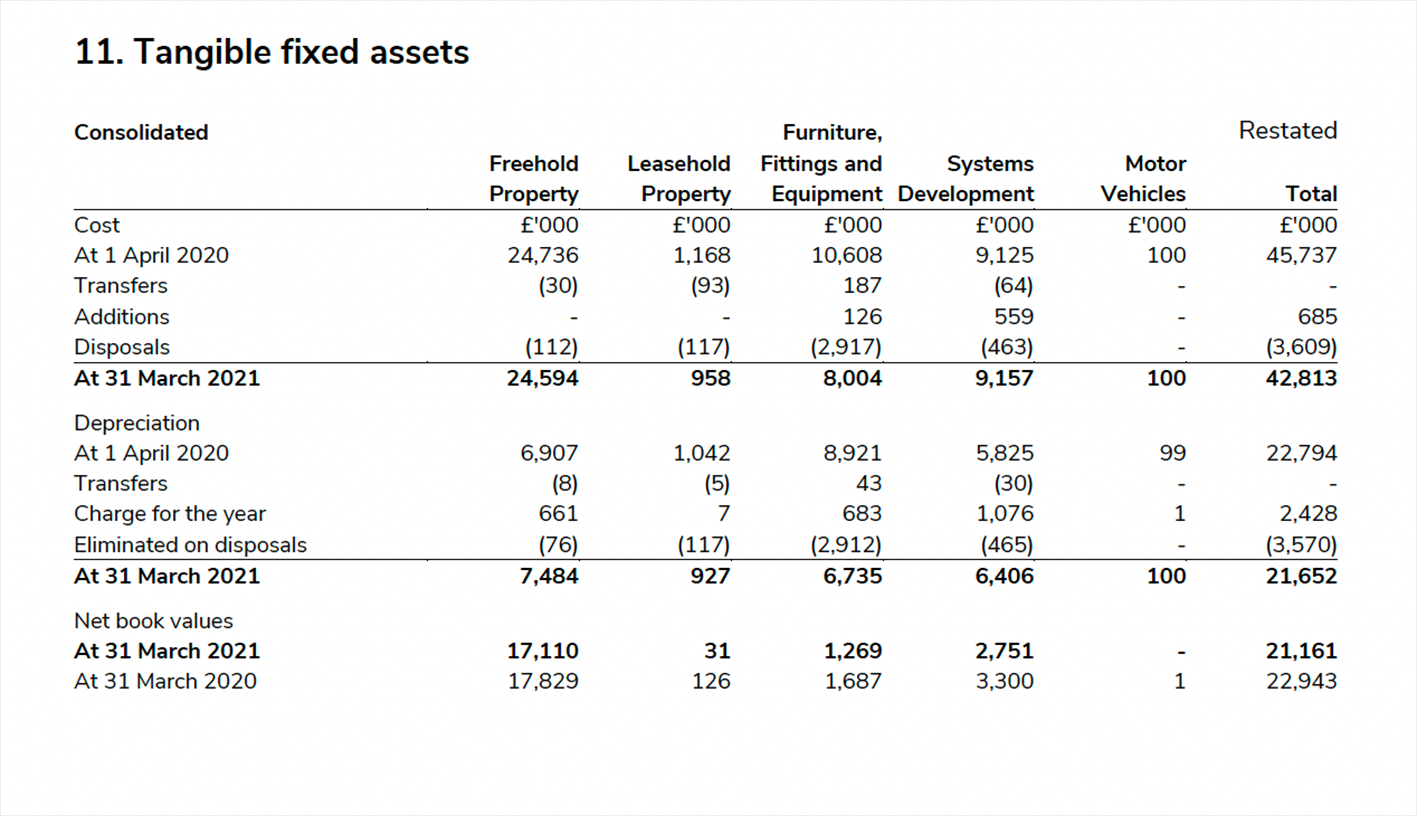

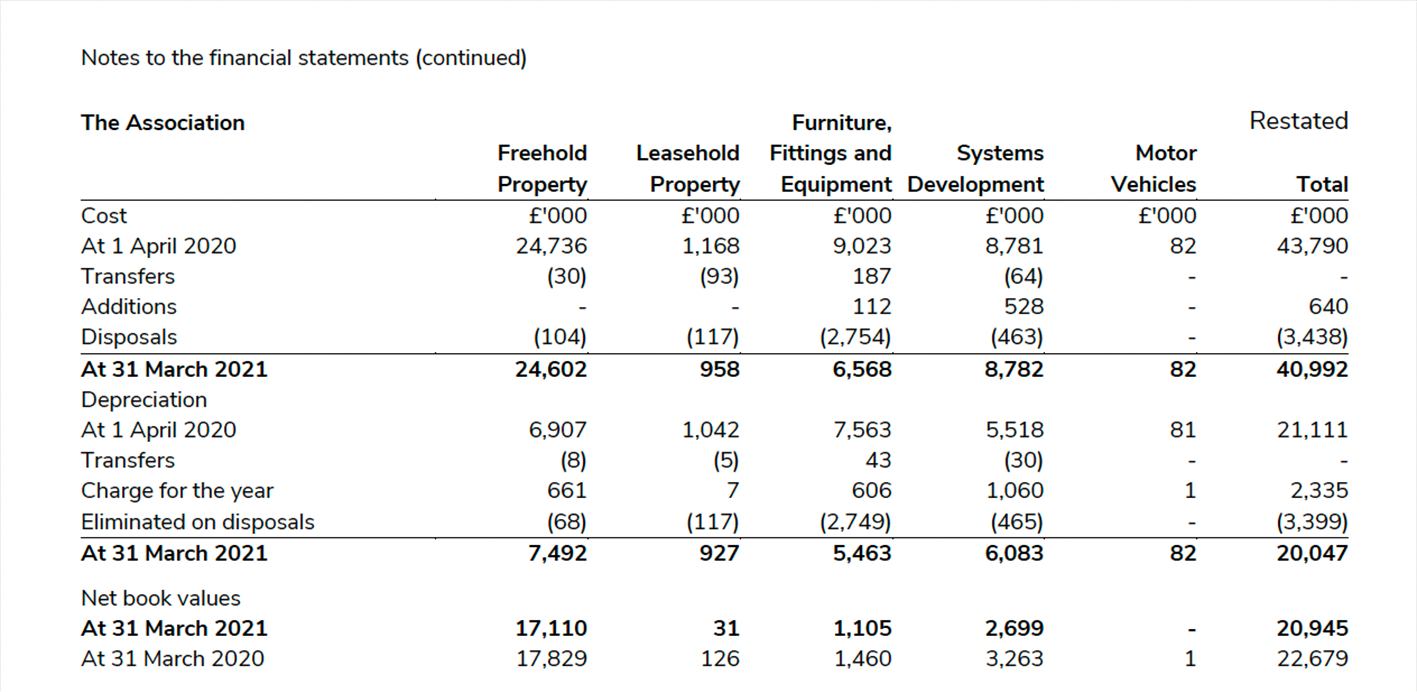

g. Other fixed assets

Other fixed assets are stated at cost. Where land and buildings are acquired together it is assumed that the buildings represent 50% of the initial cost. Investment in systems development in support of the charity's strategy is capitalised as a tangible fixed asset. Depreciation is calculated to write off the cost of assets by equal annual amounts over their expected useful lives. Assets costing less than £1,000 are not capitalised. No depreciation is provided on freehold land.

Depreciation rates used are:

Freehold property – 50 years, with

10 years for replacement elements

Leasehold property – the shorter of the lease period or 50 years

Furniture fittings and equipment – 4 to 5 years

Systems Development – 5 years

Motor vehicles – 5 to 10 years

Gains or losses on the disposal of fixed assets are reflected in net income/expenditure for the year shown in the Statement of Financial Activities.

Impairment reviews on fixed assets are carried out each year and any asset with a carrying value materially higher than its recoverable or useful value is written down accordingly.

Fixed assets held for investment purposes are stated at market value on the balance sheet date. Any gains or losses on the disposal or revaluation of investment assets are shown as net gains/(losses) on investments in the Statement of Financial Activities.

h. Investments

The Scout Association holds investments both in order to generate income for the support of charitable objectives and to provide assets to meet the need of reserves, identified in the reserves policy. Investments are stated at current market value on the balance sheet date unless there’s evidence of a different fair value.

Gains or losses arising during the year are disclosed in the statement of financial activities within other recognised gains and losses in the year, and in the notes to the

financial statements.

i. Current asset investments

The funds deposited by Scout Groups in the Short Term Investment Service are held on short-term deposit with an external investment manager. These short-term deposits are not held by the Scout Association for investment purposes and are included in the balance sheet at fair value as current asset investments. Movements in these funds are shown in the notes to the financial statements.

j. Stocks

Stocks are valued at the lower of cost and estimated net realisable value.

Cost is calculated using the current purchase price method and consists of the original cost of goods without any addition for overheads.

k. Provisions

A provision is recognised in the balance sheet when the Association has an obligation as a result of a past event and it is probable that an outflow of economic benefits that can be reliably measured will be required to settle that obligation.

l. VAT

The Association is partially exempt for VAT purposes and is not able to reclaim all the VAT it pays. It is not practicable to allocate irrecoverable VAT to the expenses and assets concerned, and irrecoverable VAT is written off.

m. Leases

Significant assets held under finance leases and the related lease obligations are included at the fair value of the leased assets at the inception of the lease. Depreciation on leased assets

is calculated to write off this amount on a straight-line basis over the shorter of the lease term and the useful life of the asset.

Rentals payable are apportioned between the finance charge and a reduction of the outstanding obligations.

All other leases have been treated as operating leases and the rentals written off as they are paid because of the insignificant amounts involved.

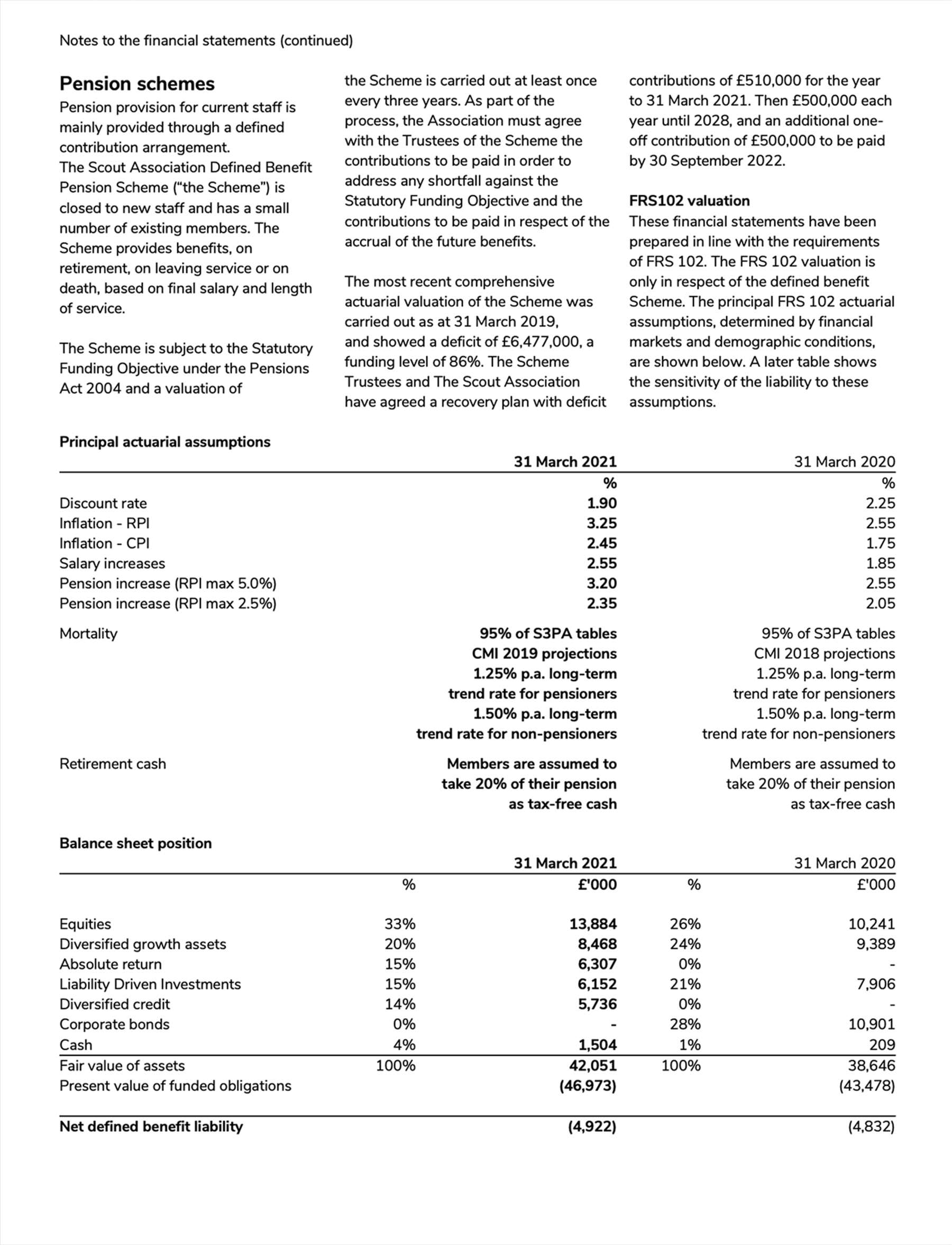

n. Pension costs

Contributions payable to The Scout Association Pension Scheme are charged to the Statement of Financial Activities so as to spread the cost of pensions over the working lives of employees in the scheme. The pension charge is calculated on the basis of actuarial advice.

The pension scheme liabilities are measured using a projected unit method and discounted at an AA sterling corporate bond rate. The pension scheme deficit is recognised in full on the balance sheet.

The current service cost and net return on the scheme’s assets and liabilities for the year is allocated across the resources expended categories in the Statement of Financial Activities. The

actuarial gain on the scheme for the year is included in the gains/(losses) section of the Statement of Financial Activities.

Contributions towards personal pension policies, which are defined contribution schemes, are charged to the Statement of Financial Activities as they are incurred.

o. Financial assets

Financial assets, other than investments and derivatives, are initially measured at transaction price (including transaction costs) and subsequently held at cost, less any impairment.

p. Financial liabilities

Financial liabilities are classified according to the substance of the financial instrument’s contractual obligations, rather than the financial instrument’s legal form. Financial liabilities, excluding derivatives, are initially measured at transaction price (including transaction costs) and subsequently held at amortised cost.

q. Forward currency contracts

The Scout Association enters into forward contracts for the purchase of currency in order to manage its exchange rate exposure relating to the World Scout Jamboree and other overseas events. Hedge contracts are measured at fair value at each reporting date.

Where there is a change in exposure at the balance sheet date, through movement in the forward exchange rate from the contract rate, that change is included in expenditure in the statement of financial activities.

r. Judgements in applying accounting policies and key sources of estimation uncertainty

In preparing these financial statements, the Trustees have made the following judgements:

– The determination of whether fixed asset properties owned by the Scout Association are held for operational use, and so classed as tangible fixed assets, or whether they are classed as Investment properties.

– The determination of whether or not there are indications of impairment of the Scout Association’s tangible and intangible assets, including goodwill, taking into consideration the economic viability and expected future financial performance of

the asset.

– The determination of appropriate provision for claims, supported by legal advice.

– The determination of appropriate financial and demographic assumptions in valuing the defined benefit pension liability in line with FRS 102 requirements, supported by actuarial advice.

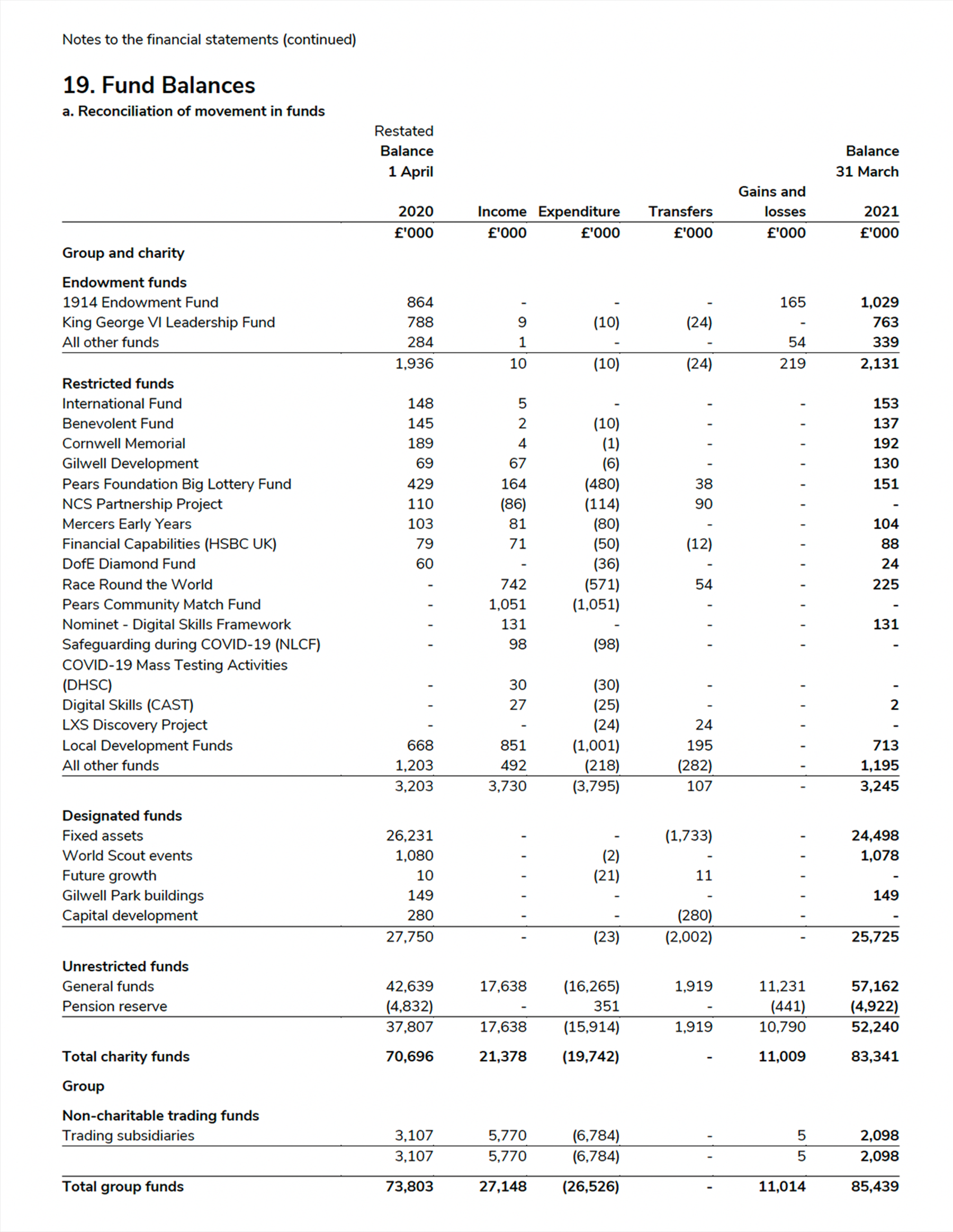

4. Nature of funds

All funds are identified as falling into one of three categories.

Endowment funds

Endowment funds are those received to be held as capital with only the income available to be spent. Subsequent gains or losses on the disposal of the underlying assets of the fund become part of the capital.

Restricted funds

Restricted funds are those received which have been earmarked for a special purpose by the donor or the terms of an appeal.

Unrestricted funds

Unrestricted funds are those received, which aren’t subject to any special restriction. They are divided between general funds and designated funds. Designated funds comprise amounts

set aside by the Trustees to be used for particular purposes.

Charitable activities have been analysed into four categories as explained in note 3.d. Costs are allocated using the principles explained in that note.

Youth programme includes the various educational activities in which members participate.

Development activities are those which are focused on growing our movement.

Adult support and training includes those activities which assist leaders and other adults involved in Scouts.

Support and services to the movement includes those activities that help ensure the safety and safeguarding of children, which underpin the activities of Scout Groups.

A valuation is provided for some of the key items in the Association’s collection, particularly those relating to the Founder, since the nature of these items permits sufficiently reliable valuation. The initial valuation was prepared by Lyon & Turnbull, members of the Society of Fine Art Auctioneers and Valuers, in 2011.

A revaluation report was produced by Pall Mall on 1 April 2016. In the opinion of the Trustees, the values are applicable to these assets at 31 March 2021. Any surplus or deficit on revaluation is charged to the net movement in funds on the Consolidated Statement of Financial Activities. Additional valuations will only be carried out for the purpose of lending items to other organisations and insurance.

The Trustees consider that obtaining valuations for the remainder of the Collection would involve disproportionate cost due to the diverse nature of the material held and the lack of comparable market values. Other than the items that have been valued as described above, the Association does not recognise these assets on its Balance Sheet. It’s the intention of The Scout Association to preserve these items indefinitely, therefore amortisation isn’t, in our view, appropriate.

b. Five year financial summary of heritage asset transactions

There have been no purchases, donations, disposals or valuations in the last five years.

c. Further information on heritage assets

The Association maintains a heritage collection of around 250,000 items. Through an active and innovative programme of collecting, interpreting and engagement, the Heritage Collection helps create connections between members of The Scout Association, both past and present, and the wider community. The Heritage Collection is managed by the Headquarters’ Heritage Service. To ensure its ongoing representation of Scouts’ story, the Heritage Service continues to collect both historical and contemporary material. New acquisitions are normally made by donation with occasional low cost purchases. New material is acquired in accordance with The Scout Association’s Collecting Policy.

The Heritage Service, supported by a small team of volunteers, is working to catalogue the Collection in line with The Heritage Collections Trust SPECTRUM standard and the national standard for archive cataloguing: this activity is an ongoing priority. Currently, approximately 10% of the Collection is catalogued to these standards.

The Association will occasionally approve the disposal of elements of the Collection. This process is carried out in accordance with the Code of Ethics and industry best practice as dictated by the Arts Council England Accreditation Standard. Disposal will be judged against the Association’s Collecting Policy. Disposal will be carried out in line with the Disposal Policy and follow the Disposal Procedure. Disposal of accessioned material only takes place with the approval of the Trustees or their designated representative. Disposal of non-accessioned items takes place with the approval of the Director of Commercial Services. In accordance with best practice, the Heritage Service will always try to keep the item in the public domain by gifting it free of charge to other relevant museum collections or archives. If an appropriate museum or archive can’t be found, the item may be considered for sale: any proceeds from such a sale would be restricted to the care and preservation of the Collection.

Expenditure that is, in the Trustees’ view, required to conserve or prevent further deterioration of individual items, including conservation work, is recognised as expenditure when it’s incurred. The Heritage Service actively seeks external funding to support the delivery of this work.

A small number of Collection items are displayed within the buildings and grounds of Gilwell Park but most of the Collection is held in storage. Included in the development plans for Gilwell Park is a new facility which would increase public access to the Collection through a permanent display and a series of temporary exhibitions, as well as providing more appropriate storage for the Collection, ensuring its long term preservation. Currently, access to the Collection is provided through the enquiries service, research appointments, the Gilwell Park Heritage Trail, the Scout Heritage website and exhibitions and activities organised with partner organisations. The Heritage Service continues to reach out to new audiences through activities including participation in the national Heritage Open Days scheme and programmes, including the UK Dementia Friendly Heritage Network.

The Association maintains the heritage collection in a good condition, and no items currently require substantial conservation expenditure. The nature of some of the assets, such as early cine-film, means they will deteriorate over time and should be considered a priority for preservation by digitisation and specialist storage.

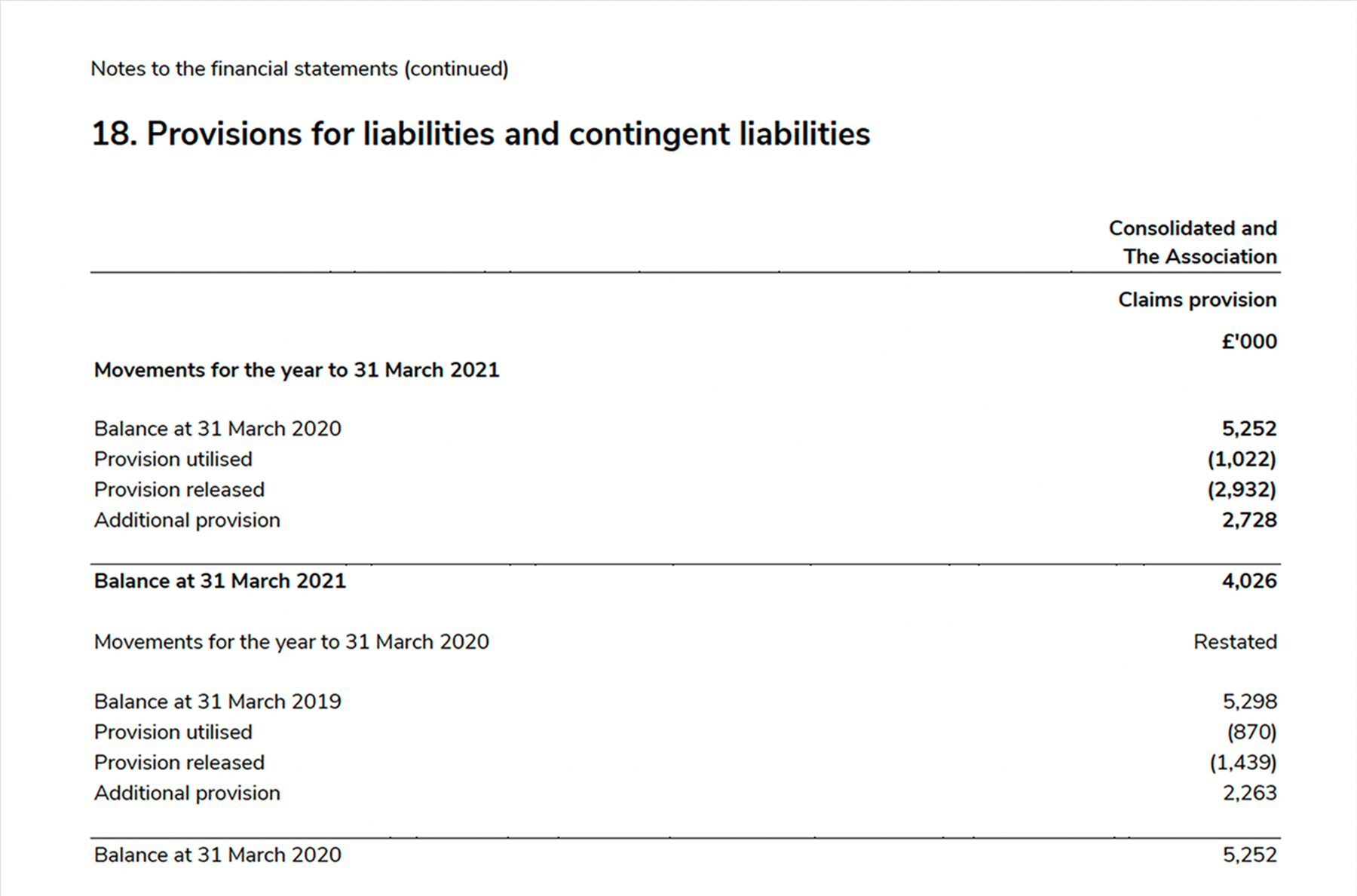

The Association puts young people first and their safeguarding and safety is paramount, but with the nature of our work there are claims made against the Scout Association. Taking account of legal advice, provision is made on a best estimate basis for those claims of which the Association is aware and for which it is assessed it is probable that the Association will be liable. Such claims are covered in part by commercial insurance policies and, in relation to the Association itself, by insurance policies issued by Scout Insurance (Guernsey) Limited. The amount receivable from insurers to the extent that provision has been made is included in debtors.

In addition it is the Association’s experience that incidents and/or claims may still be notified to the Association for events which occurred prior to 31 March 2021. Since the nature of any such incident or claim is not yet known, it is not possible for the Association to determine whether it is probable that the Association will be held liable or to estimate the amount of any consequential outflow of economic benefits. Therefore there exists an unquantifiable contingent liability in respect of such incidents and/or claims. As noted above the Association has arranged insurance cover (both with third party insurers and Scout Insurance (Guernsey) Limited) for such claims and accordingly the Association is satisfied that any such claims that might arise would not present a significant financial risk to the Association.

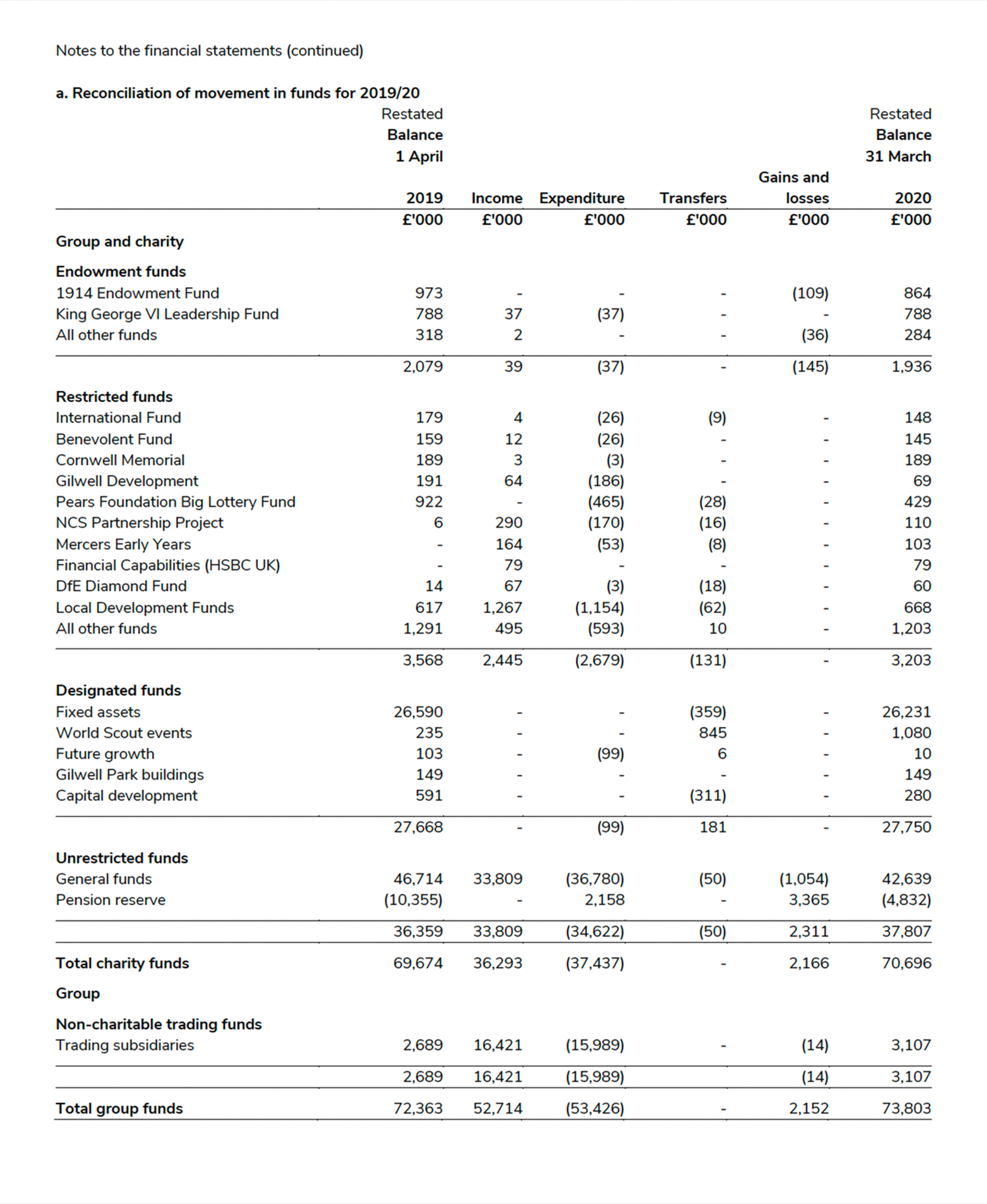

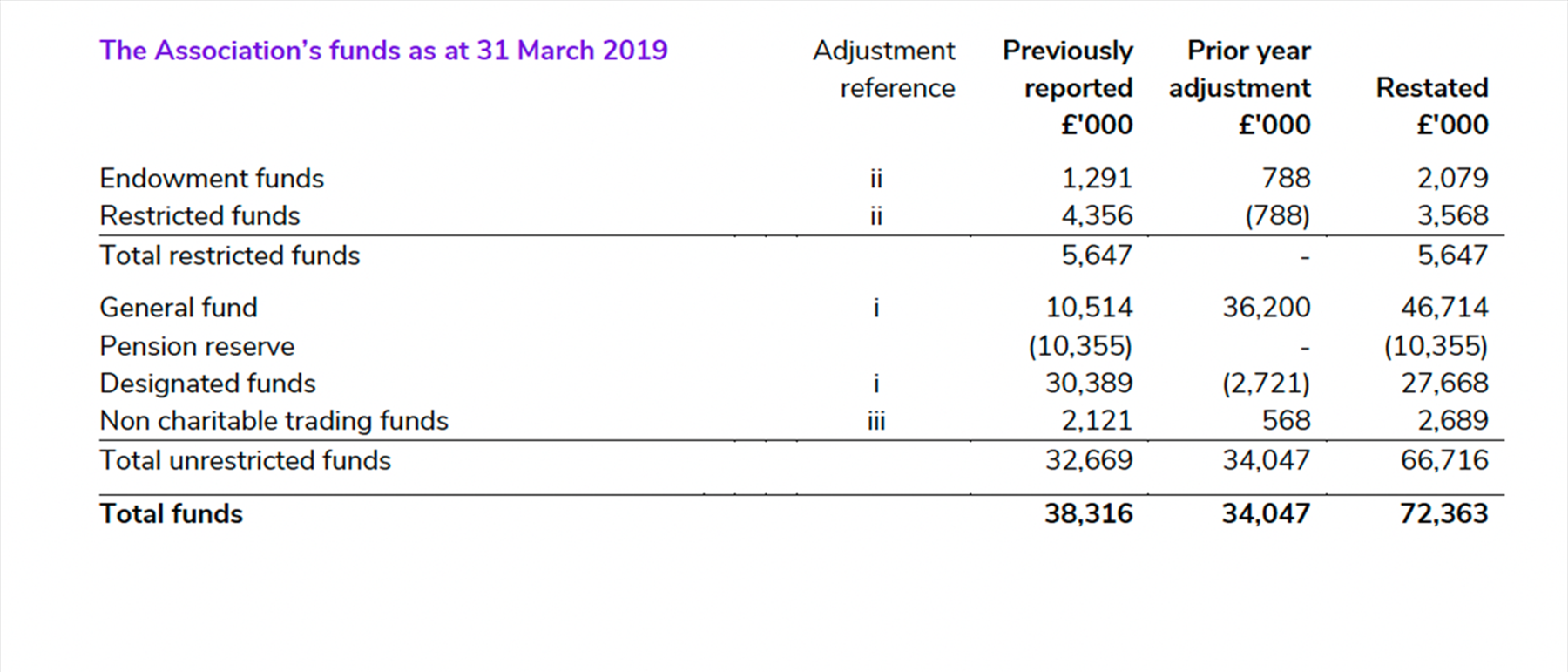

b. Restatement

The results for 2019/20, the balance sheet as at 31 March 2020 and the fund balances as at 31 March 2019 have been restated following the reassessment of a number of balances and assets.

i The Association’s property at 65 Queens Gate was previously included in tangible fixed assets at historical cost less depreciation. During the course of last year, a reassessment was made of its use by the Association – this has significantly reduced over the last few years. As a consequence, it was determined that it should be classified as an investment property certainly since 31 March 2019.

Previously, 20% of the income and expenditure deriving from 65 Queens Gate was apportioned to our Youth programme in charitable activities. All income and expenditure has now been treated as trading activity.

ii The King George VI Leadership Fund has for many years been shown as a restricted fund, albeit with no spend of the capital value. With plans for further developing our spend on leadership in Scouts, the original trust documents were reviewed, identifying this as an endowment fund.

iii The Association puts young people first and their safeguarding and safety is paramount, but with the nature of our work there are potential claims against The Scout Association. Provision is made by the Association for public liability claims. In previous years these provisions have been separated by those claims handled directly by the Association and those insured through Scout Insurance (Guernsey) limited. All the liability however rests with the Association and its balance sheet has therefore been corrected to reflect the provision for such claims at the same amount as that shown by the group, albeit offset by an equal and opposite debtor to reflect amounts covered by insurance provided by both Scout Insurance

(Guernsey) Limited and third party insurers.

In addition Scout Insurance (Guernsey) Limited makes provision for claims using the insurance accounting standard FRS 103 whereas the Association and group use the stricter criteria for establishing provisions contained in FRS 102, and the prior year's group financial statements have been corrected accordingly.

The consolidated financial statements for the prior year also reflect adjustments to more correctly eliminate intercompany transactions and balances.

In the balance sheets of the group and the Association the provision for claims was included in other creditors and it has now been shown separately with the analysis in Note 18.

iv Where the Association has forward currency contracts, the movement in the value at the year end was shown in the SOFA under other recognised gains/(losses). This movement has now been included in expenditure.

These changes in treatment have been reflected as prior year adjustments, with the impact shown below, referenced to the four changes.

Notes to the financial statements (continued)

c. Endowment funds - Consolidated and the Association

Endowment funds include the 1914 Endowment Fund, the King George VI Leadership Fund and 6 (2020: 6) other funds administered by the Association. Income from the 1914 Endowment Fund, and two others, is unrestricted and credited to the General Fund. Income from two funds is restricted and income from the remaining fund is paid to an external Scouting beneficiary.

d. Restricted funds - Consolidated and the Association

The main restricted funds are shown in note 18(a), comprising national and local development funds.

Further details of the funds available, and the process of applying to them for grants, are to be found at www.scouts.org.uk/grants.

e. Designated funds - Consolidated and the Association

The fixed asset fund represents the value of the Association's tangible fixed assets, goodwill and licences, and heritage assets.

The World Scout Events Fund provides support to members attending World Scouting events, such as World Jamborees, the World Moot and the World Scout Conference.

The Capital Development Fund represents capital projects that have been approved by the Finance Committee to improve the safeguarding and operations of the charity, where the future commitment hasn’t been incurred at the year end.

21. Events occurring after the reporting period

The Scout Association has agreed heads of terms for the sale of its property at 65 Queens Gate, London, and the sale is planned to complete in July 2021.

The Trustees have decided to wind up the operations of Scout Insurance (Guernsey) Limited and dissolve the company. Assets and liabilities of the company will revert to the Scout Association.

22. Related party transactions

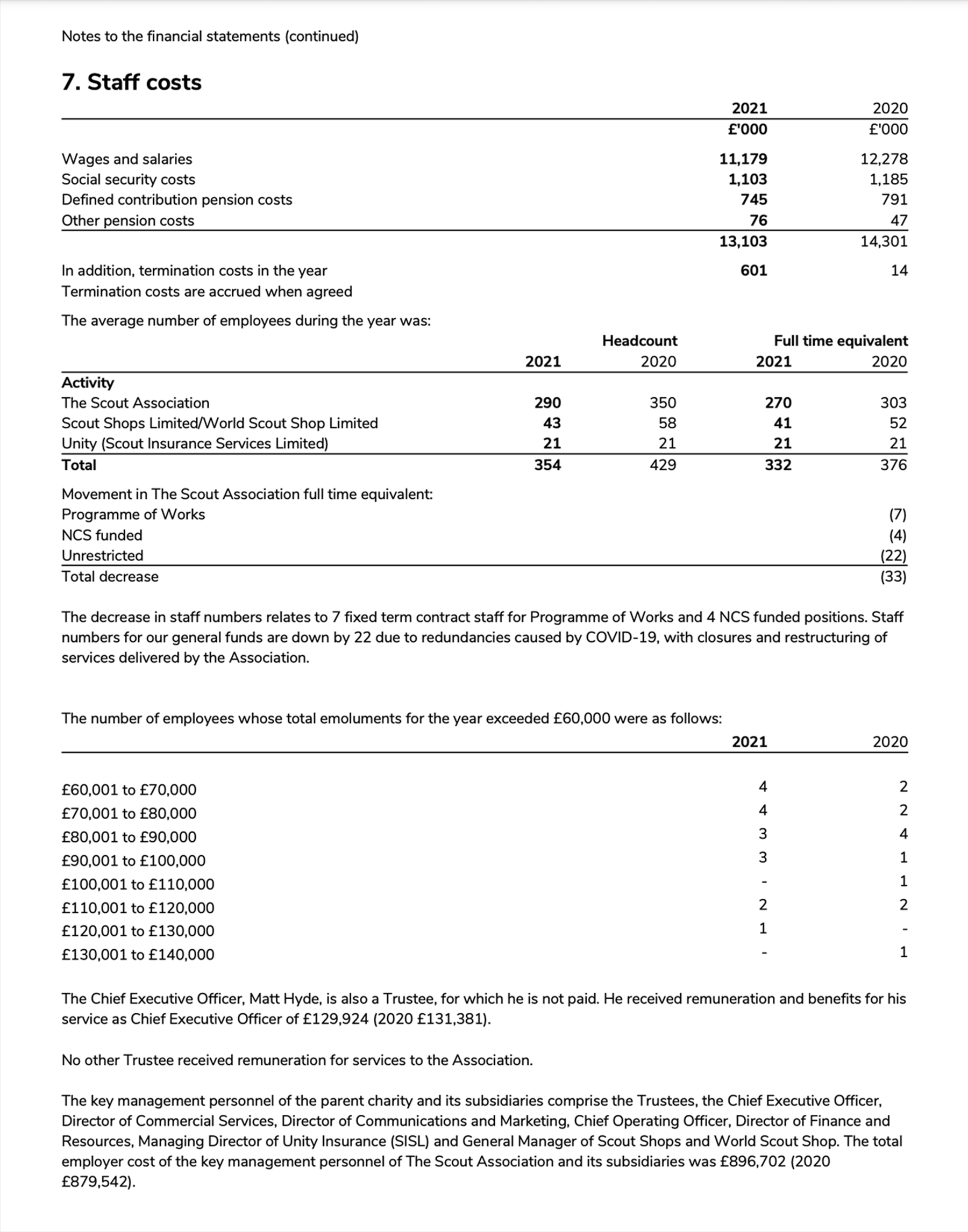

During the year 2 Trustees (2020: 20 Trustees) were reimbursed £300 expenses (2020: £15,000) for travel and subsistence, incurred in their attending meetings and in the carrying out of their duties. Note 6 refers to Trustee remuneration.

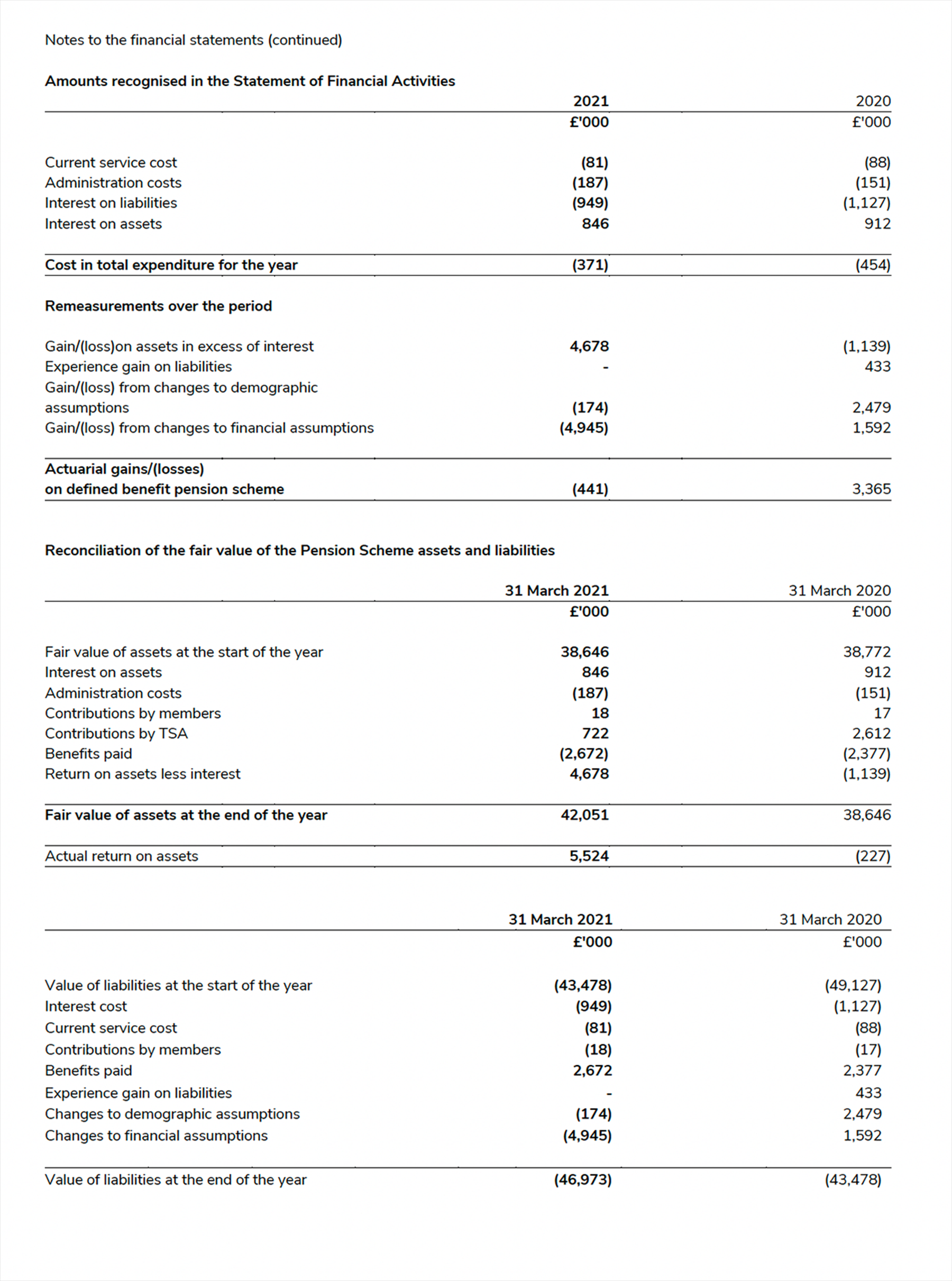

Transactions with the defined benefit pension scheme comprised agreed ongoing, deficit and administration payments of £722,000 (2020: £612,000 and a one-off £2,000,000 deficit payment) in accordance with the agreed deficit reduction plan.

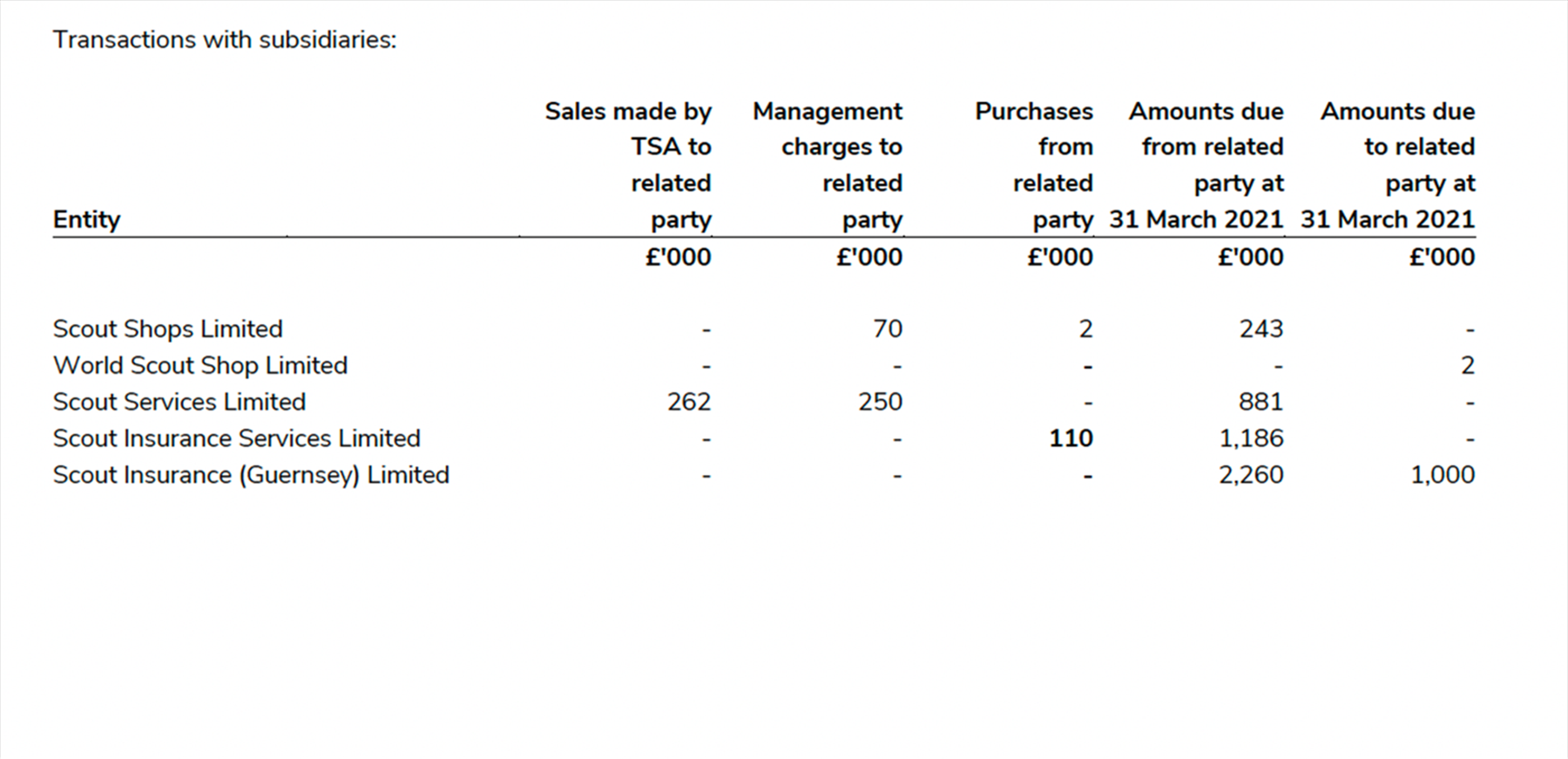

Transactions with subsidiaries: