Our finances

Contents

- Welcome from the Chair

- Different thinking for a different world

- Safety first

- Our purpose and method

- Vision and strategic objectives

- Skills for Life: Our plan to prepare better futures 2018–2025

- Growth

- Inclusivity

- Youth Shaped

- Community Impact

- Three pillars of work

- Programme

- People

- Perception

- Theory of Change

- Theory of Change (diagram)

- The impact of Scouts on young people

- Our finances

- Trustees’ responsibilities

- Independent Auditor’s Report to the Trustees of The Scout Association

- Consolidated statement of financial activities

- Balance sheet

- Statements of cash flows

- Our members

- How we operate

- Governance structure and Board membership – 1 April 2020 to 31 March 2021

- Our advisers

- Our thanks

- Investors in People

Our finances

Financial statements

The Association’s financial statements have been prepared in accordance with the Financial Reporting Standard applicable in the UK and Republic of Ireland (FRS 102), and the Statement of Recommended Practice, Accounting and Reporting by Charities, applicable to charities preparing their accounts in accordance with FRS 102, known as the Charities SORP (FRS 102), and the Charities Act 2011.

Consolidation

These accounts consolidate the results of The Scout Association and its five wholly owned trading subsidiaries:

– Scout Shops Limited (trading as

Scout Store)

– Scout Insurance Services Limited (trading as Unity)

– Scout Services Limited

– Scout Insurance (Guernsey) Limited

– World Scout Shop Limited.

With the exception of Scout Insurance (Guernsey) Limited, which makes dividend payments to the Association, all other subsidiary trading companies covenant their annual distributable profits to their parent charity, The Scout Association. More information on these companies is included in note 12 to the financial statements.

2020/21 financial overview:

Reporting our financial position this time last year, we were starting to experience the realities of the COVID-19 pandemic, and reflected on the uncertainty of how we managed then and into the future. A year on, there’s still uncertainty but so far, we’ve managed well. At the forefront of our planning and actions, we’ve looked at how we keep Scouts going and enable all our members to continue to benefit by acquiring skills for life.

We’ve been able to do that with the dedication of our volunteers and the drive of our staff. We’ve lobbied for and received government grants, noted below, which support the financial resilience that our reserves give us. We’ve benefited from the support of our corporate partners, which is really appreciated in furthering our work.

Now face-to-face Scouts has resumed, we can plan with more optimism. However, to keep financial security we need to continue to make changes, and our plans and budgets for the coming years reflect different income streams and cost savings, aligned to the delivery of our strategy.

The accounting treatment of one of our properties has had a big impact on our balance sheet, and is described below. Note 19 to the financial statements details this and other prior year adjustments that have been made.

With that context, here’s a look back at last year:

– Our finances came under severe strain and we managed them effectively to support Scouts.

– We took some difficult decisions in restructuring our functions and reducing headcount, managing our costs effectively. We availed ourselves of funds through the Government’s Job Retention Scheme and were also successful in securing £2.14 million from the DCMS Youth COVID-19 Support Fund.

– Our Activity Centres and Conference facilities closed down, and sales and income in Scout Store stopped due to face-to-face Scouting coming to a stop.

– Recognising the use of BP House was predominately to generate income, we have reclassified it as an investment property, adding £43.6 million to our balance sheet at 31 March 2021. The Board took the decision to sell BP House.

– Overall, there was a net increase in total funds of £11.6m in this year shown in the Consolidated Statement of Financial Activities (2020: £1.4m increase).

– Fundraising had specific success with initiatives such as Race Round the World and other initiatives channelled money to groups that were targeted for support.

– We raised our membership fee by £7.50 for 2021/22 and ring-fenced £1.50 of that to support groups that were in financial hardship. Membership numbers were impacted and census indicated a fall in membership numbers by 23.5%. There is a clear three year plan to build back and recover the membership numbers.

Financial results

The Association’s financial result reflects the activities mentioned above, and the economic conditions heavily impacted by COVID-19. The results for the year are shown in the Consolidated Statement of Financial Activities (SOFA) on page 33.

The successful World Scout Jamboree (WSJ) in July 2019 meant that last year’s 2019/20 income and expenditure were both increased by £15.5m. This needs to be borne in mind in the year on year comparison below.

There was an operating surplus, before investment and pension valuation changes, of £0.6m for the year compared with the previous year’s deficit of £0.7m. The result is made up of an unrestricted surplus of £0.7m, with a reduction of £0.1m in restricted funds.

Listed investment values bounced back after last year’s fall, and with an increase of £9.8m in the value of the investment property, gave a gain of £11.5m compared with last year’s loss of £1.2m.

Often, there have been large swings in the actuarial measurement of the defined benefit pension scheme deficit and this year’s £0.4m loss is modest compared to last year’s £3.4m gain.

Overall, the net movement in funds in the SOFA was an increase of £11.6m compared with an increase in 2020 of £1.4m.

The classification of 65 Queens Gate as an investment property has substantially increased the value of our balance sheet. The opening total funds at 31 March 2019, the start of the two years covered by these financial statements, had been reported at £38.3m. Including 65 Queens Gate at market value, and a £0.6m restatement of the claims provision, increased those funds to £72.4m. With the net movement in funds increases of the last two years, the balance sheet total at 31 March 2021 is £85.4m.

That value gives the Association capacity to resolve issues and achieve developments that previously hadn’t seemed possible. Primarily, that is fully delivering our Skills for Life strategic plan. In coping with the COVID-19 pandemic, we’ve called on our reserves, and we’re able to promptly restore these to give us the resilience against future pressures.

The structure of the Association’s group hasn’t altered for many years, and Scout Store needs increased capital to enable it to trade soundly and support the movement. We’ve reviewed our insurance arrangements and to most efficiently continue to manage our claims as part of our safeguarding for Scouts, we’ll dissolve Scout Insurance (Guernsey) Limited and incorporate its assets and liabilities into The Scout Association.

These plans will be developed and included in the next three-year rolling budget.

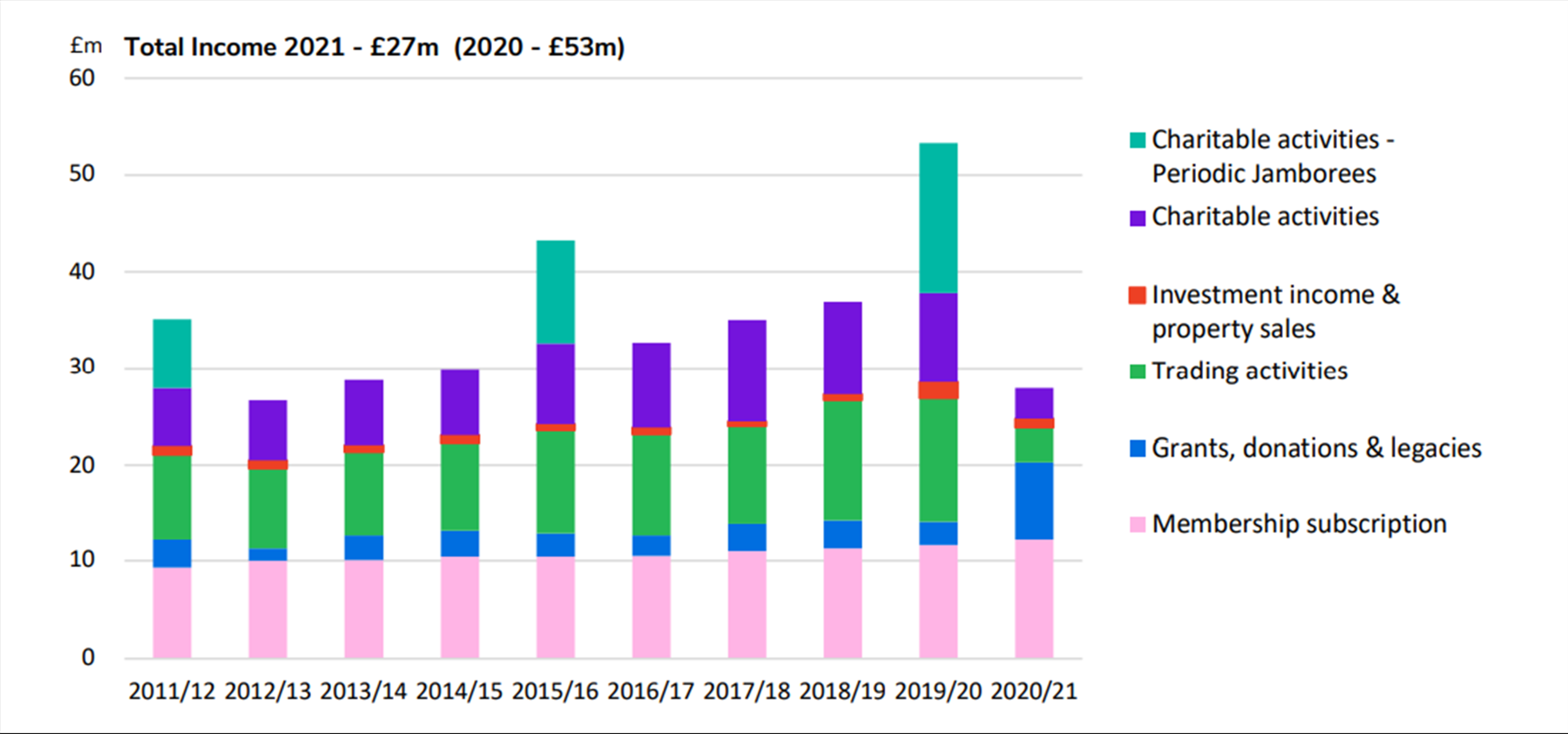

Income

As shown in the graph below, total income for the year was £27.1m compared with £52.7m in 2020. Allowing for the £15.5m WSJ income in 2020, there was a decrease of £10.1m. The understandable reasons are expanded below.

We noted last year that the past consistency and robustness of our income streams was now more uncertain. This 10-year graph shows the impact of the loss of income from activity centres, shop trading and conference centres. The £3.9m we’ve received from government grants has helped mitigate this loss for the year.

Our member subscriptions are key to funding all the support provided to members, and particularly with increasing safeguarding costs, the Trustees agreed a £1 increase in fees for 2020/21. The fee is paid for youth members and adult members, Young Leaders and members of Network pay no fees. There was an increase in youth members of just under 1%, and with the fee increase, member subscriptions increased by £0.6m to £12.2m.

The support of our donors is important and greatly appreciated by the Association. Despite the hard, uncertain economic conditions, legacies and donations increased by £0.5m to £2.0m. This increase reflects the income generated from our exciting Race Round the World campaign, which inspired inventive activities from so many of our members during lockdown.

We’ve benefited hugely from grants we received in 2020/21. The wonderful continued support of Pears Foundation and DCMS as part of the government’s Community Match Challenge brought in £3.2m. Where staff were unable to continue working, we claimed under the Government’s COVID-19 job retention scheme and received grants of £1.7m. With the financial benefit, we recognise the support of our staff and the difficulties of furlough arrangements. We were successful in lobbying for more government support for the youth sector which led to the Youth COVID Support Fund being created. This fund helps ensure services providing vital support to young people can remain viable.

We’ve benefited hugely from grants we received in 2020/21. The wonderful continued support of Pears Foundation and DCMS as part of the government’s Community Match Challenge brought in £3.2m. Where staff were unable to continue working, we claimed under the Government’s COVID-19 job retention scheme and received grants of £1.7m. With the financial benefit, we recognise the support of our staff and the difficulties of furlough arrangements. We were successful in lobbying for more government support for the youth sector which led to the Youth COVID Support Fund being created. This fund helps ensure services providing vital support to young people can remain viable.

Income from charitable activities is received from our activity centres and sales linked to our charitable purposes. These include camping, training and other activities, and accommodation charges at Gilwell Park and the other National Scout Adventure Centres. With lockdown and very limited face-to-face Scouts, this income ceased. Charitable activities also includes insurance commissions earned by Unity Insurance. These too are down. Excluding last year’s £15.5m WSJ income, there was decrease in charitable income of £5.7m to £2.4m.

Our trading operations include the retail sales made by Scout Shops Limited and World Scout Shop Limited, non-Scouting revenues generated by the Gilwell Park Conference Centre and 65 Queen’s Gate, and sponsorship and promotional income.

Shops activity had been given a boost by the WSJ last year and was particularly badly hit with sales down from £9.9m to £2.4m. Hostel and conference income withered from £2.3m to £0.2m. For some time, the conference centres haven’t been profitable and the Trustees have decided to close the two centres. 65 Queens Gate will be sold and Gilwell Park used for volunteers.

We’ve continued to establish strong links with corporate sponsors and brought in £0.8m from these beneficial connections, only down £0.1m on the previous year.

As we’ve sold investments, using our reserves and with investment returns below historic trends, investment income decreased by £0.2m to £0.5m.

One property was sold during the year and the £0.4m profit is shown in the SOFA.

Expenditure

Total expenditure was £26.5m compared with the year before of £53.4m. Excluding the WSJ, expenditure was down £11.4m as we were unable to deliver face to face services and Scout Store had limited trading.

We plan to spend as much as we can on our charitable objectives, while retaining a safe level of reserves. The cost of raising income and supporting operations for members are essential, but we keep these as low as possible. We reduced fundraising costs, and support costs were £0.9m lower.

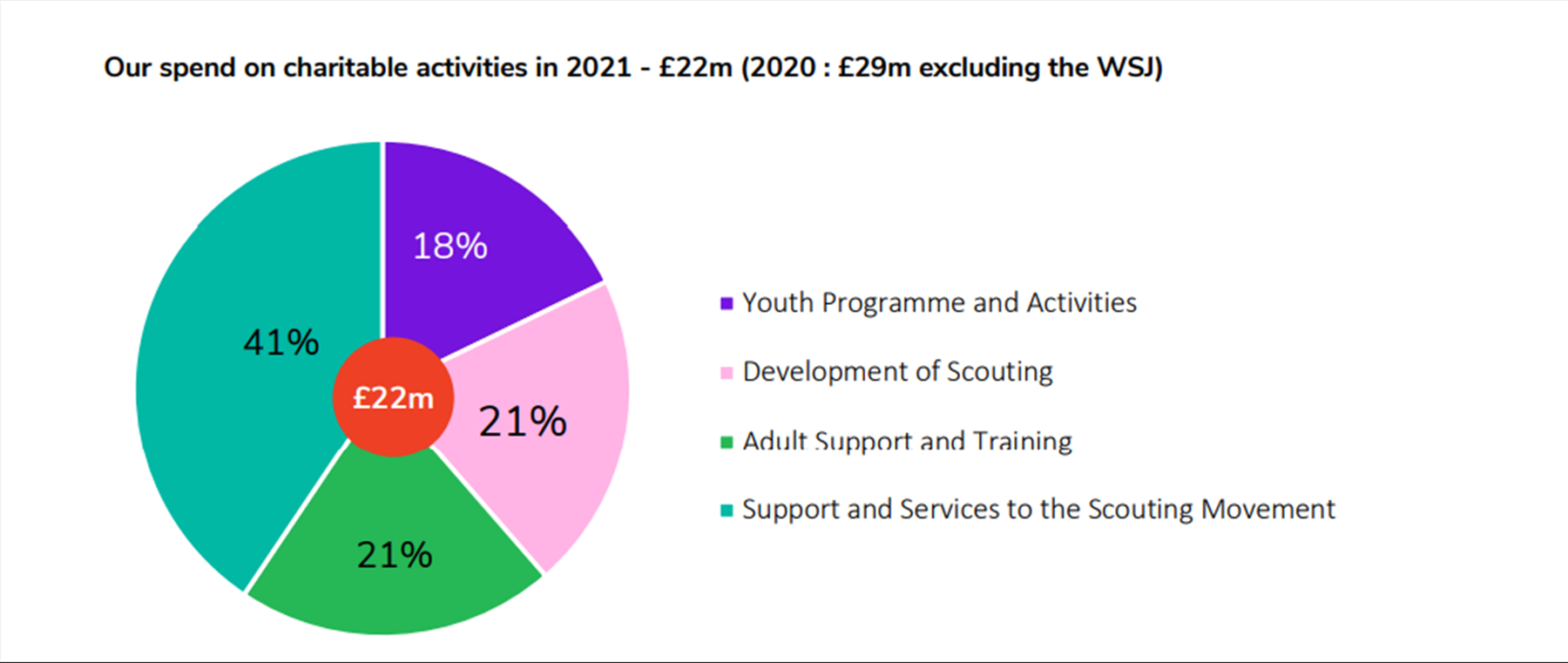

Our spend on charitable activities was £22.2m, scaled down to reflect our reduced income, and was £6.7m below that of 2020 excluding the WSJ. This is shown in the graph above under our activity headings, followed by a description of what we provide and achieve through these activities.

Youth programme and activities

We know that Scouts is needed more than ever, so we adapted our programme over the past year to make as much of it as possible work for our members from their homes. As a result, over 1.2million hours of Scouts sessions were delivered over Zoom. Over 1,200 activities are now available on our website – including a large number of lockdown-suitable activities – and we’re making a conscious effort to retain the blend of digital, indoor and outdoor activities going forwards, as we’re aware that these will be helpful for young people (particularly those with different abilities or in isolated locations) post-pandemic too.

Development of Scouting

We lost a large number of adult volunteers and young people during the pandemic, but are already seeing a return of young members. We’ve continued our commitment to extending Scouts to 4 and 5 year olds with a new Scouts section. We’ll create 300 early years sections in underrepresented communities over the next year. We’ll be ready to open another 500 sections in 2022/23 and by 2033, we hope to welcome another 130,000 four and five year olds, supported by 40,000 new adult volunteers.

This, coupled with our national volunteer recruitment campaign, #GoodForYou, means we remain optimistic about our growth goals and the bright future of Scouts.

Adult support and training

Our adult volunteers have been amazing this year, and we’ve done our best to support them in the way they deserve.

We moved our inclusion support and events online, providing members with guidance, lived experience panels, expert speakers and new programme ideas. To make sure the crucial early stages of a volunteer’s journey with us are as good as they can be, we also entered into a partnership with Girlguiding, funded by Pears Foundation. In addition, we started an ongoing review of our website and a review of our essential training, making sure both are as clear and useful as possible for our volunteers. As part of this, we’re offering a ‘blended learning’ approach: digital first but with workshops and ‘on the job’ learning too.

Support and service to members

This year, we focused on supporting members and communities most affected by COVID-19.

We had great success with our national fundraising campaign, Race Round the World, which supported our Recovery Fund. This distributed £1.5 million to groups in need across the UK and will distribute a further £700k to support groups to accelerate their recovery.

We also launched a national recruitment campaign, #GoodForYou, to attract new volunteers, and rolled out online volunteer recruitment training to support groups in regaining lost numbers.

Our four strategic objectives – Growth, Inclusivity, Youth Shaped and Community Impact – are fulfilled by these four activities. As many of the actions and activities that deliver the strategic objectives are led and delivered by volunteers, with proportionately less financial expenditure than those activities delivered by our salaried staff, the Trustees feel that these four headings used to analyse charitable activities provide a more meaningful and appropriate explanation of our income and expenditure.

Charity funds

The Scout Association’s consolidated funds increased by £11.6m to £85.4m as at 31 March 2021. The value of endowment funds was £2.1m, restricted funds £3.2m, designated funds £25.7m, the pension reserve £(4.9)m, trading funds £2.1m, and general funds were £57.2m.

All funds are described in more detail in note 19 to the financial statements with analysis of the movements in year.

Reserves policy

The Trustees annually review the reserves policy, and continue to plan to hold reserves to protect the Association and delivery of its charitable programmes by providing time to adjust to changing financial circumstances.

The reserves policy establishes an appropriate target for the level of general ‘free’ reserves. The target is based on a risk assessment of the probability and likely financial impact on the Association’s activities which might be caused by a decline in income, an inability to meet its financial obligations, or an inability to reduce expenditure in the short term. Reserves are also held to support the development of Scouts. The policy seeks to ensure an equitable balance between spending the maximum amount of income raised as soon as reasonably possible after receipt, while maintaining an appropriate level of reserves in order to ensure the uninterrupted operation of the charity. It also provides parameters for future budgeting and strategic plans and contributes towards decision making.

The pandemic has highlighted the risks to the TSA of short term reductions in membership and losing commercial income due to curtailment of face-to face Scouting while needing to maintain member services. As a consequence the Trustees have determined that the appropriate target on a go forward basis for free reserves for TSA itself is represented by one year’s worth of expenditure which is currently about £20m. This will likely be increased following the proposed liquidation of SIGL later this year and incorporation of its free reserves which are designed to provide cover for unexpected claims.

The general free reserves for TSA itself shown as at 31 March 2021 are £57.2m (excluding the reserve for the pension fund deficit) which is considerably in excess of this target due to recognition of the market value of Baden-Powell House which is now classified as an investment property and the sale of which is in the final stages of completion.

However the Trustees recognise there are a number of factors which will significantly reduce the free reserves over the next two years in particular:

– Budgeted losses while membership numbers recover to previous levels.

– Potential impacts from the next pension fund triennial funding review and changes in pension regulation due in 2022 which may accelerate the funding requirements.

– Investments required to recapitalise Scout Stores following its recent losses during the pandemic and further invest in the commercial operations and Scout Adventures.

After taking into account the above allocations, the residual funds will be deployed in delivering the Skills for Life strategy and further investments will be made for delivering services to the movement. We will keep the movement informed as plans for such investments are further developed over the coming year.

Forward financial forecast and going concern

The Trustees have considered the financial plans for the budget year of 2021/22 and the following two years, looking at the cash and reserve projections. This covers a period of at least 12 months from the signing of these financial statements.

The proactive actions initiated, and the clear plans for resurgence and growth of membership, provides a route to growth and stability of the finances of The Scout Association. The sale of assets will provide us with the resources to build back our reserves and invest for growing our services. Our income streams such as membership income and commercial revenues are growing. Costs have been cut and controlled in line with income, while protecting critical safeguarding and safety functions and frontline support to volunteers.

There will be future changes and there are residual risks, but over the short-term, we have the capacity to manage such exposures, as well as planning, monitoring and managing cash flows accordingly.

We set out the charity’s risk management approach, as well as the key risks faced, on page 63. Despite the volatility of social, economic and market conditions, the pension deficit has reduced over recent years and a deficit plan agreed with the Pension Scheme Trustees is included in our budget.

Taking all of the above into account, the Trustees have a reasonable expectation that the charity has adequate resources to continue operating for the foreseeable future. Accordingly, they believe that the going concern basis remains the appropriate basis on which to prepare the financial statements.

Fixed assets

Capital investment plans were held back during the year as we took stock of how we invested in infrastructure to support our strategic objectives and members. As we looked at our future use of properties, spend was limited to making sure we maintained safety compliance.

Volunteers

During the year, over 141,659 adults volunteered their time, energy, skills and commitment to Scouts at Group, District, County, Region or National levels. Their roles ranged from regularly leading Zoom meetings and helping to organise camps at home, to helping with administration, the training of future leaders, and attending other online meetings at every level. Without this contribution of volunteers, Scouts would be unable to offer such a wide range of challenging and inspiring activities that makes it the largest co-educational youth movement in the UK today.

Subsidiary companies

The Association’s trading subsidiaries are reviewed below. Each company is wholly owned and each – other than Scout Insurance (Guernsey) Limited, which is incorporated in the Bailiwick of Guernsey – is incorporated in England and Wales.

Scout Shops Limited

Scout Store sells Scouts and ancillary products mainly to members of The Scout Association, both directly and through District Scout Stores and other wholesale outlets.

To manage business loss with no face-to-face Scouts, the directors moved to rapidly change priorities to focus upon the long term sustainability of the business. The Company pursued funding options and was successful in attaining a government backed CBILS loan of £3.0m which eased cash flow pressures. In light of the significant drop in turnover, the business undertook a full financial review resulting in a reorganisation, reduced staffing levels and stringent cost containment.

Turnover decreased to £2.2m (2020: £9.4m) with the impact of the lockdown and 2019 sales were increased by the World Scout Jamboree. Loss before taxation for the year was £0.8m (2020: profit of £3.0m). With this loss Scout Shops had insufficient reserves to pay the full gift aid payment and there was a partial reversal of £0.2m of last year's deed of covenant.

There are signs of recovery, with significant sales activity in April 2021, and the development of online purchasing which will improve the customer experience.

World Scout Shop Limited

Turnover of £0.2 was down £0.3m on the previous year, with a small loss of £0.01m (2020: profit of £0.03m).

Scout Insurance Services Limited

Scout Insurance Services trades under the name of Unity Insurance Services. Its principal activity is that of insurance broker, providing services primarily to The Scout Association, the Scout movement, to other charities and not-for-profit organisations, including Girlguiding UK.

With lockdown, turnover was down, with no demand for certain products such as travel and event insurance. But the company successfully put in place facilities for staff to work from home, enabling continued good service to customers supported by the introduction of phase 1 of a new broking system.

In the year to March 2021, turnover was £2.2m (2020: £2.4m) with a profit before tax of £1.1m (2020: £1.2m), which it covenanted to The Scout Association.

Scout Insurance (Guernsey) Limited

In the year to March 2021 net insurance premiums were £0.5m, compared with £0.8m in the previous year. There was a net loss before taxation of £0.1m (2020: profit of £0.2m). During the year, the company declared and paid a dividend of £0.1m (2020: £0.2m) to The Scout Association.

The Association Trustees have reviewed the operations of Scout Insurance (Guernsey) Limited, and as the costs outweigh any benefits it provides have decided to wind up the operations and dissolve the company. Assets and liabilities of the company will revert to The Scout Association.

Scout Services Limited

Scout Services Limited’s principal activities are that of sponsorship and marketing services for The Scout Association, including the provision of conference facilities.

With the enforced closure of the Gilwell Park and Baden-Powell House conference centres, there was a review of their long-term benefit and profitability. The decision was taken that they wouldn’t reopen. Baden-Powell House is in the process of being sold and Gilwell Park facilities used for volunteer accommodation. The company retained a positive relationship with corporate partners, and the small reduction in income this year is expected to recover next year.

Scout Services Limited produced a net loss of £0.8m (2020: profit of £0.7m) from turnover of £1.0m (2020: £3.8m).

The Scout Association Defined Benefit Pension Scheme

The most recent full actuarial valuation of The Scout Association Defined Benefit Pension Scheme was carried out as at 31 March 2019. The valuation showed a deficit of £6.5m, a funding level of 86%, which is an improvement from the 78% funding level at the March 2016 full valuation. Based on this valuation, the Trustees agreed a deficit recovery plan aimed at clearing the deficit by 2028. The Scheme closed to new members in the year ended 31 March 2001.

In the year to March 2021, the Scout Association contributed £0.6m to the Scheme (2020: £2.6m including a special contributions of £2.0m). The Trustees regularly monitor the Scheme funding deficit to make sure that general reserves provide adequate cover against the future liability.

In accordance with Charity Commission guidance (“Charity Reserves and Defined Benefit Pension Schemes”), the Trustees have reviewed the cash flow impact on the general reserves of the planned funding of the deficit and these are included in the charity’s budget.

The valuation of the Defined Benefit Pension Scheme at 31 March 2021 for the accounting purposes of Financial Reporting Standard 102 (FRS 102) showed a funding deficit of £4.9m (2020: £4.8m).

Investment policy and performance

The fund assets have been held in the Cazenove Charity Multi-Asset Fund since 2018, which is ethically screened.

The performance objectives are:

– to maintain an optimum level of income tempered by the need for capital growth in order to safeguard future grant-making capacity,

– and to outperform benchmarks on a rolling three-year basis.

The investment return for the year was 24.7%, which reversed the negative 7.5% return in 2020, with the two years straddling the benchmark of CPI+4%, as an average of 6.1%.

The Association’s current asset investments represent cash holdings which are managed separately from the main investment portfolio, held in Royal London Asset Management Funds on behalf of the Short Term Investment Service on behalf of the movement. As at 31 March 2021, total deposits by Scout Groups, Districts, Counties and Regions in the Short Term Investment Service were £11.1m (2020: £11.5m). We will be reviewing the operation of the Short Term Investment Service given the risks of potentially negative returns in a very low or even possible negative interest rate environment.

Remuneration policy

The Trustees consider that the Board of Trustees and the Senior Leadership Team (the Chief Executive and the Directors) comprise the key management personnel of the Charity.

All Trustees give of their time freely and no Trustee received remuneration in the year. The Chief Executive (who is also a Trustee and a full member of the Board) is paid for his executive duties only.

Details of Trustees’ expenses and related party transactions are disclosed in note 6c to the financial statements.

The remuneration of the senior staff is reviewed annually by the People and Culture Committee (a subcommittee of the Board), taking into account market conditions, cost of living increases and the financial position of the organisation. The salaries of the Senior Leadership Team are benchmarked in order to make sure that they’re commensurate with the size of the roles.

The Senior Leadership Team members are entitled to employer pension contribution rates and other benefits that are available to employees generally. In addition, enhanced medical insurance provision is provided.

The Senior Leadership Team sets the salaries for all other employees.

The remuneration benchmark is the mid-point of the range paid for similar roles. If recruitment and retention proves to be difficult, a market rate supplement is also paid.